Investors always are searching for the next big hit in the world of technology -- and this is a wise move, considering how such innovations have resulted in soaring earnings and stock prices. Great examples are iPhone giant Apple and artificial intelligence (AI) chip designer Nvidia. They've created game-changing products that individuals or companies need, and this has helped their growth explode over time.

Right now, quantum computing is an area of such potential. Quantum computers, guided by the principles of quantum mechanics, work differently from classical computers and are complicated to build and scale -- but they hold enormous potential as they may allow us to solve problems deemed impossible today. That's why, if you're a growth investor looking for the next big boom, it's a great idea to add a few of these shares to your portfolio.

Here, we'll check out two players that are well-positioned for success in the field. One makes a great investment for investors who are comfortable with a bit of risk; the other is a buy for any investor interested in betting on quantum computing. These stocks, in the context of a diversified portfolio, could become potential millionaire-makers.

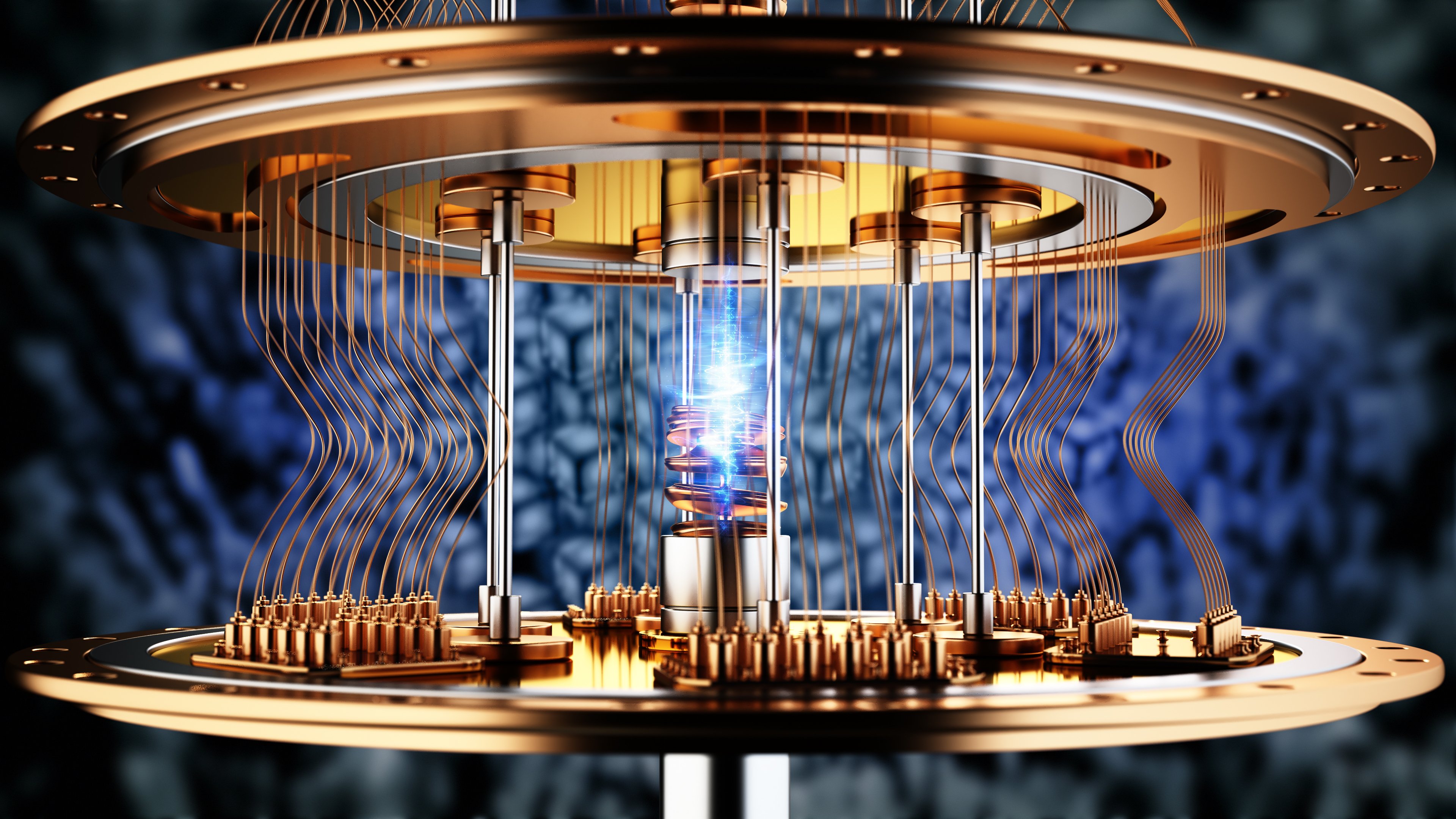

Image source: Getty Images.

1. IonQ

IonQ (IONQ +6.81%) is a pure play quantum computing company, meaning it focuses specifically on this technology. This could result in enormous gains if the company makes it to the finish line, but it also implies more risk. Since IonQ truly depends on success in quantum computing, any setback or failure could seriously hurt stock performance. So the stock is right for you only if you can accept that risk.

IonQ stands out thanks to its way of constructing qubits, or the elements that power a quantum computer's computations. (Classical computers rely on bits for that.) The company uses trapped ion technology, a method that results in a lower error rate -- this is key because error rates have been a challenge in quantum computing. And trapped ions remain in quantum states longer, offering more computing time. These are significant advantages that could make this company a winner down the road.

NYSE: IONQ

Key Data Points

Today, IonQ offers access to its quantum computers primarily through major cloud service providers and generates some revenue, but as the company itself says, "we are still in the early stages of commercial growth." That's why now is a good time for aggressive investors to get in on this story and hold on as the technology progresses.

2. Alphabet

Alphabet (GOOG 0.85%) (GOOGL 0.83%) is a company most of us are in contact with on a daily basis. That's because it's the owner of the world's No. 1 search engine, Google. And the Google platform, through advertising, generates billions of dollars in revenue quarter after quarter.

Alphabet's second major moneymaker is its cloud unit, known simply as Google Cloud. This business has been growing in leaps and bounds, and demand from AI customers has added to the momentum.

These two businesses make Alphabet a solid buy for any investor, whether you're cautious or aggressive. But what's even better is that the company also offers you the opportunity to benefit from the high-potential field of quantum computing.

NASDAQ: GOOGL

Key Data Points

This is because Alphabet is working intensely in this area, developing its own quantum chip. In late 2024, the company introduced Willow, saying the chip can cut errors exponentially as systems are scaled up with more qubits -- this is a huge milestone. And this past fall, Alphabet ran a verifiable algorithm on its Willow platform, surpassing the performance of the most powerful supercomputers. This brings quantum computing a step closer to real-world usefulness.

So, Alphabet offers investors the strength of a long-established, highly profitable business along with the opportunity to potentially benefit from success in quantum computing. And if the company wins in quantum, it may help deliver million-dollar returns for early investors.