Breakfast News: Meta Freezes AI Hiring

August 21, 2025

| S&P 500 6,396 (-0.24%) |

|

| Nasdaq 21,173 (-0.67%) |

|

| Dow 44,938 (+0.04%) |

|

| Bitcoin $114,044 (+0.77%) |

|

Source: Image Created by Jester AI.

1. Meta Pauses Recruitment for Superintelligence Labs

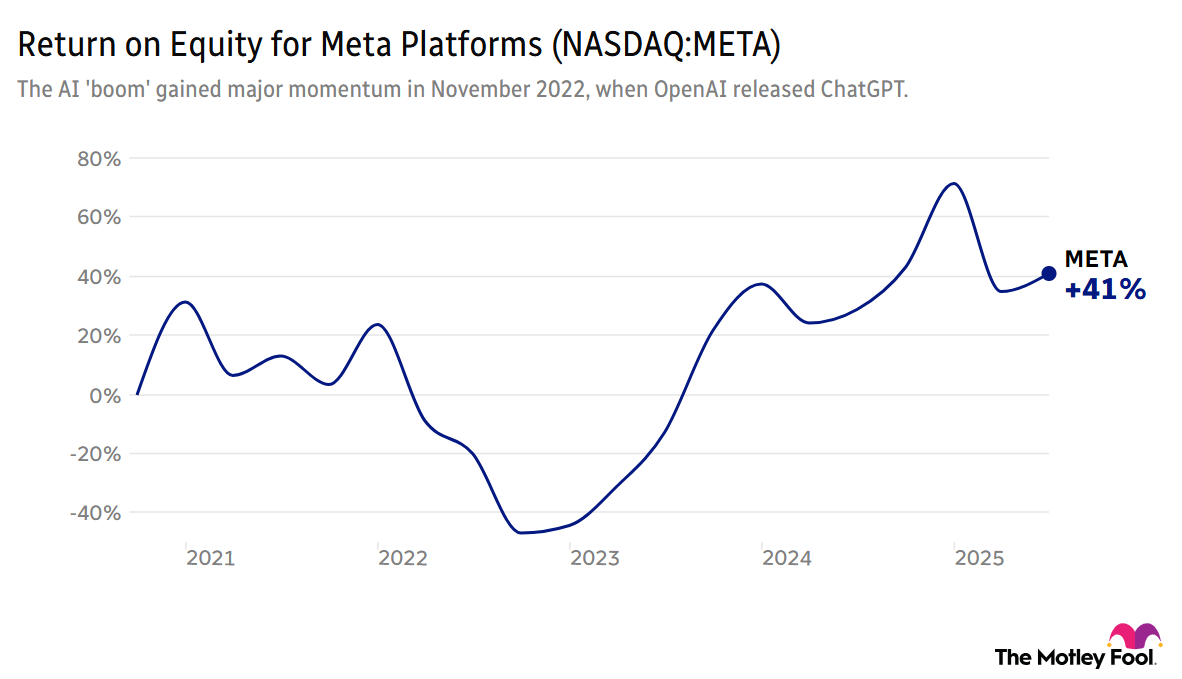

Meta (META -1.15%) has halted hiring in its AI division, the WSJ reports, as the scale of recent restructuring has caused some investor concern due to the size of compensation packages and overall capex spend.

- "Basic organizational planning...after bringing people on board and undertaking yearly budgeting and planning exercises": Meta downplayed the severity of the move, which has seen over 50 AI researchers and engineers hired in recent months, some with nine-figure pay packages.

- "The potential to drive AI breakthroughs with massive value creation or could dilute shareholder value without any clear innovation gains": A research note from Morgan Stanley (MS -1.27%) noted the recent shift from tech companies to spend big on talent has the potential to make or break investor returns in the coming years.

2. CME and FanDuel Team Up

Stock Advisor recommendation CME Group (CME -0.74%) has teamed up with FanDuel to offer sports-betting clients financial event-driven contracts, broadening the target market for trading stocks, oil, gold, and other assets.

- "Individual investors are increasingly sophisticated and continually pursuing new financial opportunities": CME CEO Terry Duffy outlined the new joint venture, where clients will be able to speculate on outcomes of economic data releases and where global benchmarks like the S&P 500 will trade.

- Regulatory landscape murky: Critics say event-driven contracts are akin to gambling, with other financial providers such as Robinhood (HOOD 4.77%) having run into trouble earlier this year when it had to remove a Super Bowl event contract at the regulator's request.

3. The Big Short's Burry Turns Bullish

The latest Scion Asset Management portfolio update showed 'The Big Short' investor Michael Burry has flipped from bearish to bullish positioning, betting several struggling companies will make a strong comeback.

- Option exposure provides large potential payoff: Burry swapped put options (products profiting from a stock fall) for call positions (profiting from a stock rise) in nine stocks last quarter, including Alibaba (BABA -0.70%) and JD.com (JD -1.87%).

- "He has gone from a strong conviction bet on a sector fall to a broad-based bet the bull run will continue": Peter Mallouk, CEO of Creative Planning, explained the shift in Burry's portfolio indicates a large pivot in his outlook.

4. Thursday's Key Earnings: WMT, WDAY and ZM

Walmart (WMT -0.01%) released quarterly earnings before the opening bell, raising full-year earnings and sales guidance, but noted higher costs, with prices rising as management warned about last quarter. In response, the stock fell around 3% in pre-market trading.

- Revenue expectations beaten every time for the past two years: Rule Breakers rec Workday (WDAY -2.80%) should report after the market closes, with progress on the major new client wins from last quarter in focus.

- EPS estimates have 22 upward revisions in the past three months: Zoom Communications (ZM -1.33%) will report following the closing bell, with the Hidden Gems rec pushing for more AI integration and targeting enterprise solutions after a disappointing previous update.

5. Your Take

What industry do you think will look completely different in 10 years, and how are you positioning for that change? Discuss with friends and family, or become a member to hear what your fellow Fools are saying.