Shares of Beyond Meat (BYND +3.10%) are up 22% over the past week, as of Dec. 4. The rally doesn't appear to be connected to any company-specific news, and it comes during a choppy stretch for the overall market.

For context, Beyond Meat has been a horrendous long-term investment. The share price has plummeted 98% since the company's IPO in May 2019, and it's down 67% year to date, even with the recent surge. But meme stock traders fueled a rally in late October that briefly lifted the stock 1,400% higher. Was that a signal that more upside is on the way, or should investors avoid this stock at all costs?

Image source: Getty Images.

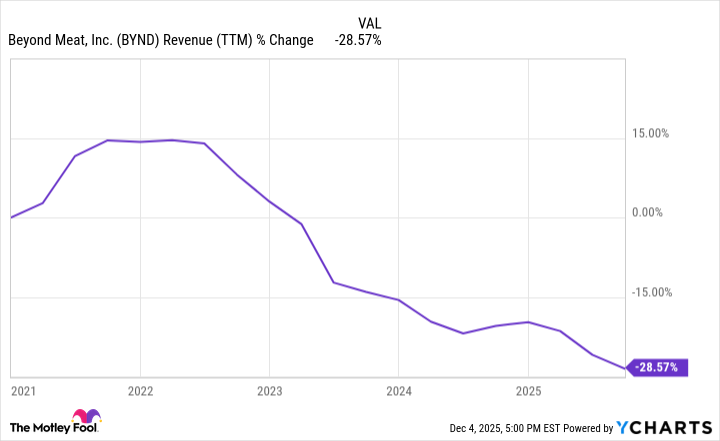

Two charts tell the story

Beyond Meat's third-quarter net revenue dropped 13% to $70.2 million, which the company attributed to "weak category demand," shrinking U.S. retail distribution, and lower sales to fast-food restaurants in international markets. Beyond Meat said it expects Q4 revenue of $60 million to $65 million, which would be a 15% year-over-year decline at the high end of the guidance.

As you can see in the chart below, the declining sales are an extension of a troubling multiyear trend:

Data by YCharts.

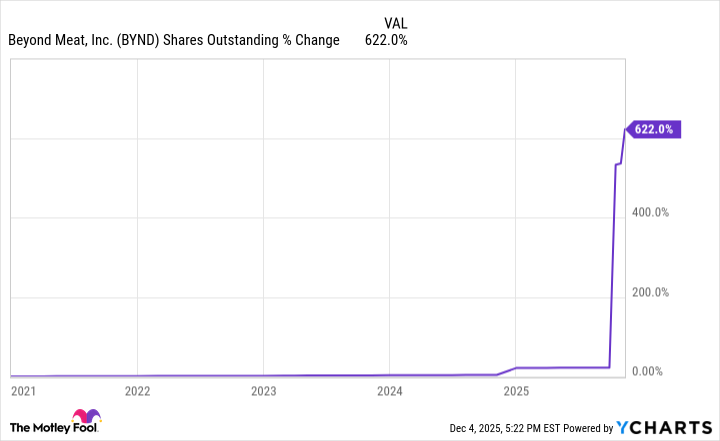

Beyond Meat ended the third quarter with $1.3 billion in long-term liabilities. The company subsequently refinanced around $900 million of that debt, issuing 318 million shares of common stock to bondholders who chose to convert their bonds to shares.

But that's a drop in the bucket compared to a recently approved charter amendment that increases the number of authorized shares from 500 million to 3 billion. As the chart illustrates, share dilution is a very real concern:

Data by YCharts.

Beyond Meat is in turnaround mode, and the company is scrambling to rebuild its distribution network, cut costs, and expand its product lines. But in my opinion, these charts are glaring red flags that this stock is a high-risk bet for speculative traders, not a serious investment.