Breakfast News: Is It Ethereum's Turn?

July 22, 2025

| S&P 500 6,306 (+0.14%) |

|

| Nasdaq 20,974 (+0.38%) |

|

| Dow 44,323 (-0.04%) |

|

| Bitcoin $117,101 (-0.9%) |

|

Source: Image Created by Jester AI.

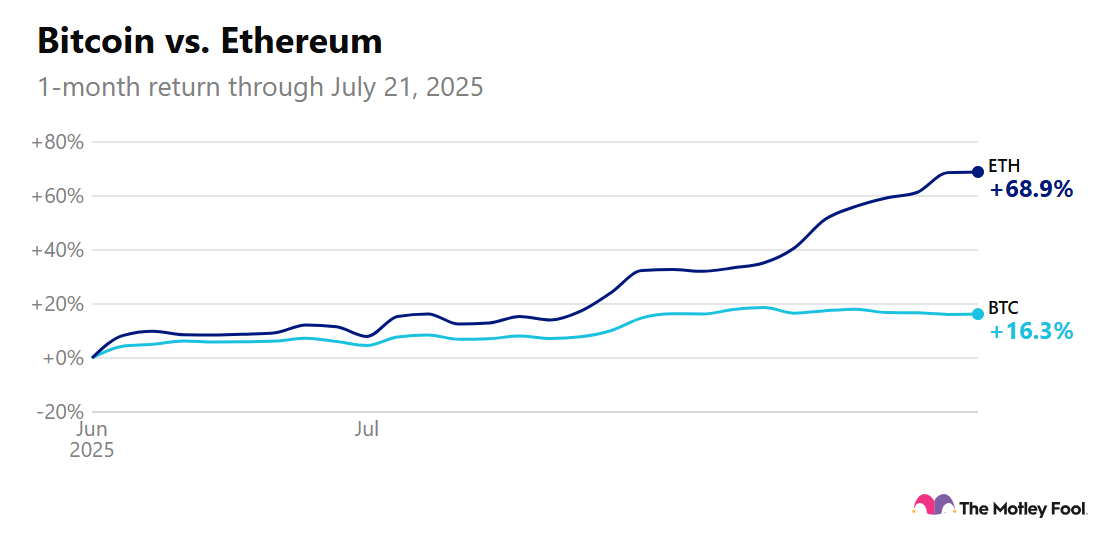

1. Ethereum Soars on Bullish Outlook

As the government and big banks increasingly embrace cryptocurrency, Ethereum (CRYPTO:ETH) has been climbing in the shadow of Bitcoin (CRYPTO:BTC). Near $3,800, the second-largest crypto is up 60% in the past month, as Coinbase (NASDAQ:COIN) now holds more than $440 million in the coin.

- Superscore of 89 in Cryptoball: Fool analyst Cody Kaminski noted Ethereum's underperformance in 2025, up 9.5% compared to Bitcoin's 27%, but posted to the Digital Explorers service that "a shift in market structure and social sentiment suggests that it is ETH's turn to rally."

- ETH commands 35% share of global stablecoin volume: Cody highlighted how recent interest has been boosted by the GENIUS Act legislation, as the Ethereum network is a critical component of stablecoin technology.

2. Oracle In Skydance Deal, Palo Alto Eyes SentinelOne

Oracle (NYSE:ORCL) and Skydance Media are planning a software deal when the latter -- founded by David Ellison, son of Oracle chairman Larry -- completes its takeover of Paramount (NASDAQ:PARA), Bloomberg reports.

- Saving "hundreds of millions of dollars": Expected to be worth around $100 million per year, the deal will see the combined company using Oracle's cloud software as it upgrades its systems.

- 9.8% Monday boost from bid talk: Meanwhile, cybersecurity provider SentinelOne (NYSE:S) added a pre-market 2% to yesterday's gains, on reports claiming Palo Alto (NASDAQ:PANW) is in talks to acquire the $6 billion company.

3. Next Up: ISRG, ENPH, EQT After Market Close

Rule Breakers recommendation Intuitive Surgical (NASDAQ:ISRG) will report second-quarter results, after the robotic surgery pioneer posted revenue and earnings beats in Q1. Watch for news of any tariff impact on the global business.

- Down 42% in 12 months: Stock Advisor rec Enphase Energy (NASDAQ:ENPH) has been suffering under the Trump administration's turn against renewable energy. Revenue and earnings rose in Q1, but both missed estimates. We'll have Q2 results, in this "wait and see" game for investors.

- Beating the S&P 500 by 32% since June 2024 Hidden Gems rec: Things have gone better for natural gas producer EQT (NYSE:EQT), with a Q2 report also due. Look for a continuation of a strong Q1 start to 2025, boosted by acquisition and raised production guidance.

4. Public Offerings From Universal, LA Times

Universal Media Group is planning a public offering in the U.S., the company said yesterday, as part of a deal with Pershing Square that could see the hedge fund manager sell at least $500 million in Universal shares in the new offering. Already listed in the Netherlands, Universal currently has a $58.5 billion market cap.

- "We also believe the U.S. listing will greatly improve trading liquidity for the shares": Pershing Square CEO Bill Ackman believes the value of Universal -- which distributes music from stars including Taylor Swift and Drake – would benefit.

- "We're literally going to take LA Times public and allow it to be democratized": Los Angeles Times owner Patrick Soon-Shiong said he's planning to go public in the next year, after the newspaper has faced financial losses and job cuts.

5. Your Take

Off the back of the LA Times and Universal Media IPO news, where have you enjoyed content recently that you wish would become a publicly traded company so you could invest in them, and why? Discuss with friends and family, or become a member to hear what your fellow Fools are saying.