Warren Buffett is heading into his final days as chief executive officer of Berkshire Hathaway, but his last message isn't completely cheerful. In fact, expressed not by words but through Buffett's recent moves, this message could be seen as a $381 billion warning to Wall Street.

It's important to note that Buffett isn't completely leaving the investing scene, as he'll continue on as Berkshire Hathaway's chairman, but, as of Jan. 1, he is handing over the investment decision reins to Greg Abel, who currently serves as the holding company's vice-chairman of non-insurance operations. This means that investors may be paying particularly close attention to Buffett's last moves as CEO.

In recent quarters through this very moment, Buffett's warning has been ringing out loud and clear. And history offers a strikingly precise picture of what may happen in 2026.

Image source: The Motley Fool.

Why investors care about Buffett's investing moves

First, though, a quick note about why investors care so much about Buffett's every investing move. This is because Buffett has been so successful over time that he's won the nickname the "Oracle of Omaha," a reference to his skill and his hometown. Buffett over nearly 60 years at the helm of Berkshire Hathaway has led market-beating returns, with Berkshire Hathaway delivering a compounded annual gain of almost 20% compared to the S&P 500's 10%.

This investing giant puts an emphasis on value investing -- the idea of buying a stock for less than what it's truly worth -- and holding on to stocks for the long term. He's joked around in the past, saying his ideal holding period is "forever."

SNPINDEX: ^GSPC

Key Data Points

These principles have worked well for Buffett, and throughout the years, other investors have looked to him for guidance on what to do in certain market environments or which stocks to buy. And this brings me to Buffett's big warning to Wall Street.

The billionaire has been a net seller of stocks for the past 12 quarters, and as he's sold stocks and limited his purchases, he's built up a record level of cash. In the latest quarter, it reached $381 billion.

The element that may be guiding Buffett

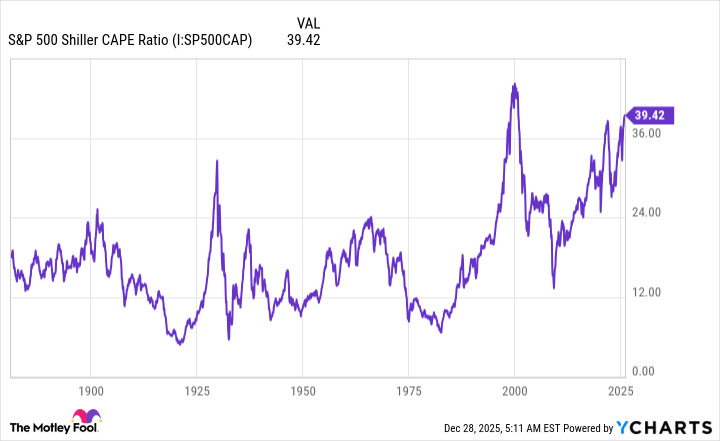

This suggests that Buffett hasn't seen many opportunities in the stock market over that time period. Though the investing giant hasn't explained the reasoning for his moves, it's very likely that one element in particular may be guiding him. And that's valuation. Stocks have reached record levels in recent times, as we can see through the S&P 500 Shiller CAPE ratio. This is a measure of earnings per share and stock price over a 10-year period. Since we know Buffett refuses to buy stocks that are too expensive, this trend most certainly has put the brakes on his buying activity.

S&P 500 Shiller CAPE Ratio data by YCharts

Now let's consider what history tells us about the situation. Looking over the past 25 years, we can see that every time the Shiller CAPE has peaked, the S&P 500 has gone on to post declines. In some cases, these decreases are brief, and other times, they are longer-lasting. Considering the Shiller CAPE levels of today, this suggests that the S&P 500 could be in for declines in 2026. And we can't say Buffett hasn't warned us.

S&P 500 Shiller CAPE Ratio data by YCharts

What does this mean for you?

So, what does this mean for you as an investor right now? Does this mean you should stop buying stocks? No. It's important to remember that even though Buffett hasn't been a big buyer of stocks in recent times, he still has found some opportunities and added them to the Berkshire Hathaway portfolio. Buffett's moves simply mean that investors shouldn't just pile into certain stocks because they're popular, and instead, should pay close attention to valuation. If a stock is trading for a cheap or even reasonable price, go for it. But if it isn't, you may want to think of Buffett's recent moves before hitting the buy button.

Finally, a key thing to consider is that though history points to a potential drop in stocks next year, a decline may not result in the S&P 500 falling for the year. The index may pull back at some point, but finish the year on a positive note. Even better: History has shown us that after any decline, even the biggest ones, the index has always gone on to rebound and advance.

So, though Buffett's warning rings out loud and clear, the S&P 500 still could win in 2026 -- and the best news of all is it's well-positioned to roar higher over the long term.