The U.S. labor market has shown signs of significant deterioration over the past year. An economy that had pretty steadily been creating 100,000-plus jobs every month has sputtered to near-stagnation.

From May 2025 through December 2025, U.S. non-farm payrolls have increased by only 93,000 jobs total, an average monthly increase of just 11,625. On top of that, the month-over-month change has been negative in three of the past seven months.

| Month | Non-Farm Payroll Monthly Change |

|---|---|

| June 2025 | -13,000 |

| July 2025 | +72,000 |

| August 2025 | -26,000 |

| September 2025 | +108,000 |

| October 2025 | -173,000 |

| November 2025 | +56,000 |

| December 2025 | +50,000 |

Data source: Trading Economics

To provide a sense of how rare the "three in seven" signal is, it's only happened three other times in the past 40 years:

- September 1990-November 1991

- April 2001-December 2003

- January 2008-December 2010

Right now is the fourth instance of this occurring.

Image source: Getty Images.

Why is this important?

All three of the previous times this was triggered coincided with major U.S. recessions.

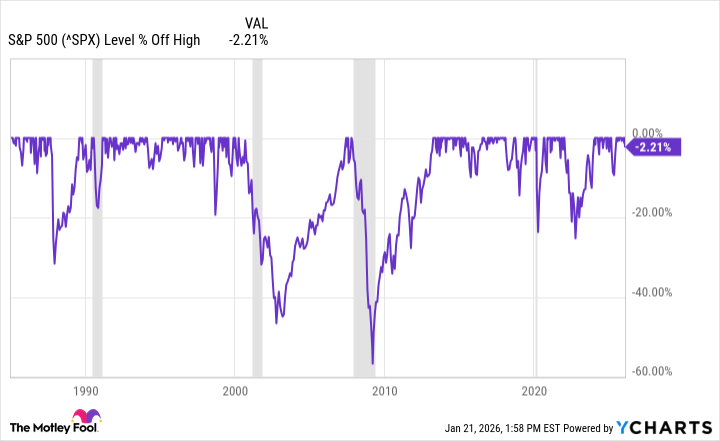

The early-1990s recession was the most benign of the three from a U.S. stock market perspective. The S&P 500 fell by roughly 20%. During the tech bubble, the index fell by nearly 50%, but the Nasdaq-100 experienced a much deeper pullback. During the financial crisis, the S&P 500 fell by more than 50%.

SNPINDEX: ^GSPC

Key Data Points

With stocks still near all-time highs, U.S. GDP growing at a 4% annualized rate, and the unemployment rate still below 5%, the economy would appear to still be in good shape.

This signal, however, is suggesting much tougher times ahead.