It's easy for a dividend investor to get so enamored of a huge dividend yield that they overlook other, equally important, investment factors. Real estate investment trust (REIT) Annaly Capital's (NLY 2.79%) huge 12%+ dividend yield is one that could easily distract you. Note that the S&P 500 index (^GSPC 2.06%) has a tiny little 1.2% yield, and the average REIT yield is around 3.9%.

Here's why you might be better off in the middle with Realty Income (O +0.33%) and its roughly 5.6% yield.

Not all REITs are the same

There are two broad types when it comes to real estate investment trusts. The first type, property-owning REITs, is fairly easy to understand. These companies do what you would do if you owned a rental property, just on a much larger scale. Buying properties and leasing them out to tenants, which is what Realty Income does, provides a broad perspective, of course, since there are a variety of different property sectors in which REITs can invest.

Image source: Getty Images.

However, the property-owning model is drastically different from mortgage REITs, the other broad type of REIT you can invest in. Annaly is an mREIT. These companies focus on owning, managing, and/or making loans secured by physical properties. In Annaly's case, the company buys mortgages that have been pooled into bond-like securities.

There's nothing inherently wrong with mortgage REITs, per se, but they are simply not the same kind of dividend stock as a traditional property-owning REIT. The lofty yields on offer from mREITs are just one aspect of that. The more important factor is the reliability of the dividend over time.

NYSE: NLY

Key Data Points

Annaly is kind of like a mutual fund

Realty Income is an operating business. It grows by acquiring new properties and effectively managing its existing ones. Realty Income is the largest net lease REIT, which simply means that its tenants are responsible for most property-level costs. One drawback with Realty Income is that its vast size, with a portfolio of more than 15,000 properties, limits its growth potential. It requires huge amounts of investment to move the needle on the top and bottom lines.

NYSE: O

Key Data Points

That said, Annaly's business is somewhat similar to a mutual fund that owns mortgage securities. The company even reports a figure called tangible net book value, which essentially represents the value of the company's investment portfolio. That's roughly similar to the net asset value figure reported by mutual funds.

What's interesting here is that the value of mortgage securities changes on a daily basis and can be affected by factors ranging from interest rates to mortgage repayment trends and housing market dynamics. The self-amortizing nature of mortgages, meanwhile, generally leads to the value of mREIT mortgage portfolios shrinking over time.

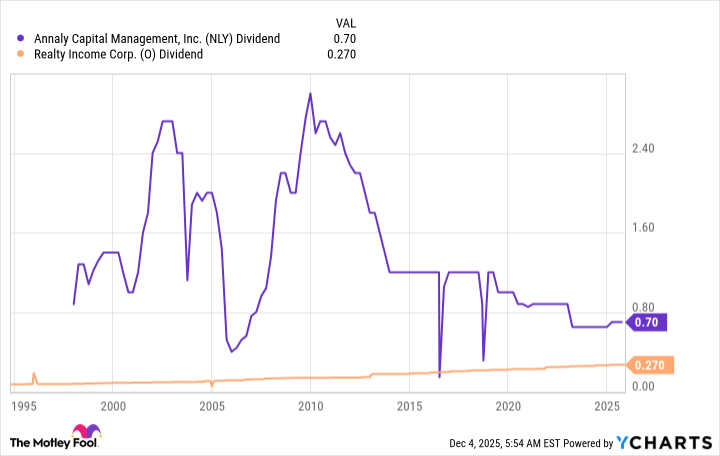

NLY Dividend data by YCharts.

This is where the rubber hits the road for dividend investors. As the chart above highlights, Annaly Capital's dividend has been highly variable over time. That's normal for an mREIT and comes from the unique nature of the core business.

Realty Income's dividend has increased steadily for decades as the company has expanded its property portfolio. In fact, Realty Income's dividend has been increased for an impressive 30 years, and counting. If you need the income your portfolio generates to pay for living expenses in retirement, Realty Income's steady business and dividend growth will be the better choice for most investors.

Annaly Capital isn't a bad company

It's important to note that Annaly Capital is a fairly well-respected mortgage REIT. The difference here is that Annaly's goal isn't really income -- it is total return. Total return requires that dividends be reinvested. If you do that, history suggests that you'll probably be pleased with the results you get from Annaly. However, if you spend the dividends, you are likely to be let down and far better off with Realty Income's growing dividend.