If you are looking for stocks that you can buy and hold for the long term, you need to examine the quickly emerging field of robotic surgery. Intuitive Surgical (ISRG 2.71%) is one company that stands out as a pure play in the space. Not only was it one of the first to market with a surgical robot, but it also has a massive and still-growing installed base.

Here's what you need to know if you're considering an investment in the stock.

Image source: Getty Images.

Demand for Intuitive Surgical's robots is strong

At the end of the third quarter of 2025, Intuitive Surgical had placed 10,763 of its da Vinci surgical robot systems into service. That was up from 9,539 in the same quarter of 2024, a 13% increase. There is clearly strong demand for the company's high-tech medical devices.

However, that demand isn't the only demand that's important to monitor. A 13% increase in da Vinci surgical robots operating in the world would, logically, result in a 13% increase in surgeries performed with those robots. Only that's not what happened. The number of surgeries performed with a da Vinci system increased 20% year over year.

Doctors and patients alike clearly want to use surgical robots. That makes sense, given that the technology allows for less invasive procedures and better surgical outcomes. This technology represents a significant advance for the healthcare sector, which is likely to continue finding new applications.

In fact, Intuitive Surgical just received Food and Drug Administration (FDA) approval for da Vinci systems to perform inguinal hernia repairs, cholecystectomies, and appendectomy procedures.

NASDAQ: ISRG

Key Data Points

You have to think long term with Intuitive Surgical

There is a huge opportunity for Intuitive Surgical's business. However, Wall Street is well aware of this fact, and the stock appears somewhat expensive today. The price-to-earnings (P/E) ratio is currently around 75, which is very high on an absolute level. However, it is roughly in line with the five-year average P/E ratio. All in, it looks like investors are paying full price for the stock.

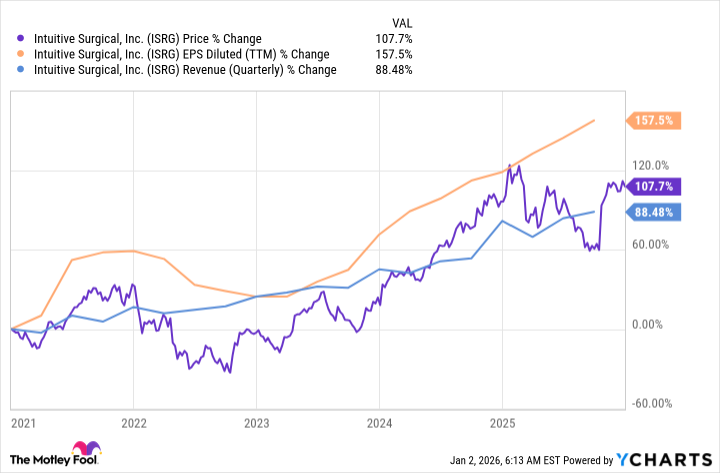

For value-focused investors, Intuitive Surgical isn't going to be an attractive investment. However, if you are a growth investor, it could still be very interesting. Over the past five years, the company's revenue increased by nearly 90%, earnings rose by more than 150%, and the stock gained just over 100%.

ISRG data by YCharts. EPS = earnings per share. TTM = trailing 12 months.

Given the still-strong demand for the company's da Vinci systems, the increasing demand for surgeries using those systems, and the growing number of indications for the system's use, it seems highly likely that Intuitive Surgical's growth will continue. Wall Street has rewarded that growth in the past and is likely to keep doing so in the future.

If you buy and hold, you'll get to benefit from the growth of this robotic surgery titan's business over time -- even if it's not a 100% gain by 2030.

GARP investors shouldn't buy just yet

If you care about valuation, don't give up on Intuitive Surgical. Like most growth stocks, the shares can be volatile. Drawdowns of 20% to 30% are fairly common for the stock, even as it continues to push broadly higher over time. If you can handle swings like that, buying and holding is just fine. But if you can be a little patient, a drawdown could be an opportunity for a growth at a reasonable price (GARP) investor to jump aboard without paying full fare.

That said, even after a 30% drawdown, the stock is unlikely to appear cheap on an absolute level. Unless the growth story breaks, which seems unlikely, Intuitive Surgical is likely to fetch a premium to the market for the foreseeable future. However, if history is any guide, the company's strong business growth has been worth that premium.