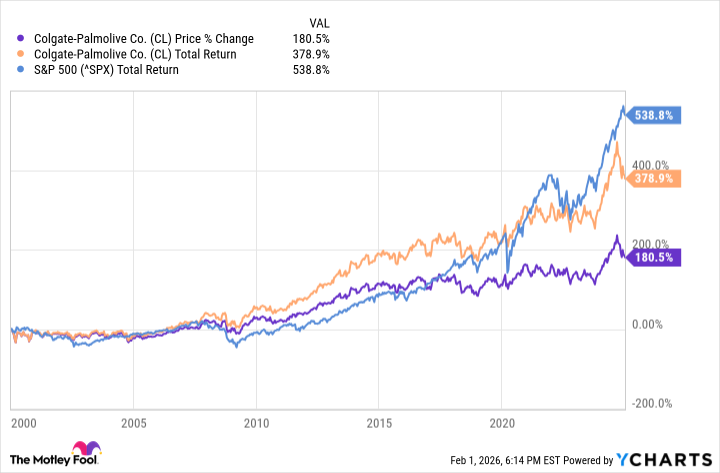

For the first 25 years of this century, Colgate-Palmolive (CL +1.37%) was a decent stock to own. The $73 billion global producer of numerous consumer goods, from toothpaste to dish soap to pet food, raised its dividend by 533% over those 25 years, as part of its 63-year streak of annual payout increases. In this period, it achieved a total return of 379%, including dividends.

However, notice I said "decent," rather than great when referring to Colgate-Palmolive's stock performance. The stock significantly underperformed the S&P 500's 539% total return in that window, and spent 2025 in the doldrums.

Data by YCharts.

Yet, so far in 2026, shares are up 16.8% (as of Monday afternoon), compared to the S&P 500's 2.1% rise. These numbers can change in a hurry, but for now, this 8-to-1 market beat may have investors wondering if they should get in on the stock's momentum.

Why Colgate-Palmolive's stock popped

Last Friday, the share price rose over 5% on news that its fourth-quarter earnings report showed sales rising 5.8% year over year. The $5.23 billion in sales, slightly higher than Wall Street expected, came mostly from higher prices rather than volume growth. In another good sign, organic sales, or sales generated exclusively from a company's existing operations and core business activities, grew by 2.2%.

NYSE: CL

Key Data Points

Interestingly, Wall Street shrugged off a reported $5 million net loss for the quarter, which came largely from a $794 million impairment charge over its skin-health segment. Without that charge, earnings would have come out to $0.95 per share, ahead of the $0.91 per share analysts expected.

Similarly, while markets generally hate uncertainty, on Friday they cheered management's more imprecise sales outlook for the year ahead. The company now expects anywhere from 2% to 6% growth in sales, compared to the 3% analysts are expecting.

Image source: Getty Images.

Then again, analysts have underestimated Colgate-Palmolive's sales for each of the last four quarters, by between three and six percentage points in each instance. Maybe Wall Street figures that the company isn't done surprising.

Should you buy today?

Despite the stock's recent surge, sales beat, and its Dividend King status that matches even the storied income stock Coca-Cola, there are drawbacks to Colgate-Palmolive that investors should be aware of.

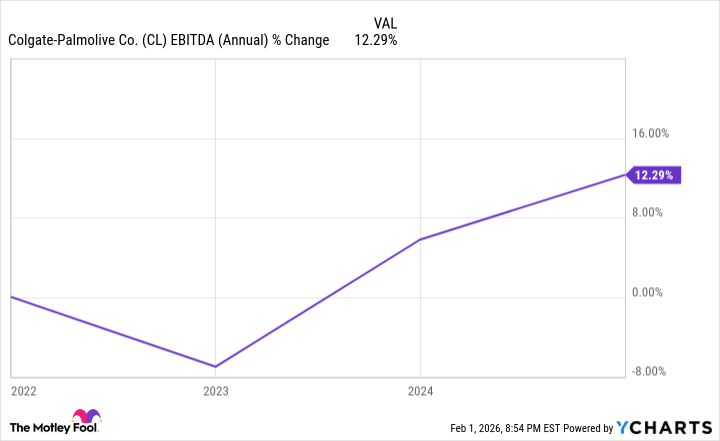

First, its recent uptick has made shares expensive, with a price-to-earnings ratio of over 34, compared to the S&P 500 average of 29.5. Granted, it's a modest premium. But expensive stocks are only worth it if they can grow earnings fast enough to grow into their valuations and then some. Even if you write off the company's negative quarterly earnings as an anomaly stemming from the impairment charge, there's still the fact that from January 2022 to January 2025, earnings grew by just 12.3%, or annualized growth of a hair over 4%.

Data by YCharts.

To me, that number doesn't justify paying any kind of premium. Colgate-Palmolive might be suitable for investors craving above-average income and below-average volatility. But even then, it's not hard to find better candidates. I would stay on the sidelines of its rally.