Breakfast News: ORCL Flies on Cloud Demand

September 10, 2025

| Tuesday's Markets |

|---|

| S&P 500 6,513 (+0.27%) |

| Nasdaq 21,879 (+0.37%) |

| Dow 45,711 (+0.43%) |

| Bitcoin $111,145 (-0.79%) |

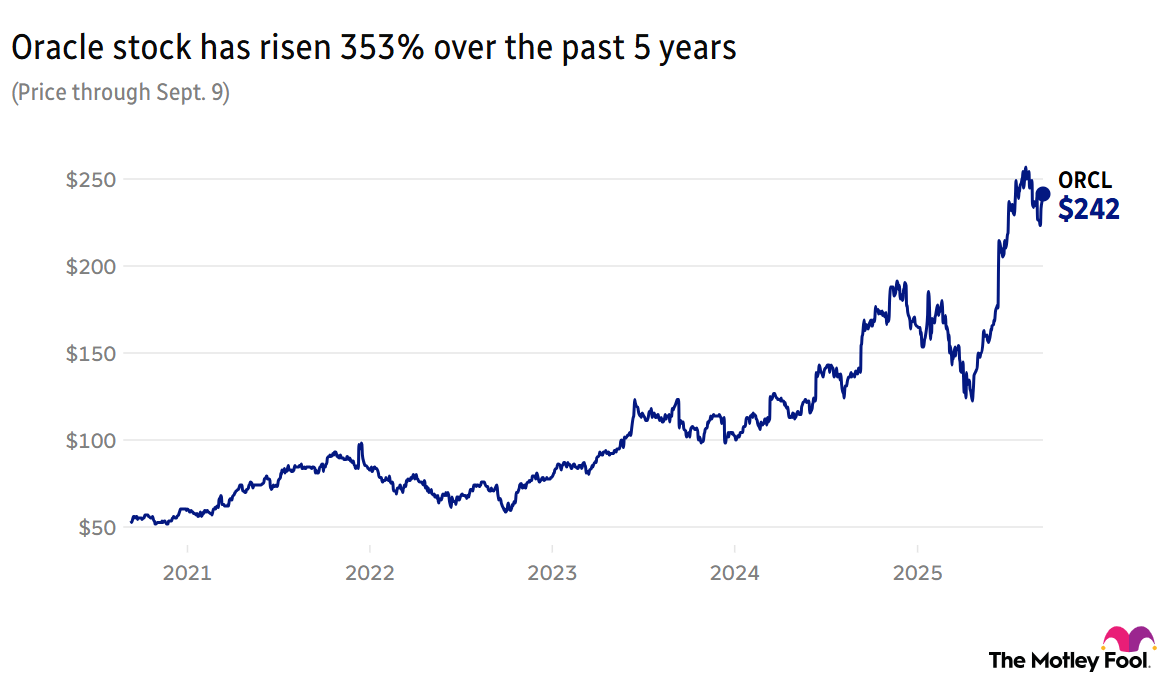

1. Oracle Cloud Bookings Explode

Oracle (ORCL +1.10%) surged 30% overnight to hit an all-time record, after the company said it expects booked revenue at its cloud business to exceed half a trillion dollars. Four multi-billion-dollar contracts pushed remaining performance obligations – booked revenue not yet recognized – up 359% to $455 billion during the first quarter, as CEO Safra Catz added "we expect to sign-up several additional multi-billion-dollar customers."

- "We're all kind of in shock, in a very good way": Deutsche Bank's (DB +0.41%) Brad Zelnick echoed analyst reactions, as Oracle predicted AI-fueled cloud revenue to rise to $144 billion by 2030, from $18 billion expected in the 2026 fiscal year.

- "Dramatically increasing cloud demand and consumption over the next several years": Chairman and CTO Larry Ellison underlined Oracle's driving force, as investors overlooked the company's narrow top- and bottom-line misses this quarter.

2. Stagflation Fears Grow

Stagflation – stagnating economic growth with high inflation and unemployment – looms after Tuesday's Bureau of Labor Statistics revision showed 911,000 fewer jobs than previously thought were added to the economy in the 12 months through March 2025.

- "Whether it's on the way to recession or just weakening, I don't know": JPMorgan (JPM +0.99%) CEO Jamie Dimon said it confirms the economy is slowing, as fears grow of the 2025 bull market coming to a halt.

- Balancing act: Eyes are now on the Federal Reserve's response to today's producer price index update, followed by a consumer price index print tomorrow, which could be crucial.

3. Big Movers From Tuesday's After-Hours Earnings

Synopsys (SNPS +0.06%) slumped 20% after hours, as Chinese export restrictions impacted Q3 results. The electronic design software specialist missed Wall Street expectations for both revenue and earnings, even with revenue rising 14% year over year to $1.74 billion. The company lowered full-year non-GAAP earnings guidance to $12.76 to $12.80 per share, well below analyst estimates of $15.

- Superscore of 66 in our Moneyball database: Data security company Rubrik (RBRK +0.06%) dipped 3.5% after market close, wiping out the day's earlier gains, even with Q2 revenue and earnings better than expected

- 3,200 worldwide video game stores: GameStop (GME +0.70%) posted comfortable Q2 revenue and earnings beats, with revenue growing 22% year over year to $972.2 million, though the company declined to offer forward guidance. The stock popped 7% after hours.

4. OpenAI Revenue Set to Soar

OpenAI, which is partnering with Microsoft (MSFT +0.28%) and Oracle to expand Microsoft's Azure Al to the Oracle cloud, expects revenue to more than triple in the current year. Speaking at the Goldman Sachs Communacopia conference Tuesday, CFO Sarah Friar predicted "$13 billion in revenue from about $4 billion last year."

- "It is a wild pace that we're on. You're defining a whole new era of AI": Friar's optimistic comments come after CEO Sam Altman previously admitted the company "screwed up" the rollout of ChatGPT 5 following unenthusiastic reviews.

- No IPO timetable for OpenAI yet: According to the New York Times, OpenAI is in talks to sell $6 billion of employee shares. That could boost its valuation to $500 billion, up from a $300 billion estimate in March.

5. Your Take

If you could only own 5 stocks for the next 20 years, how would you choose them? Discuss with friends and family, or become a member to hear what your fellow Fools are saying.