Robinhood Markets' (HOOD +1.83%) stock rocketed higher last year, after the company rapidly expanded its asset base and joined the S&P 500 just one year after turning profitable. However, given Robinhood's meteoric rise, I believe another brokerage company, Tradeweb Markets (TW 0.28%), is a better pick for investors. Here's why.

A breakout year for Robinhood

Last year was a banner year for Robinhood. The company posted stellar growth, with third-quarter revenue roughly doubling year over year to about $1.27 billion, while net income soared by more than 270%. Funded accounts and Gold subscribers hit record levels, showing strong customer engagement and a growing asset base to build on.

Image source: Getty Images.

The company expanded its offerings, including event contracts, which are growing in popularity. It has also embraced tokenization. As a shareholder, I like what Robinhood is doing and the levers it continues to pull to drive growth. However, the stock has gotten expensive, with shares priced at 42.8 times forward earnings.

NASDAQ: HOOD

Key Data Points

Tradeweb stands to benefit from active markets

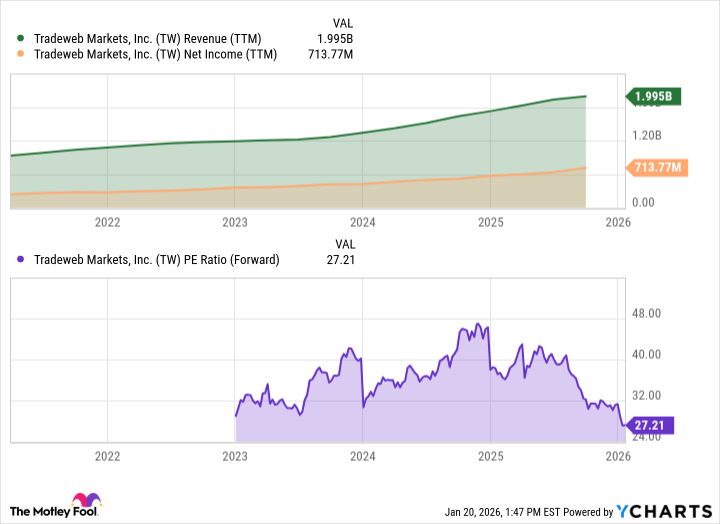

Tradeweb operates a professional trading platform for professional investors across industries that has achieved stellar growth over the past few years as it's grabbed market share from competitors. It has done an excellent job and finished 2024 as the top platform for U.S. electronic high-grade credit markets. It also boasts a 22% share of U.S. Treasury trading volume.

Last year was tough for Tradeweb, which has declined 31% from its April peak. At that time, markets were experiencing high volatility driven by U.S. tariff announcements, which sent shockwaves through interest rate and equity markets. In the third quarter, CEO Billy Hult noted that muted volatility, stemming from fewer data points amid the government shutdown, led to decreased activity, which weighed on its performance.

NASDAQ: TW

Key Data Points

Tradeweb still sees opportunity for further growth. With geopolitical tensions remaining high, management expects volatility to normalize as data becomes available and sees the setup heading into 2026 as constructive for its business. December trading volume supports this view, with total volume hitting $63 trillion and average daily volume rising about 27.5% year over year.

Data by YCharts.

Tradeweb stock is currently trading at about 27 times forward earnings, and its core business continues to maintain a strong market position across credit, interest rate, and equity markets. If you believe volatility could pick up in 2026 due to uncertainty around geopolitics and interest rates, Tradeweb is a solid stock to scoop up today.