Quantum computing is a difficult area to invest in. It's similar to investing in early-stage biotechs, where there are some promising results, but nothing indicative of true future success. Couple that with how many companies are competing for quantum computing dominance, and it turns into a very difficult area to invest in.

Furthermore, this industry has a lot of hype around it, and some of the pure-play stocks, like IonQ and Rigetti Computing, are seeing their stocks rapidly rise and fall in line with the risk tolerance of the market.

Many investors may want to shy away from this industry because of the volatility and lack of a clear leader, which is fine. However, I think there's a smarter way to invest in the quantum computing realm without needing to expose yourself to high-risk investment that has a huge chance of paying off.

How? Through an investment in Alphabet (GOOG 0.85%) (GOOGL 0.69%).

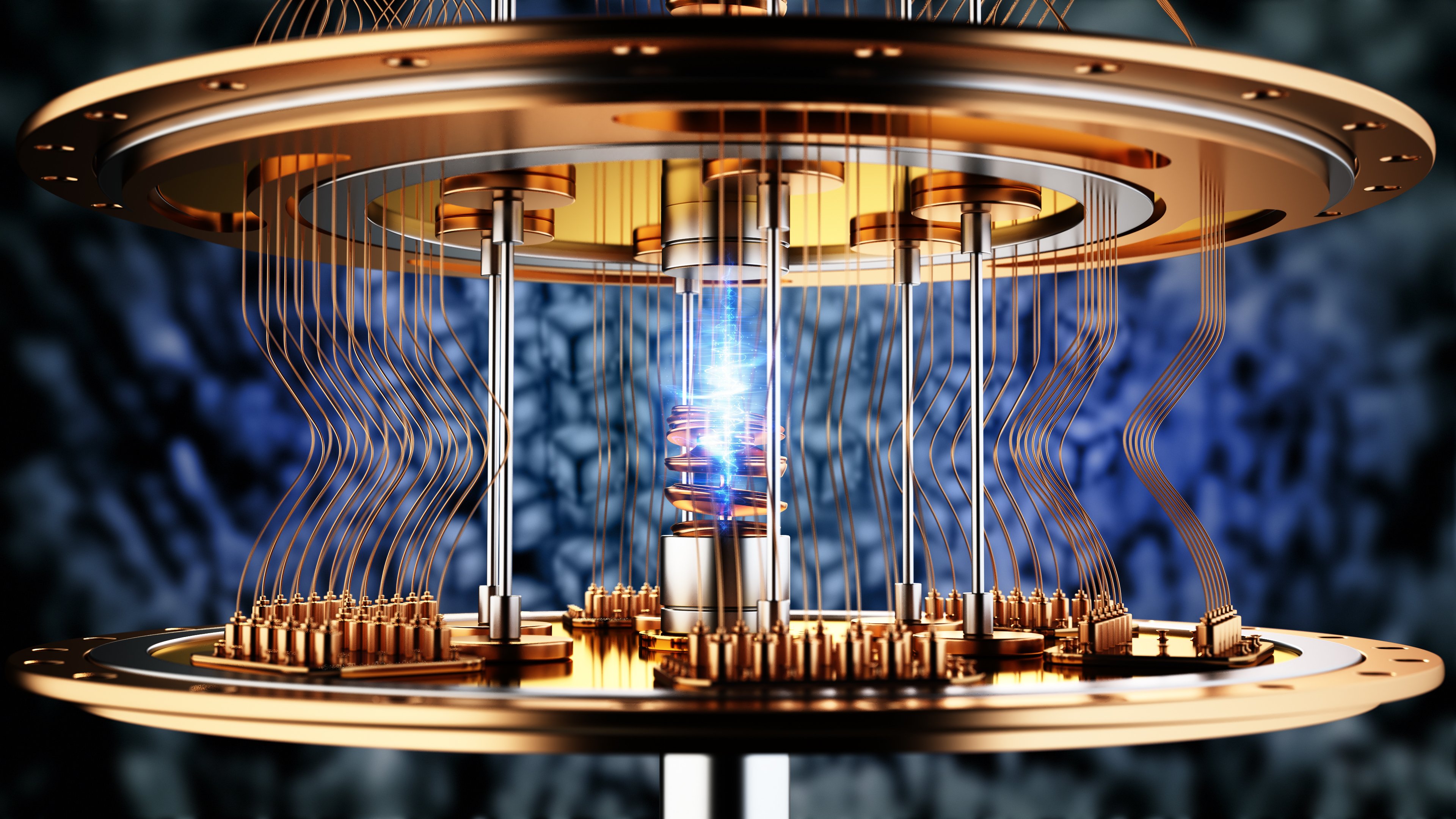

Image source: Getty Images.

Alphabet could see a huge benefit by developing quantum computing technology

Alphabet is a large conglomerate of companies, but it's mainly centered around the Google ecosystem. While Google Search and the ad revenue it generates are the core of Alphabet's business, it's more diversified than that segment.

Alphabet also owns a cloud computing business, Google Cloud. Google Cloud uses computing units from other providers, such as Nvidia's graphics processing units (GPUs), to rent out computing capacity to customers for a wide variety of tasks. However, it has to purchase those GPUs from Nvidia, which is expensive.

Google also developed the Tensor Processing Unit (TPU) in-house in collaboration with Broadcom, which is a step closer to fully building its own computing hardware. However, Alphabet has chosen to develop its quantum computing hardware entirely on its own, which could pay off big-time for its cloud computing business if it succeeds.

NASDAQ: GOOGL

Key Data Points

If Alphabet can win the race to build the first commercially viable quantum computer, then clients will flock to Google Cloud to utilize this cutting-edge technology. This would have other trickle-down effects, such as more clients using its generative artificial intelligence (AI) model, Gemini. Quantum computing technology is expected to greatly reduce the cost of running artificial intelligence training and inference, which would make Gemini the go-to model if Alphabet can develop a quantum computing advantage.

There are also other implications, such as its self-driving car division, Waymo. Self-driving technology is incredibly complicated and it takes a long time to build the models that control the cars. But what if a quantum computer could help? That could provide a huge advantage over the competition and boost Waymo into becoming the first widespread self-driving network. There's no guarantee that this will occur, but building a quantum computer will certainly give Waymo an edge.

Alphabet has a ton to gain from developing quantum computing technology, and it's already showing great signs of progress.

Alphabet recently unveiled the first visible quantum advantage

In October, Google announced that its Willow chip had successfully completed the first verifiable algorithm in quantum computing. It ran an algorithm 13,000 times faster than the world's fastest supercomputer, which is a huge improvement. However, that speed isn't so fast that the same calculation couldn't be run to verify its accuracy. This first confirmed quantum advantage is a big deal and has real-world implications, as the algorithm used is the same one that is used in MRI technology in the medical industry.

There is a ton of upside in Alphabet's quantum computing research, and not a lot of downside. If Alphabet's quantum computing endeavors fail, it still has a strong core business to lean on. If it succeeds, Alphabet will have an advantage over the competition in every field it competes in, making it a near-unstoppable stock. As a result, it's a great one to buy now and hold on to for the coming years.