Breakfast News: Nvidia Slips On Outlook

August 28, 2025

| Wednesday's Markets |

|---|

| S&P 500 6,481 (+0.24%) |

| Nasdaq 21,590 (+0.21%) |

| Dow 45,565 (+0.32%) |

| Bitcoin $111,489 (+0.24%) |

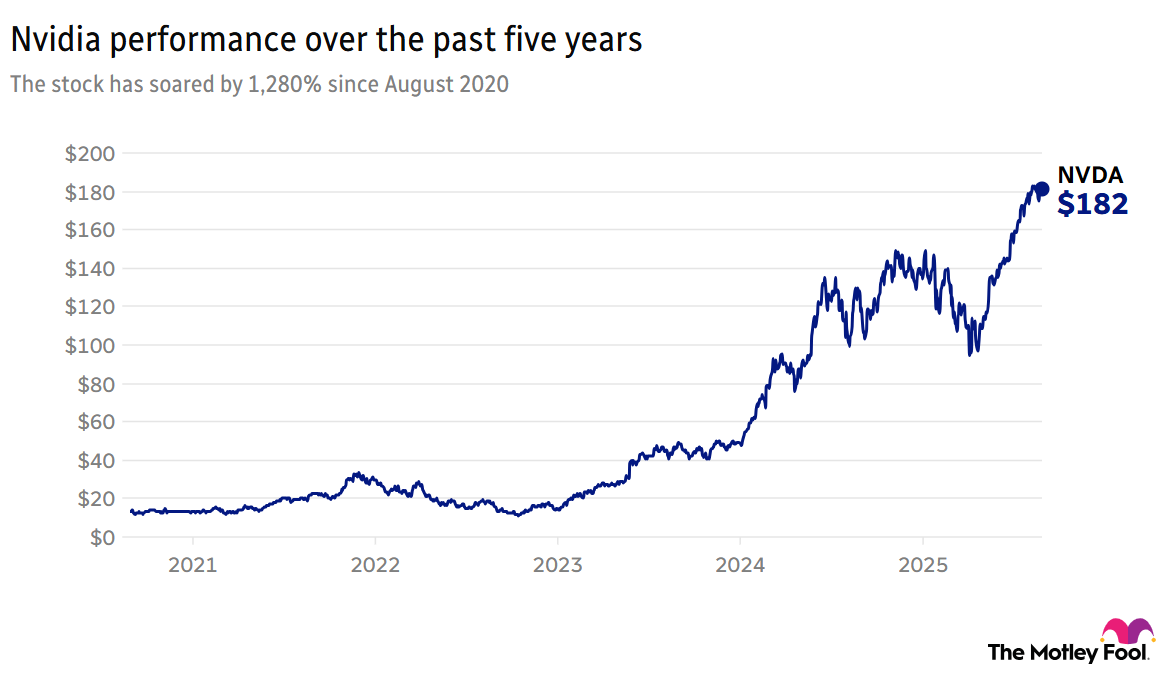

1. Nvidia's Q2 Beat Overshadowed by Outlook

Nvidia (NVDA 0.32%) fell around 3% after the market closed after issuing a tepid revenue forecast and a lack of clarity on H20 chip sales to China, despite CEO Jensen Huang talking up AI demand potential.

- "We see $3 trillion to $4 trillion in AI infrastructure spend by the end of the decade": Huang downplayed any notion AI spending from clients was slowing, calling the opportunity ahead "immense." The data center division alone is now larger than any other chipmaker.

- "I think there's probably enough demand outside of China for Nvidia to keep rolling quite well": Fool analyst Seth Jayson believes it was an overall solid quarter for the business, but noted the surprise in the outlook not including any H20 sales, given some believed Nvidia would be able to start shipping those systems again soon.

2. CRWD Drops Despite Strong Recurring Revenue

Stock Advisor recommendation CrowdStrike (CRWD 0.36%) fell over 4% after the closing bell following weaker-than-expected revenue guidance for the coming quarter, despite posting the second highest quarter ever for annual recurring revenue (ARR).

- "Market demand for our AI native Falcon platform and FalconFlex subscription model drove strength across the business": CFO Burt Podbeare outlined how the business exceeded expectations across all guided financial metrics, as more customers consolidate their security operations into CrowdStrike platforms.

- Beating the S&P 500 by 97% since October 2023 recommendation: The cautious revenue outlook led some to believe future client spending could be hampered by economic uncertainty, but the stock reaction is modest given the long-term share price gains.

3. China Triples Down on Domestic AI Chips

China's chipmakers are expecting to triple the total output of AI processors over the coming year, as challengers to major U.S. companies look to step up competition further.

- "Domestic output won't be an issue for long, especially with all the capacity coming online next year": A Chinese chipmaker executive told the FT that new DeepSeek models and more efficient training will allow domestic companies to make up the gap for their less-advanced hardware capabilities.

- Beijing pushing for greater local AI collaboration: Four domestic AI chipmakers are looking to go public as soon as the end of this year, having raised about $3 billion in pre-IPO funding rounds, as the Chinese government aims to build its own domestic AI ecosystem.

4. Snowflake and Pure Storage Rocket on Results

Snowflake (SNOW 1.41%) jumped over 13% in overnight trading after delivering a strong earnings beat based on a 32% year-over-year increase in product revenue, based on continued demand for data analytics services.

- Now boasting 751 Forbes Global 2000 customers: The Rule Breakers rec issued positive guidance but at a slower pace, highlighting its transition from rapid scale-up to more measured, profitable growth.

- "Our second quarter results demonstrate ever more customers' confidence in the value of the Pure Storage platform": Pure Storage (PSTG 0.09%) soared 16% ahead of the opening bell, raising full-year revenue and operating profit guidance, citing growing customer adoption and high gross margins as part of the latest quarterly results.

5. Earnings Watch: ULTA, ADSK, DELL

Ulta Beauty (ULTA +0.80%) will report after the market closes, with investors hoping for more clarity going forward after management flagged high economic uncertainty last time around.

- Beating revenue estimates for 14 out of the past 16 quarters: Autodesk (ADSK +0.23%) is due to release earnings following the closing bell, with another double-digit percentage revenue gain expected, as the activist investor saga with Starboard appears to have settled down.

- Demand for AI servers is growing: Dell (DELL +0.60%) also reports post-market, with investors keen to see the pace of growth in AI server orders, where last quarter it booked $12.1 billion – more than the entire total last year.

6. Your Take

If you were the CEO of Nvidia for a day, what's one thing you would do to improve the business? Become a member to hear what your fellow Fools are saying!