Finding the ultimate stock to buy for 2026 is no easy task. First, you have to address whether the stock will come from an AI-related field or not. There are growing fears of an AI bubble forming, but those fears are negated by real money being spent by the AI hyperscalers, who are racing to build out as much computing capacity as possible. I think one of the best stocks to buy for 2026 comes from this industry, and it's a key supplier.

While I'll entertain an argument of whether Nvidia's dominance is slipping, what isn't up for debate is how much is being spent on AI infrastructure. After setting records in 2025, the AI hypercalers look to be setting a new record on data center capital expenditures again in 2026. There are several companies positioned to take advantage of that buildout, but none is in a better spot than Taiwan Semiconductor Manufacturing (TSM 1.64%).

Image source: Getty Images.

Taiwan Semiconductor is a neutral party in the AI arms race

Taiwan Semiconductor is a chip fabrication business and sells its production capacity to various companies in the chip realm. Taiwan Semiconductor is regarded as the top company in its industry, which is why nearly all of the major computing unit designers partner with Taiwan Semiconductor. It doesn't matter if the computing unit being purchased is from Nvidia, Advanced Micro Devices, or Broadcom; chances are, it has a chip from TSMC in it.

This places Taiwan Semiconductor in a neutral position, as it benefits from increased spending regardless of which computing unit is the most popular. The trends are clearly in favor of increased data center spending, and that trend isn't expected to slow down anytime soon.

NYSE: TSM

Key Data Points

Nvidia believes that the global data center capital expenditures will rise from $600 billion in 2025 to $3 trillion to $4 trillion by 2030. Not all of that money will flow toward computing, as there are also construction and land costs to consider. AMD offered a similar projection, as they believe the compute market will be worth $1 trillion by 2030. This bodes well for Taiwan Semiconductor, as it will be providing the chips to power most of these data centers.

However, one issue that may hamper the growth of the industry is power capacity. It's no secret that we could be headed for an energy shortage in the near future, and doing everything possible to consume less energy to maximize computing performance is critical.

Taiwan Semiconductor understands this, which is why its latest technology is focused on improving energy consumption. Its next generation of chips, 2nm (nanometer), promises to consume 25% to 30% less energy when configured for the same speed as its 3nm predecessor. That's a huge jump in efficiency, and may be what's needed to keep the AI buildout going.

These chips are entering production right now and will boost Taiwan Semiconductor's finances throughout 2026. However, Taiwan Semiconductor is also doing incredibly well right now.

TSMC provides incredible performance at a low price

In its most recent quarter, Taiwan Semiconductor's revenue rose at a 41% pace in U.S. dollar terms, placing it among the fastest-growing big tech stocks. With the AI buildout not expected to slow down anytime soon, Taiwan Semiconductor should be able to keep this growth rate up for several years.

Despite its strong growth, the stock really doesn't have a premium price tag assigned to it.

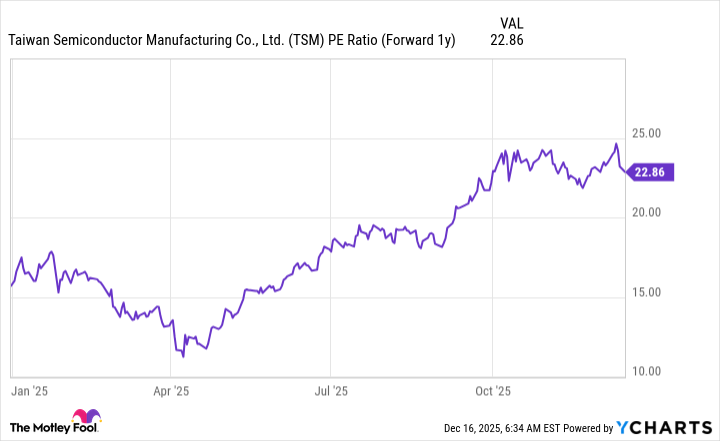

TSM PE Ratio (Forward 1y) data by YCharts

At 23 times next year's earnings, Taiwan Semiconductor doesn't carry a premium price tag. It is priced lower than its peers, with AMD trading at 32 times next year's earnings, Broadcom at 25, and Nvidia at 24.

Taiwan Semiconductor is reasonably priced and is slated to deliver impressive growth over the next few years. As a result, I think it's the ultimate stock to buy now, as it's set to benefit regardless of which computing unit the AI hyperscalers are using. All it needs to succeed is for the AI hyperscalers to continue spending heavily, and they are primed to do just that.