Breakfast News: Meta's $10B Google Deal

August 22, 2025

| Thursday's Markets |

|---|

| S&P 500 6,370 (-0.40%) |

| Nasdaq 21,100 (-0.34%) |

| Dow 44,786 (-0.34%) |

| Bitcoin $112,255 (-1.79%) |

1. Meta Signs $10B Cloud Contract With Google

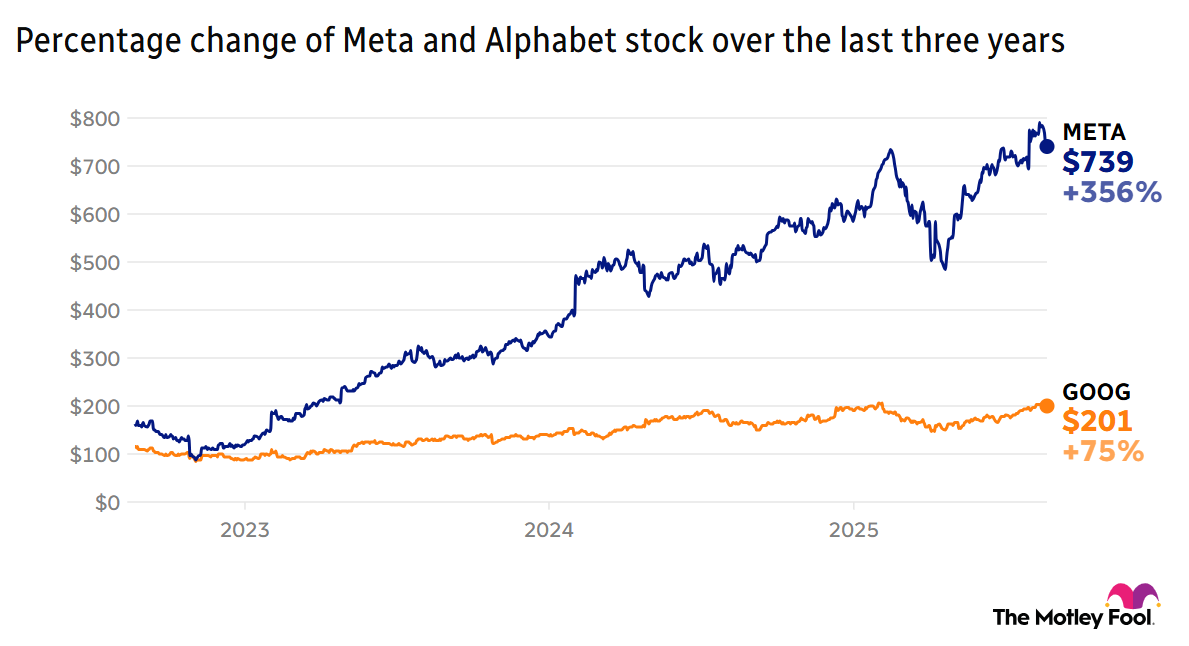

Meta (META +0.79%) has signed a six-year deal worth over $10 billion with Alphabet (GOOG 1.11%), The Information reports, in a major cloud computing win where Meta will use Google Cloud's servers, storage and networking.

- The deal makes Meta one of the world's largest cloud customers: The move gives Meta the scope to further build out AI infrastructure, improve its ability to serve clients around the world, and better compete with the likes of OpenAI.

- One of the largest ever known contracts for Google Cloud: Given Alphabet reported revenue of $13.6 billion for cloud services last quarter, the deal will provide a notable financial boost, enabling it to further take market share from Amazon (AMZN +0.54%) and Microsoft (MSFT 0.61%).

2. China Concerns Hit Nvidia H20 Production

The Information also reports Nvidia (NVDA +2.06%) has informed some component suppliers of the H20 chip for the Chinese market to stop production work, indicating potential concerns on delivery following Chinese authorities warning local companies about using the chips.

- "We constantly manage our supply chain to address market conditions": Nvidia's response didn't detail the specific market conditions influencing the decision, or how long the halt would be in place for.

- An estimated 700,000 H20 chips have been ordered in the last month: In the weeks since President Trump reversed the export restriction, Chinese tech businesses have ordered significant chip quantities, highlighting demand in the region is strong.

3. Oaktree's Marks Sees Early Bubble Signs

Howard Marks, the billionaire co-chairman of Oaktree Capital, believes the stock market is in the beginning of a bubble, citing factors such as high valuations and a lack of any recent serious market correction.

- "The single biggest mistake...is that they conclude that the way things are today is the way it'll always be": Marks believes investors aren't prepared for a reversion to the mean when it comes to markets, with his investment company adding more defensive assets.

- "It's essential to prepare for uncertain futures by gauging the market climate rather than predicting events": In an interview with TMF co-founder and CEO Tom Gardner and Fool analyst Buck Hartzell, Marks stressed the importance of the old adage that time in the market beats timing the market.

4. Mixed Earnings: ZM Jumps, WDAY and INTU Fall

Rule Breakers recommendation Workday (WDAY 0.69%) is down over 4% in pre-market trading after issuing underwhelming guidance for the coming quarter, despite results being inline with expectations with notable growth in recurring subscription revenues.

- Stock up almost 6% after closing bell: Zoom (ZM 1.50%) beat revenue and earnings expectations, with Fool analyst Jason Moser saying "the enterprise business continues to grow with revenue up 7% & large customers (contributing more than $100K annually) up 8.7% from a year ago, though the net dollar expansion rate of 98% could be better."

- Launch of new all-in-one AI-powered platform: Stock Advisor rec Intuit (INTU 2.12%) dropped over 5% after the market closed, with guidance assuming no immediate monetization from its new AI agents, disappointing investors.

5. Next Up: Powell's Jackson Hole Speech

Federal Reserve Chair Jerome Powell will give the keynote address at the Jackson Hole economic symposium later today, providing valuable insights into the direction of monetary policy.

- "He's done a good job in terms of keeping the Fed's independence, ignoring the noise...and keeping it focused on the data dependency": Michael Arone, chief investment strategist at State Street (STT +1.17%), expects Powell to continue to walk the line of observing data ahead of the September FOMC meeting.

- Other Fed members weigh in on interest rate discussions: Fed presidents Jeffrey Schmid and Beth Hammack offered caution on cutting interest rates in September, given recent inflation data.

6. Your Take

Which U.S. publicly traded company will be the first to hit $1 trillion in revenues for a calendar year, and why? Debate with friends and family, or become a member to hear what your fellow Fools are saying.