Breakfast News: Mag 7's Role in Q2 Earnings

July 21, 2025

| Friday's Markets |

|---|

| S&P 500 6,297 (-0.01%) |

| Nasdaq 20,896 (+0.05%) |

| Dow 44,342 (-0.32%) |

| Bitcoin $117,282 (-1.35%) |

Source: Image Created by Jester AI.

1. Mag 7 Set to Drive S&P 500 Earnings Growth

The Nasdaq climbed 1.6% last week with the S&P 500 gaining 0.7%. Both are near all-time highs as we head into Magnificent Seven reporting season, in a week that sees more than 100 S&P 500 companies posting earnings.

- "Earnings growth rate for the S&P 500 is 5.6%": The latest estimate from FactSet shows predicted year-over-year growth accelerating from June's 4.9% outlook, with Mag 7 stocks taking three of the top six forecast growth slots.

- NVDA, MSFT, META lead shifting AI race: A report from The Wall Street Journal suggests the different businesses of the big seven AI stocks are diverging. Nvidia (NVDA 0.32%), Microsoft (MSFT +0.28%), and Meta Platforms (META +0.47%) have gained more than 20% in 2025, as Apple (AAPL +0.59%) has fallen 16%.

2. GOOG, TSLA Commence Mag 7 Earnings

Alphabet (GOOG 0.07%) and Tesla (TSLA 0.15%) kick off Magnificent Seven earnings Wednesday with second-quarter reports. FactSet data predicts earnings growth of 14.1% year over year, with the remaining 493 S&P 500 stocks managing just 3.4%.

- Ranked 14th across all TMF services for its ability to beat the market over the next 5 years: Alphabet has a track record of beating Wall Street expectations, with forecasts showing an 11% rise in revenue from a year ago, with earnings per share up 13%. All eyes will be on further AI progress, though antitrust fears mean the stock is still down 2.4% in 2025.

- Down 18% year to date: It's back to basics with Tesla, as weakening auto sales have dragged investors away from AI excitement. A key question is whether the robotaxi business can catch up with Alphabet's Waymo?

3. Key Results to Watch This Week

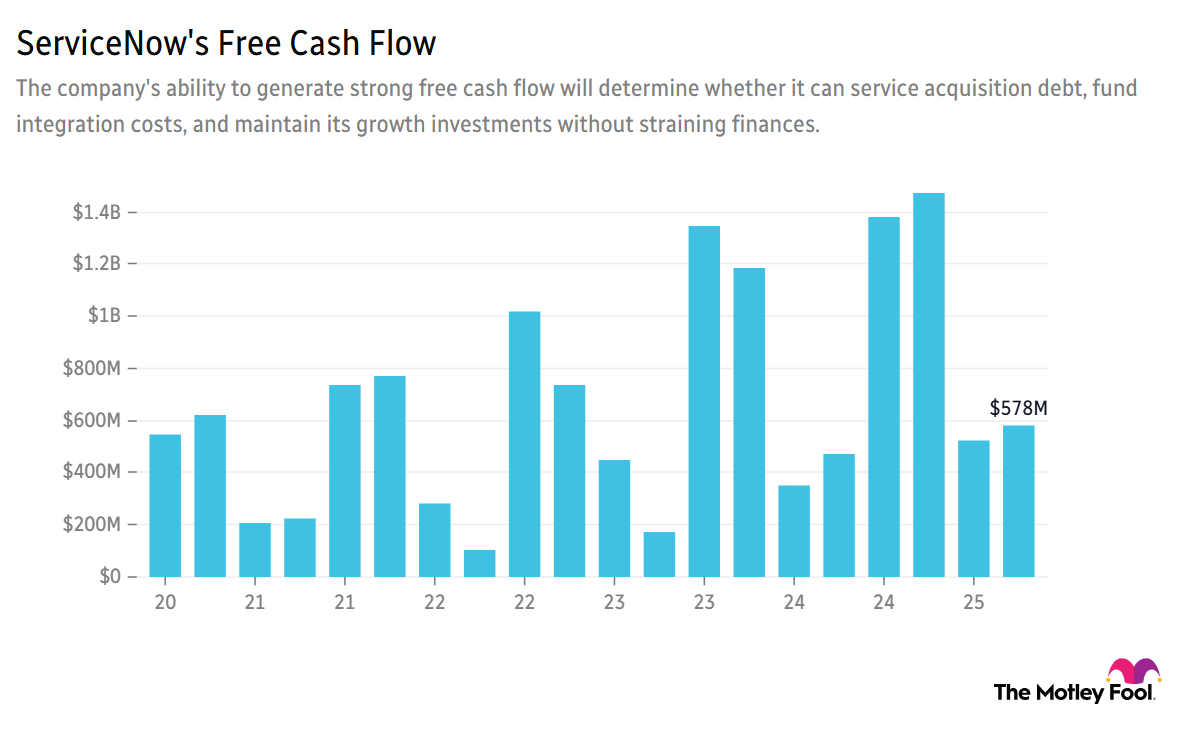

ServiceNow (NOW 1.15%) reports Q2 on Wednesday, after beating revenue and earnings guidance last time as the company's agentic-AI technology helped grow subscriptions. Estimates suggest a 19% rise in revenue over the same period last year.

- A Moneyball Superscore of 74: Stock Advisor recommendation Chipotle (CMG +0.29%) will also post Wednesday, with the stock dipping 10% so far in 2025 after a slowing first quarter. Some analysts predict an earnings dip, though a revenue consensus suggests 4% to 5% growth.

- Up 196% in five years vs the S&P 500's 96%: We're due a Q2 update from Hidden Gems rec Kinsale Capital (KNSL 0.11%) Thursday, after California wildfire losses led to a Q1 revenue miss. Watch for forecast double-digit percentage revenue and earnings growth.

4. EU Trade Tensions Escalate

August 1 is the hard deadline for President Trump's tariff rates to kick in, Commerce Secretary Howard Lutnick told CBS News, after the president has delayed implementation several times.

- "Nothing stops countries from talking to us after August 1": Lutnick was responding to questions about duties on European Union (EU) imports, and emphasized the new rates will be paid from that date.

- EU preparing to retaliate: EU talks are expected to commence this week to work out a response plan if no deal is made by the deadline and Trump's threatened 30% levy becomes reality.

5. Next Up: VZ and DPZ Get the Ball Rolling

Verizon (VZ +1.00%) will report Q2 before today's opening bell, after posting revenue misses five times in the past two years. In its last quarter, the telecoms giant saw a 1.5% revenue rise year over year, as analysts expect it to accelerate to 2.8% this time.

- Shares up around 5% on the news: Domino's Pizza (DPZ 0.18%) posted a 3.4% rise in Q2 same-store U.S. sales this morning, ahead of a 2.2% estimate, though EPS of $3.81 fell slightly short of the expected $3.95. A 4.3% revenue rise to $1.15 billion hit the target.

- Tariff revenue hit?: We'll have a Q2 update from two-time Rule Breakers recommendation NXP Semiconductors (NXPI 0.32%) after market close. The Netherlands-based chip maker previously warned of a possible $3 billion drop.

6. Your Take

On Friday, we asked about qualities you look for in a good management team. Today we want to know, when it comes to leadership, are there any dealbreakers that would cause you not to invest in a company? Debate with friends and family, or become a member to hear what your fellow Fools are saying.