Breakfast News: MongoDB's AI Bet Pays Off

August 27, 2025

| Tuesday's Markets |

|---|

| S&P 500 6,466 (+0.41%) |

| Nasdaq 21,544 (+0.44%) |

| Dow 45,418 (+0.3%) |

| Bitcoin $111,305 (+0.77%) |

1. MongoDB Jumps 30% on Strong Atlas Growth

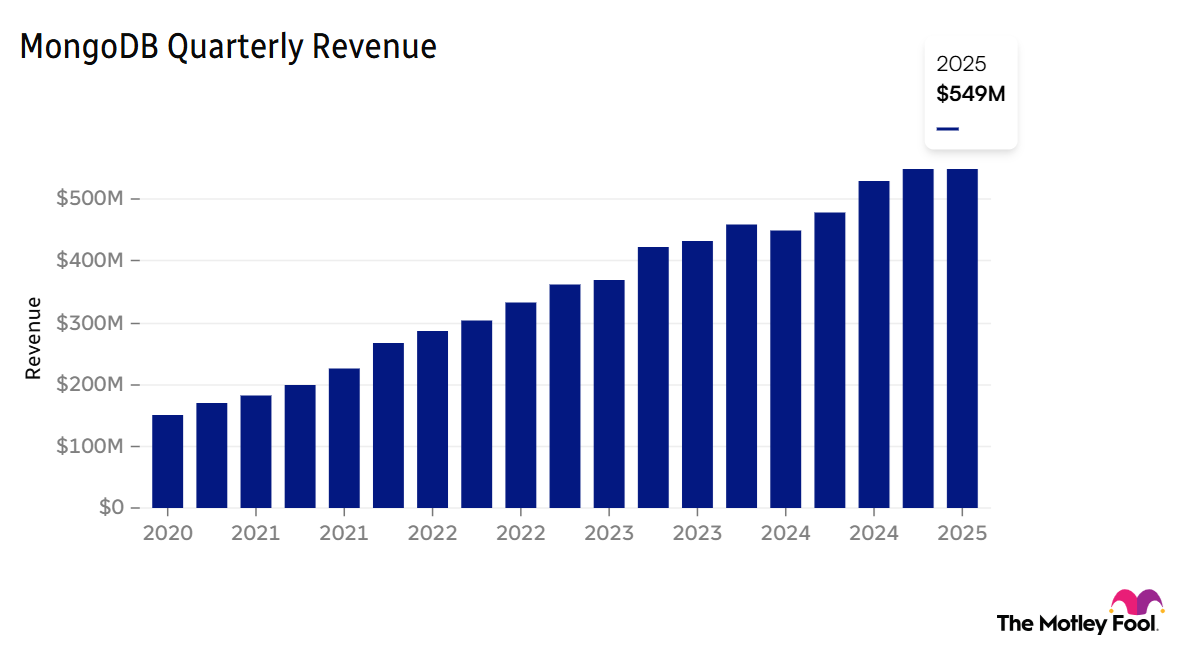

Rule Breakers recommendation MongoDB (MDB 0.37%) soared 30% higher in pre-market trading after posting a 24% year-over-year rise in second-quarter revenue to $591.4 million yesterday, up from $478.1 million in Q2 a year ago and from $549 million in Q1. It beat the high end of guidance, with the company's Atlas cloud platform revenue – up 29% – accounting for 74% of the total. MongoDB added new AI features from its Voyage AI unit and announced new partnerships with AI developers.

- "MongoDB is emerging as a key component of the AI infrastructure stack": CEO Dev C. Ittycheria said MongoDB counts 70% of the Fortune 500 among its customers – pushing total customer numbers to 59,900 as of July 31.

- 2018 MDB recs in Rule Breakers beating the S&P 500 by 119% and 410%: The company lifted full-year revenue guidance to $2.34–$2.36 billion, even against competition from other cloud database providers. Investors should watch for AI-based competitive advantage.

2. Okta Rises on Strong Q2

Okta (OKTA 0.75%) is up 5% overnight after the company posted revenue and earnings beats in yesterday's after-hours Q2 update. Revenue rose 13% year over year, as earnings per share gained 26%.

- "Okta's unified identity platform is winning customers ranging from the world's largest global organizations to massive government agencies": CEO Todd McKinnon says Okta's software helps provide independence from the major AI infrastructure builders.

- FY revenue growth estimated at 10-11%: Stressing a prudent approach to guidance, Okta expects Q3 revenue to show growth between 9% and 10% year over year.

3. Nvidia Sets the AI Compass

All eyes are on Q2 earnings from Nvidia (NVDA 0.32%) after market close. Seen as a bellwether for the AI boom, the stock is up 35% year to date. Analysts expect revenue to rise 53% year over year, after growth slowed to 69% in the previous quarter – following five quarters in a row above 100%.

- "The assumptions and performance of Nvidia really dictates what the market is going to start to price into the AI trade": Melissa Otto at S&P Global (SPGI +0.11%) highlighted the driving force of AI on the stock market.

- "Even if you don't own Nvidia, you probably own Nvidia given its 8% weight in the S&P 500 index, where so many people park retirement funds": Fool analyst Seth Jayson expects we'll "get a decent read on Blackwell demand, the timeframe for the upgrade, as well as the next-generation stuff. We'll find out how much attached networking revenue there is – something that's nice for Nvidia but often over-weighted as a threat to network specialists."

4. Wednesday's 'Best of the Rest'

Several other Fool favorites are due to post earnings updates after today's close, including a Q2 update from flash data storage developer Pure Storage (PSTG 0.09%). Q1 beat Wall Street estimates with annual recurring revenue jumping 18%. Estimates suggest 10.8% revenue growth this time, year over year.

- Number 6 in July's Stock Advisor rankings for its ability to beat the market over 5 years: It's Q2 time for Veeva Systems (VEEV 0.46%) following on from strong top- and bottom-lines beats in Q1, as analysts predict around 13.5% year-over-year revenue growth this time. Veeva's moves into the health sciences industry could be key.

- Cloud services favorites: CrowdStrike (CRWD 0.36%) and Snowflake (SNOW 1.41%) are also set to deliver earnings updates this afternoon, as we mentioned on Monday. Watch for second-half growth guidance from both.

5. Alphabet Dumps Medical Devices

Alphabet's (GOOG +0.00%) life sciences company, Verily, has closed its medical devices development, reports Business Insider. Verily had developed products including a clinical study watch, a retinal camera, and a wearable glucose sensor.

- "Narrowing product focus around our precision health platform, and data and AI strategy": In a memo to staff, CEO Stephen Gillett said the company "cannot support the investment of the resources necessary" to continue device development.

- Started as a moonshot – a high-ambition technology project – in Google's X lab: Verily has been turning to cost-cutting and streamlining, with the number of job cuts currently unknown.

6. Your Take

What do you think is an appropriate balance between U.S.-listed and non-U.S. investments, and how do you achieve that? Discuss with friends and family, or become a member to hear what your fellow Fools are saying.