Costco Wholesale (COST +0.72%) stock didn't have a great year in 2025, losing 6% of its value. But over many decades, Costco has outperformed the market and rewarded shareholders. It's reliable for sales growth and high profits, and its model continues to stand out and attract new members. If you'd invested $1,000 20 years ago and just held on, you'd have a lot more today.

Image source: Getty Images.

The winning Costco model

Costco's rock-bottom prices appeal to any shopper at any time, but the company's bare-bones warehouses, bulk packaging, and low prices are even more attractive when customers are pinching pennies. That's why the company typically grows in any kind of market, but reports some of its best performance under pressure.

NASDAQ: COST

Key Data Points

In the current environment, it has consistently reported high-single-digit sales growth, including 8.2% in the 2026 fiscal first quarter (ended Nov. 23, 2025). It continues to add millions of new members and upgrade many of them to executive status, which implies greater loyalty.

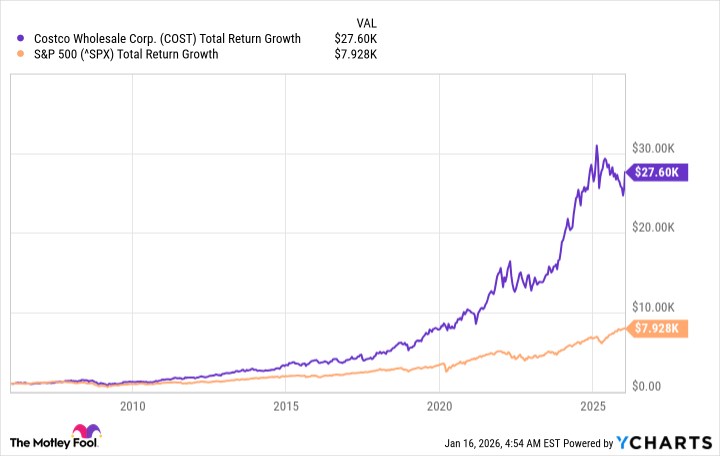

The core model hasn't changed in decades, and if you'd recognized the potential and invested 20 years ago, you'd have a lot more money today. If you'd invested $1,000 in Costco stock, you'd have $27,600 today, including dividends. Contrast that with $7,900 invested in the S&P 500.

COST Total Return Level data by YCharts

Can Costco stock still deliver? Its model hasn't changed, although the company is embracing technology where it makes sense. Costco is still expanding and has robust long-term opportunities, and although past results aren't a guarantee for the future, Costco stock should keep rewarding investors for the foreseeable future.