Long-term investing is one of the most effective ways to build wealth while minimizing the impact of market volatility, and exchange-traded funds (ETFs) are low-maintenance investments that let you buy into hundreds of companies at once with next to no effort on your part.

Choosing the right ETF can be tricky, though, especially with so many to choose from. But if I could only choose one to buy and hold for decades, there's one I'd stock up on in 2026.

Image source: Getty Images.

A growth ETF that offers some stability

Generally speaking, many ETFs fall into one of two camps: those designed for stability and those aiming for growth. Some funds, though, can do both.

The Vanguard S&P 500 Growth ETF (VOOG +1.06%) only includes stocks from the S&P 500 (^GSPC +1.11%). These companies are among the largest and strongest in the U.S., and many are industry leaders with a long history of weathering economic instability.

However, this fund doesn't include all of the stocks from the S&P 500. Rather, it only holds those with the most potential for growth. This can help balance risk and reward by focusing on stocks that have both proven track records and room to grow. With its more targeted approach, it's also less likely to get bogged down by lower-performing stocks.

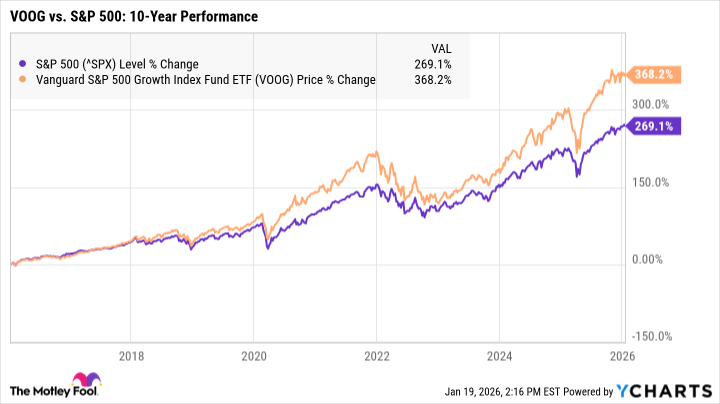

Over the past decade, the Vanguard S&P 500 Growth ETF has significantly outperformed the S&P 500 with total returns of 368%. In other words, if you'd invested $10,000 a decade ago, you'd have around $47,000 with this ETF versus around $37,000 with a standard S&P 500 ETF.

One crucial risk to consider

It's important to note that while this ETF has beaten the market over many years, its short-term performance has been rockier. This is true for many growth-focused funds, as they tend to lean heavily on tech stocks -- which are notoriously volatile.

If you choose to invest, be sure you're willing and able to stay invested for five to seven years or longer. Even strong investments can experience nauseating downturns if the market takes a turn for the worse, but you won't technically lose any money unless you sell your investment for less than you paid for it. By riding out the storm until stock prices recover, you'll likely regain any lost value.

The Vanguard S&P 500 Growth ETF offers some of the stability of an S&P 500-tracking fund, as it only contains large, strong stocks. But its narrower focus on growth stocks can also help it deliver above-average returns over time, making it a smart option for investors looking for long-term gains with less risk than some other growth funds.