Fiserv's (FISV 4.15%) stock price plummeted by 70% last year, including a one-day decline of 44% in October 2025 following its third-quarter earnings results. The company's growth projections took a big hit, and things proved more fragile than believed.

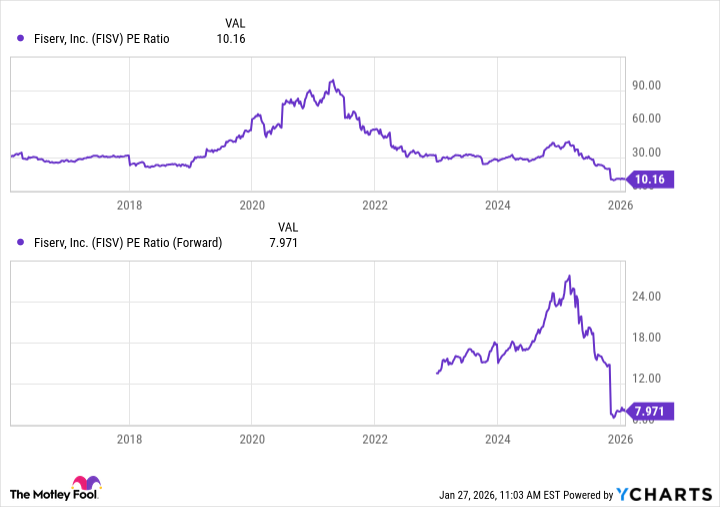

The stock now trades at a decade-low valuation as we enter 2026, but is it a good stock to buy? Let's dive into the business to find out.

NASDAQ: FISV

Key Data Points

The good news on Fiserv

Fiserv provides the "monetary plumbing" for the economy and serves over 10,000 financial institution clients globally. The company managed 1.7 billion accounts and authorized 90 billion transactions annually.

One key part of its business is its Clover point-of-sale system. This system and platform enable small and medium-sized businesses to accept various payment methods from consumers, including debit, credit, and digital wallets. Beyond payments, merchants also get tools to help with things like inventory management, employee scheduling, and customer engagement.

Clover is one aspect of Fiserv's wide-ranging payments business. The company also provides technology infrastructure for banks and other financial institutions, including payment processing, card issuance, and banking services. IN the first nine months of 2025, Fiserv generated $15.9 billion in revenue and $2.7 billion in net income.

Image source: Getty Images.

The bad news on Fiserv

Although Fiserve has a strong technology platform at the center of global payments, the company has faced serious struggles over the last year, and the stock has gotten hammered as a result. Its third-quarter results were especially concerning, as adjusted earnings per share (EPS) fell 11% year over year, while management slashed its projected organic revenue growth from 12% at the high end to just 4% for 2025.

One reason for this huge revision was that its organic growth rates were distorted by inflationary pricing in Argentina. Management informed investors that Argentina contributed roughly 10 percentage points to the reported 16% organic growth in 2024 and over 5 percentage points to the 12% growth in 2023. Excluding these figures, Fiserv's organic growth is mid-single digits. With inflation in Argentina normalizing, the company took the painful but necessary step to reset its expectations.

The company is launching "One Fiserv," a multiyear plan to deprioritize short-term revenue initiatives and focus on structural, recurring revenue instead. It raised its capital expenditure guidance for 2025 to approximately $1.8 billion as part of this turnaround plan.

Should investors buy, sell, or hold Fiserv in 2026?

Data by YCharts.

Fiserv stock has fallen significantly, but I don't know if it is a buy quite yet. While the stock is cheap, it tends to be for a reason, and the reason behind Fiserv's decline is hard to ignore. If the 2026 transition year fails to deliver results, the stock risks becoming a value trap amid slow growth and heightened competition.

Given the uncertainty ahead, I'd say Fiserv is a sell and would like to see tangible improvements in its results before buying the stock.