Breakfast News: Berkshire's Cash Hits $344B

August 4, 2025

| Friday's Markets |

|---|

| S&P 500 6,238 (-1.6%) |

| Nasdaq 20,650 (-2.24%) |

| Dow 43,589 (-1.23%) |

| Bitcoin $113,402 (-2.81%) |

Source: Image Created by Jester AI.

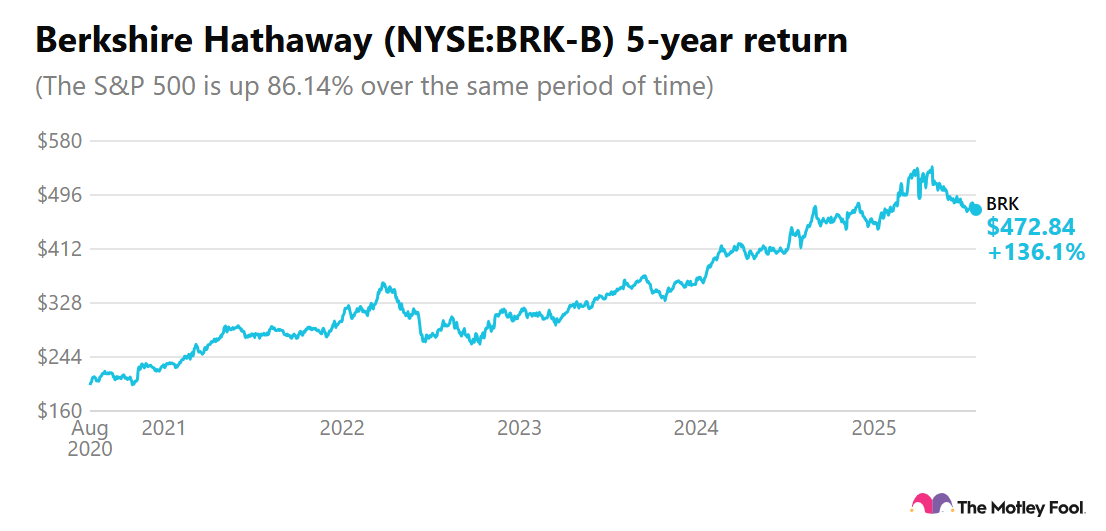

1. Why Berkshire Sold Stocks, Built Cash

Berkshire Hathaway (BRK.B 1.60%) posted a 3% drop in Q2 operating earnings to $11.2 billion Saturday, after taking a $3.8 billion writedown on its stake in Kraft Heinz (KHC +0.98%). Lower insurance underwriting profits and a foreign exchange loss of $877 million contributed to the dip.

- Net seller for 11 quarters in a row: Berkshire sold another net $3 billion in stocks in the quarter, and now has a cash pile of $344 billion. That's more than enough to buy Coca Cola (KO +1.87%) at today's market cap.

- "There could be adverse consequences on most, if not all, of our operating businesses": CEO Warren Buffett warned of "considerable uncertainty" and potential impact from international trade policies and tariffs.

2. Apple's AI Ambition: Beyond ChatGPT

When Apple (AAPL 3.68%) joined the AI race, it didn't immediately jump on the "Let's make another chatbot or AI search" bandwagon. Instead, a partnership with OpenAI allows ChatGPT to be used to back Apple's own Siri virtual assistant – though Siri remains relatively unpopular compared to ChatGPT and Alphabet's (GOOG 2.48%) Google Gemini.

- CEO Tim Cook to dedicate more staff to AI: According to a Bloomberg report Sunday, Apple's "Answers, Knowledge and Information" (AKI) group is recruiting for a new general-knowledge answer system, to provide a stand-alone app and integrate with Siri, Spotlight, and Safari.

- $20 billion a year under threat?: Why develop your own search if you can earn billions from Alphabet by making Google the default on your devices? That's been Apple's approach, but the Justice Department could upend such cosy deals.

3. Top Stocks Face Q2 Earnings Test

We enter yet another busy earnings spell, following a week that saw the S&P 500 drop 2.4% with the Nasdaq down 2.2%. Ranked eighth across all TMF services for its potential to beat the market over the next 5 years, MercadoLibre (MELI 2.04%) will report its second quarter after today's close. Look for momentum continuing after strong top- and bottom-line beats in Q1.

- Third in Moneyball rankings with a Superscore of 91: It's Q2 time for Arista Networks (ANET 1.81%) Tuesday, after quarterly revenue topped $2 billion for the first time in Q1 with a 28% rise year over year. Another good quarter could trigger more stock repurchases.

- Down 11.53% since its 2020 IPO: Airbnb (ABNB +0.04%) stock has declined 2.5% year to date, as economic headwinds threaten the travel business. Q1 saw a robust start to the year, but Q2 revenue guidance of $2.99 billion to $3.05 billion was lower than hoped. Results are due Wednesday.

4. Who Else is in Line to Beat Forecasts?

"Out of the 317 S&P 500 companies that reported as of Friday morning, 83% have beaten analysts' profit forecasts," reported Evercore (EVR 3.26%). Can Shopify (SHOP 7.31%), posting Q2 results Wednesday, follow the trend? Earnings in Q1 matched estimates as tariff fears weigh on business, though revenue was ahead.

- Advertising comeback under pressure?: Unity Software (U +1.34%) also posts Q2 Wednesday, after reporting strong Q1 subscription revenue growth. Watch for how Vector, Unity's AI-powered advertising technology, copes with any economic slowdown which could impact ad spend.

- "2025 will likely remain a challenging year": After The Trade Desk's (TTD 3.79%) rollout of Kokai AI technology helped get Q1 back to revenue and earnings beats, TMF chief investment officer Andy Cross pointed to the stressful macro environment but added "this market leader's long-term earnings power remains a strength." Q2 results are due Thursday.

5. Your Take

Which, if any, shares have you sold all or some of from your portfolio in the last few weeks, and why? Become a member to hear what your fellow Fools are saying.