Roughly a year ago, I highlighted Realty Income (O +0.67%) as a top buy for 2025 due to its attractive valuation and substantial dividend. So, how did shares of the popular real estate investment trust (REIT) perform? The stock price has increased by approximately 8% this year.

Not bad, but it's fair to say that Realty Income probably hasn't lived up to such high expectations. The company didn't deliver enough profits to lift the stock as investors might have hoped.

But sometimes, you're not wrong -- just early. So, I'm mounting up and getting back on the horse. Here is why Realty Income is, once again, a top REIT to buy for 2026.

Interest rates have started to ease

When I discussed Realty Income last year, I highlighted high interest rates as a primary contributor to the stock's woes. The economy and stock market had just gone through one of the most aggressive rate-hiking cycles in history, as the Federal Reserve moved to cool rampant inflation following the COVID-19 pandemic.

Image source: Getty Images.

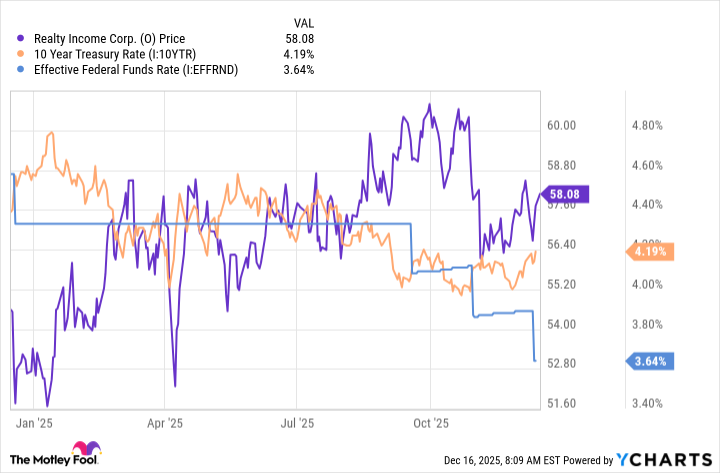

Monetary policy has eased in recent months, including a couple of rate cuts. As a REIT, Realty Income is sensitive to interest rates because it often borrows to fund new property acquisitions. Lower rates generally benefit its business.

Data by YCharts.

The stock has responded well to the easing of interest rates over the latter half of 2025.

Yes, the dividend is still rock-solid

Investors buying Realty Income for 2026 or any other year are probably at least interested in dividend income. Realty Income is primarily known for its monthly dividend, which yields 5.5% at its current share price.

Dividends represent stock returns that an investor can realize without having to sell their shares. Additionally, you can reinvest the dividends to buy additional shares, and the dividends those shares pay create a further compounding effect.

NYSE: O

Key Data Points

Realty Income's dividend remains as safe as you'll find. The company has increased the dividend 133 times since its public listing in 1994; that's over three decades of consistent growth. The REIT specializes in net leases to single tenants in consumer-facing businesses, including restaurants, retail stores, pharmacies, and other similar establishments that generate steady foot traffic.

As a result, Realty Income enjoys reliable rental income, which has enabled the company to raise its dividend through recessions, a pandemic, and other challenging periods over the years.

This is why Realty Income finally looks like a winner in 2026

All that said, Realty Income seems poised to build on a decent 2025 with an even better outing next year.

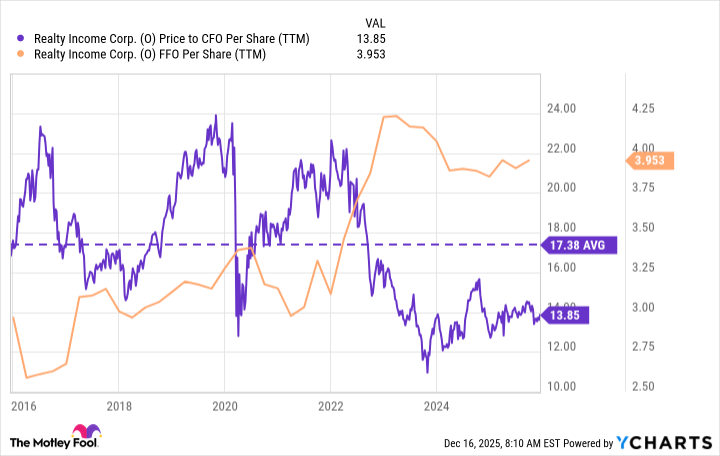

Realty Income's funds from operations (FFO) per share declined and stagnated following a significant acquisition it had funded with stock. Management anticipates the company will end 2025 with FFO per share between $4.25 and $4.27, representing a notable improvement in its performance over the past couple of years.

Data by YCharts.

Meanwhile, the stock still trades at a valuation well below its long-term norms. It sets the stock up for a potential reversion toward that level, which seems increasingly likely as interest rates continue to ease and the company begins growing its FFO per share again.

To be clear, Realty Income has historically grown at a low-single-digit rate, so it's unlikely to become a multibagger stock anytime soon. Still, Realty Income has outperformed the broader market over its lifetime, primarily due to generous dividends that you can reinvest year after year.

With the stock trading at a low valuation and Realty Income's profits heading higher, investors who buy now could enjoy strong investment returns in 2026 and potentially beyond.