The rise of artificial intelligence into the mainstream has been a boon for many businesses, including Credo Technology Group (CRDO 7.29%). Shares of the company are up over 100% in the past 12 months through the week ending Jan. 9, thanks to its solutions for AI-optimized data centers.

In addition, an analyst for Needham recently reaffirmed a buy rating on Credo stock with a $220 price target, calling it a top pick for 2026. Part of Wall Street's euphoria is due to the company's excellent earnings report for its fiscal second quarter ended Nov. 1, which bolstered the case that Credo's AI offerings will be a winner over the long term.

To assess if Wall Street's infatuation with Credo is warranted, and to weigh whether now is the time to buy, here's a deeper look into the company.

Image source: Getty Images.

The source of Credo's AI success

Credo's path to AI fortunes lies in its high-speed connectivity solutions. Its products enable fast data transfer across components that comprise an AI system. The need for speed is an essential element of tech infrastructure, since AI models are becoming increasingly sophisticated, as demonstrated by the emergence of agentic AI.

Vast amounts of digital information must be fed into artificial intelligence models to train them and help them perform inference, the process of making decisions and executing tasks. To do these steps in a timely manner requires fast and reliable connectivity solutions, which is an area Credo specializes in through products such as its active electrical cable (AEC) and proprietary serializer/deserializer technology.

But many of today's data centers were not constructed to support AI. As a result, data centers designed to meet AI's needs are being built. Some of them will be as big as cities. That's the level of computing power required for AI. The size of these data centers necessitates miles of wiring, making products such as AECs key components to AI infrastructure, and creating a market for Credo's connectivity solutions.

NASDAQ: CRDO

Key Data Points

How AI impacted Credo's financials

The demand for Credo's products is illustrated in its sales. For example, in the company's fiscal Q2, revenue grew an astounding 272% year over year to $268 million. And although Credo's Q2 operating expenses nearly doubled year over year to $102.3 million, it still exited the quarter with net income of $82.6 million. That's a dramatic turnaround from the net loss of $4.2 million experienced in the prior year. But that's not all.

Credo exited its fiscal Q2 with an outstanding balance sheet. Total assets were $1.4 billion, including $567.6 million in cash and equivalents, while total liabilities were only $163.2 million. Reflecting on the company's magnificent Q2 performance, CEO Bill Brennan stated, "These are the strongest quarterly results in Credo's history, and they reflect the continued build-out of the world's largest AI training and inference clusters."

The company expects its sales growth to continue. It expects fiscal Q3 revenue to come in between $335 million and $345 million. Even the low end of that range would be an impressive increase over the previous year's sales of $135 million, which represented record Q3 revenue at the time.

To buy or not to buy Credo stock

Credo's high-speed connection products position the company to continue capturing customer demand in the AI infrastructure market. Forecasts estimate this sector will expand rapidly from $58.78 billion in 2025 to $356.14 billion by 2032, providing Credo with years of industry growth as a tailwind.

Yet after the company's superb fiscal Q2 earnings, its stock price soared, reaching a 52-week high of $213.80 on Dec. 2. Shares have dropped since then, so is now a good time to buy?

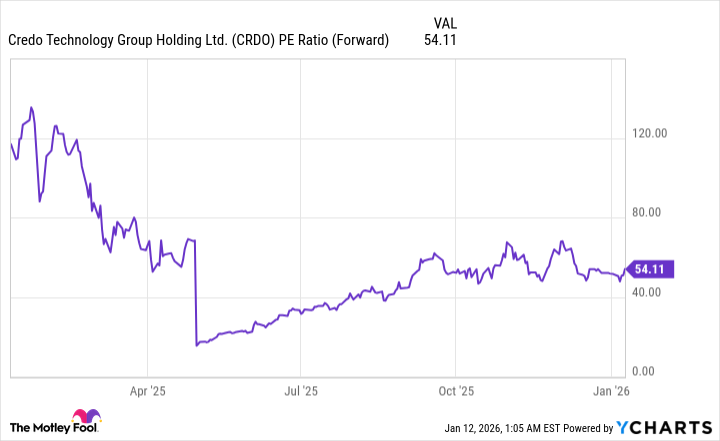

One factor to weigh is Credo's valuation. This can be assessed using the stock's forward price-to-earnings ratio (P/E), which tells you how much investors are paying for a dollar's worth of earnings based on estimates for the next 12 months.

Data by YCharts.

The chart above shows that the company's forward earnings multiple has dropped substantially from a year ago, indicating its valuation is more reasonable now. A forward P/E ratio over 50 isn't cheap. Still, the elevated valuation may be warranted in this case because of the AI sector's tailwind. Moreover, while the company faces larger competitors, such as Broadcom, Credo's robust sales growth indicates it's winning its share of the AI infrastructure market.

With several more years of strong industry expansion ahead, Credo is poised for continued success. These factors make Credo Technology a compelling investment opportunity.