Breakfast News: China Deal for Nvidia & AMD

August 11, 2025

| Friday's Markets |

|---|

| S&P 500 6,389 (+0.78%) |

| Nasdaq 21,450 (+0.98%) |

| Dow 44,176 (+0.47%) |

| Bitcoin $116,456 (-0.82%) |

Source: Image created by Jester AI.

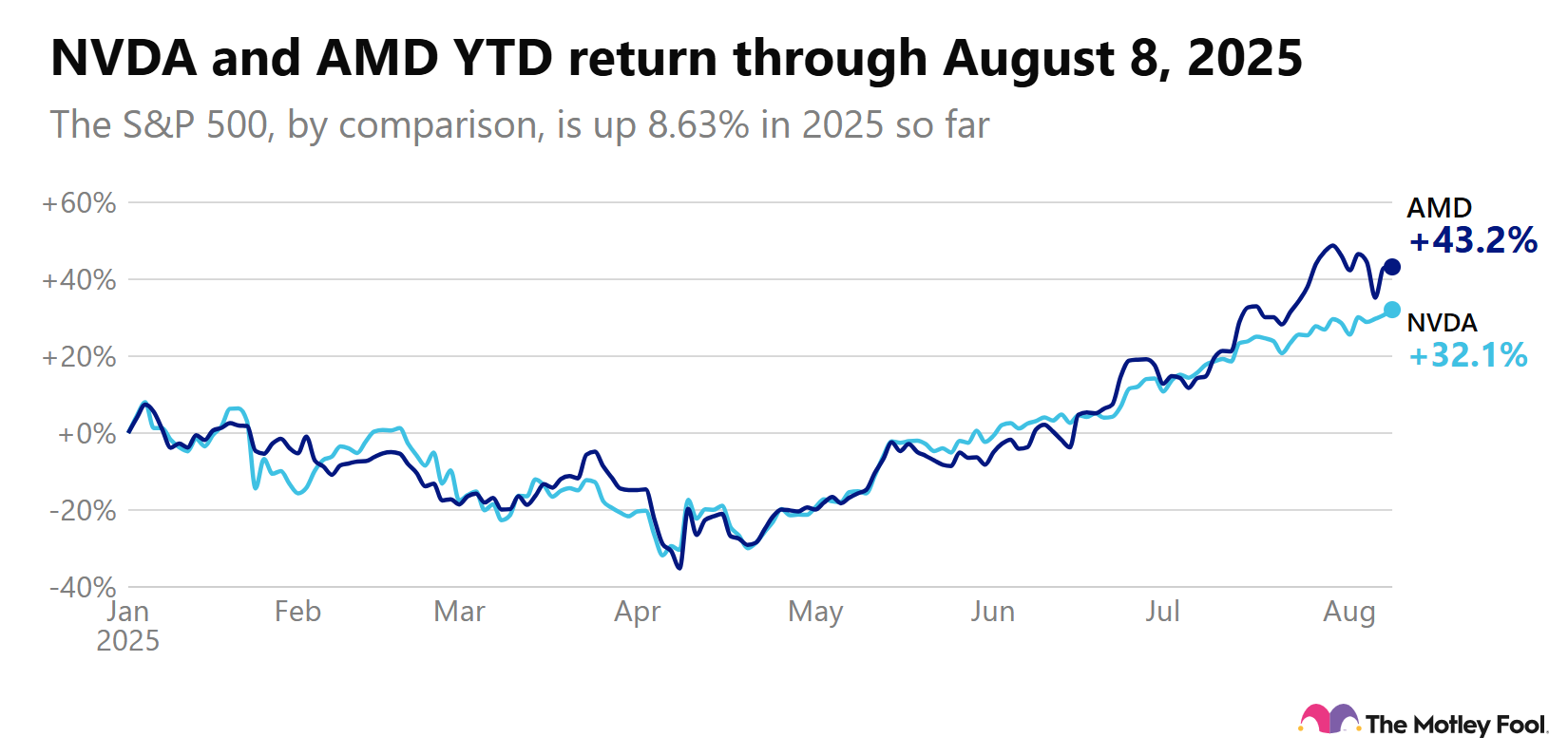

1. AMD, NVDA Pay U.S. for China Licenses

Nvidia (NVDA +0.74%) and Advanced Micro Devices (AMD +1.52%) will pay 15% of revenue from chip sales to China to the U.S. government to secure export licenses, in a deal affecting Nvidia's H20 and AMD's MI308 chips, both tailored for the Chinese market.

- "AMD faces a tough scenario": Fool analyst Loren Horst said if AMD doesn't have pricing power, it could "have to sell chips specifically designed for Chinese buyers at a loss in that market."

- "You either have a national security problem or you don't": Deborah Elms, at the Hinrich Foundation, highlighted the mismatch with the stated reasons for banning exports, adding "If you have a 15% payment, it doesn't somehow eliminate the national security issue."

2. New Stock Buyback Record

U.S. companies are expected to repurchase more than $1.1 trillion of their own stock in 2025, with $983.6 billion already announced. According to Birinyi Associates, that would be the most since their data began in 1982. The buybacks are led by tech stocks, with $100 billion pledged by Apple (AAPL +0.24%) and $70 billion from Alphabet (GOOG +0.75%). Big banks aren't far behind – $50 billion at JPMorgan Chase (JPM +0.53%) and Bank of America (BAC +0.73%) on $40 billion.

- "Things are better than everyone makes them seem": Birinyi president Jeffrey Yale Rubin added "Companies are flush with cash. They were in healthy shape even before the better earnings."

- S&P nears July's all-time record: Last week's market gains – with the S&P 500 up 2.5% and the Nasdaq up nearly 4% to a new record close – will lend strength to skeptic arguments that repurchasing when stock prices are high is not an efficient use of cash.

3. Notable 'Epic' Earnings This Week

monday.com (MNDY +0.43%), beat estimates this morning with a 27% rise in revenue year over year – analysts had been expecting 24% – as annual recurring revenue reached the $100 million mark.

- Superscore of 71 on the Moneyball database: Stock Advisor rec On Holding (ONON +0.65%) is due to post a Q2 update Tuesday, after a resilient Q1 revenue beat in the face of global trade threats to sportswear and accessories sales. Watch for tariff impacts this time.

- Currently ranked 5th in Hidden Gems for its ability to beat the market over the next 5 years: It's Q3 time for Deere & Company (DE 1.43%) Thursday, after posting revenue and earnings beats in Q2 despite a global downturn in demand. The company predicted a 15%-20% Q3 revenue dip.

4. Taking the Tariff Pain

Goldman Sachs (GS +0.03%) reports U.S. businesses are absorbing 64% of the costs from import tariffs, though we're still in early days. Consumers are paying 22% of costs, with foreign exporters bearing only 14%.

- Core CPI expected to hit 3.1% year over year: The effects on inflation should be clearer with July Consumer Price Index (CPI) and Producer Price Index (PPI) prints, due Tuesday and Thursday respectively. Retail sales will be posted Friday.

- "Rapid service will be provided. Thank you President XI": President Trump, meanwhile, urged China to quadruple soybean purchase from the U.S. ahead of an August 12 tariff deadline, though analysts cast doubts on the feasibility.

5. The Trade Desk's Opportunity Remains

Jason Moser

Shares of The Trade Desk (TTD +4.22%) fell 38% Friday after the company's second-quarter earnings report. Clearly, the market expected more.

- We think that The Trade Desk's open-internet approach can exist alongside the walled gardens of rivals: This sell-off seems like an overreaction. If the company's walled-garden competitors appear to be taking share and growth slows for The Trade Desk, we'll need to revisit the case for owning the stock.

- Drawdowns are nothing new for The Trade Desk: The stock hit a 52-week high of $141.53 in December 2024 before falling to its 52-week low of $42.96 back in April 2025 (yes, just a few short months ago).

6. Your Take

What stocks that have doubled or more over the last 12 months are you bullish on and believe can beat the market in the long term from here, and why? Debate with friends and family, or become a member to hear what your fellow Fools are saying.