When the stock market crosses the finish line for 2025 in a little over two weeks, investors are likely to be smiling. Through the closing bell on Dec. 11, the iconic Dow Jones Industrial Average (^DJI 1.37%), benchmark S&P 500 (^GSPC 1.26%), and growth-propelled Nasdaq Composite (^IXIC 1.47%) have rallied 14%, 17%, and 22% year-to-date, with all three indexes logging several record-closing highs.

It would appear that Wall Street has picked up right where President Donald Trump's first term left off. Although the stock market's major indexes have advanced under the tenure of most presidents over the last century, they outperformed in a big way during Trump's first term (January 2017 – January 2021). The Dow and S&P 500 climbed 57% and 70%, respectively, while the Nasdaq surged 142%.

However, this investment gravy train has the potential to come to an abrupt halt in 2026. Though the stock market regularly contends with headwinds, President Trump's tariff and trade policy presents a unique challenge that a comprehensive analysis suggests will be difficult for Wall Street to overcome.

President Trump speaking with reporters. Image source: Official White House Photo by Andrea Hanks, courtesy of the National Archives.

Will Donald Trump's tariff and trade policy lead to a stock market crash in the new year?

On April 2, the president unveiled his touted tariff and trade policy. It featured a sweeping 10% global tariff, along with higher "reciprocal tariffs" on dozens of countries that were deemed to have adverse trade imbalances with America.

Tariffs have been a topic Trump has discussed since he was on the campaign trail. The purpose of implementing tariffs is to make American-made products more price-competitive with those being imported into the country. Further, it has the potential to protect U.S. jobs by encouraging multinational businesses to manufacture their products domestically.

On paper, Trump's tariff and trade policy has its positives. But in practical application, it falls short.

In December 2024, four New York Federal Reserve economists writing for Liberty Street Economics published a report ("Do Import Tariffs Protect U.S. Firms") that examined the effects of President Trump's China tariffs in 2018-2019 on the stocks and businesses that they impacted. Although stocks exposed to Trump's China tariffs during his first term performed worse on days he announced tariffs, there were far more important findings.

For example, the New York Fed economists analyzed the future outcomes of the public companies that were adversely impacted by Trump's China tariffs. What they found is that these companies experienced average declines of 2.2% in labor productivity, 3.9% in employment, 6.7% in sales, and 12.9% in profits between 2019 and 2021. In other words, Trump's tariffs had a lasting negative impact on public companies with exposure.

Additionally, Liberty Street Economics' report laid out why U.S. firms were struggling. In particular, economists pointed to input tariffs, which are duties placed on goods imported into the U.S. to complete the manufacture of a product domestically. Input tariffs, such as those on copper, steel, or automotive parts, can drive up domestic production costs, which are then passed on to consumers.

While this comprehensive analysis points to the potential for economic and stock market weakness in the coming years, based on what previous events have told us, it doesn't portend a stock market crash in 2026.

However, historical valuation data tells a different story.

Image source: Getty Images.

The stock market is historically pricey -- and that's worrisome for investors

Let me preface any discussion on valuation with the reality that value is a subjective term. Every investor has their own unique method of evaluating companies, which means what you find to be expensive might be viewed as a bargain by someone else. This subjectivity is what makes the stock market so unpredictable.

Most investors rely on the time-tested price-to-earnings (P/E) ratio when evaluating stocks. A company's P/E ratio is arrived at by dividing its share price by its trailing 12-month earnings per share (EPS). The shortcoming of the P/E ratio is that recessions and shock events can render it useless.

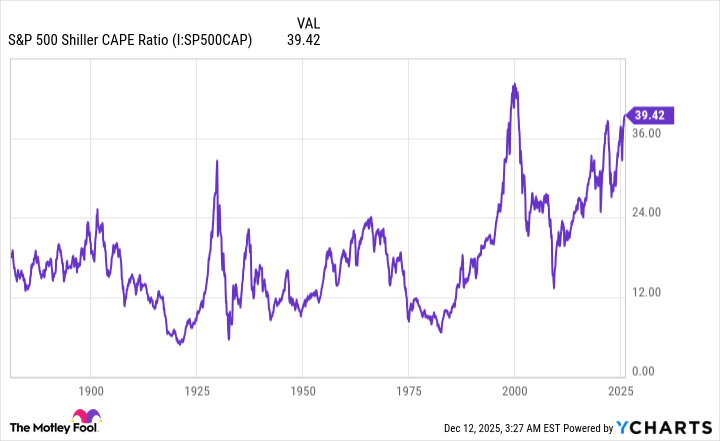

The valuation tool that maintains its utility in any economic climate is the S&P 500's Shiller P/E Ratio, which is also known as the cyclically adjusted P/E Ratio (CAPE Ratio). Unlike the traditional P/E ratio, which is based on trailing 12-month EPS, the Shiller P/E is based on average inflation-adjusted EPS over the previous 10 years.

When back-tested to 1871, the Shiller P/E has averaged a multiple of approximately 17.3. But as of the closing bell on Dec. 11, the S&P 500's Shiller P/E clocked in with a multiple of 40.67.

To put this figure into perspective, the only time stocks have been collectively pricier than they are now is in the months leading up to the bursting of the dot-com bubble, when the Shiller P/E peaked at 44.19.

S&P 500 Shiller CAPE Ratio data by YCharts.

Widening the lens even further, there have only been six occurrences in 155 years where the S&P 500's Shiller P/E has surpassed 30 for a period of at least two months during a continuous bull market. Following each of the previous five instances, the Dow Jones, S&P 500, and/or Nasdaq Composite eventually shed 20% to 89% of their value. Historically, there's no downside indicator for the stock market more reliable than a Shiller P/E above 30.

What can complicate things in 2026 is if Trump's tariffs begin hurting corporate sales and profits in the same manner that they did following the implementation of China tariffs in 2018-2019. Premium valuations are unlikely to be sustained on Wall Street if there's a slowdown in corporate EPS growth.

While no direct connection can be made to Trump's tariff and trade policy sparking a stock market crash in 2026, it could serve as an ancillary catalyst, in conjunction with premium stock valuations, to jump-start a stock market correction.