Breakfast News: AI Boom Lifts TSMC Sales

October 9, 2025

| Wednesday's Markets |

|---|

| S&P 500 6,754 (+0.58%) |

| Nasdaq 23,043 (+1.12%) |

| Dow 46,602 (-0.00%) |

| Bitcoin $123,502 (+1.42%) |

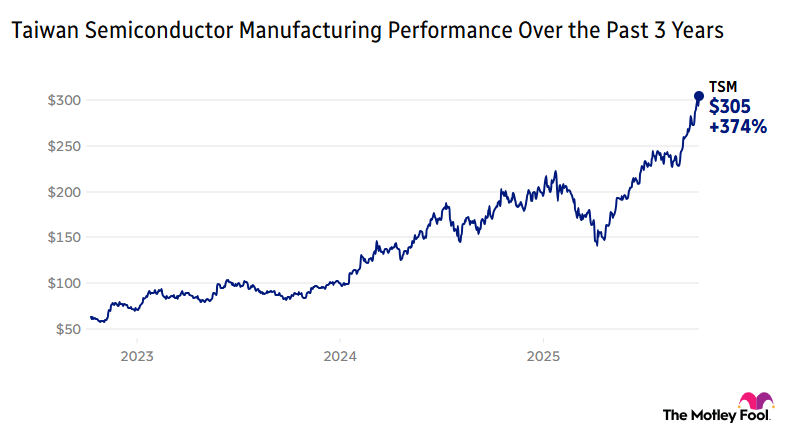

1. TSMC September Sales Beat Forecasts

Taiwan Semi (TSM 0.88%) saw September sales jump 31.4% versus the same month last year, in a preview of full quarterly results due next Thursday, as AI demand for chips continues to soar.

- Year-to-date revenue up 36.4%: The sales figures provide an initial sign of demand in the sector remaining strong, as the chipmaker is the go-to company for Nvidia (NVDA 1.06%), along with making processors for Apple (AAPL +1.97%) and others.

- Sales growth rebounds from summer lull: Despite September revenue coming in 1.4% below August, it was higher than June and July, putting to rest some fears of the start of a slowdown driven by AI infrastructure reviews.

2. Netflix Pushes TV Games for Growth

In a Bloomberg interview, Netflix (NFLX 1.29%) co-CEO Greg Peters confirmed they'll be making video games available for customers to play on their TVs, using smartphones as controllers, as it focuses on this as an area of growth for the future.

- "One of the gaming areas we're going after is social gaming experiences that can show up on your TV': Peters said previous efforts from the company weren't great, but the pivot to use phones to control play on the big screen could mark a shift given the well-developed mobile gaming market.

- Specific demographics and segments targeted: The new plan aims to go after kids and parties, as well as basing ideas around either mainstream existing games or existing Netflix shows such as Stranger Things.

3. NVDA Clears Hurdle on UAE Chip Deal

Nvidia has finally received U.S. approval for a multi-billion dollar chip export deal to the UAE, in the first sign of progress since May.

- Reciprocal deal could see up to 500,000 chips approved annually: The agreement is underpinned by the Emirati promise to invest $1.4 trillion in the U.S. over the next decade.

- Security concerns could slow down progress: The delay in approval comes as some officials question the wisdom of providing chips for large AI infrastructure somewhere China has strong existing business and economic ties.

4. AI Use Cases Continue to Expand

Alphabet (GOOG +3.33%) is aiming to retain the right to integrate its AI software into Google Maps and YouTube, with Alibaba (BABA 0.23%) signing a deal to be the cloud and AI partner of the NBA.

- Alphabet tussles with the Justice Department: In an ongoing case revolving around the potential monopolization of search and search advertising, company lawyers are now fighting to allow the Gemini AI software to be present in other apps.

- Time needed to show where AI will provide the largest enhancements: Fool analyst Jason Moser noted, "AI is profound technology and will enhance how we do many things in our lives, both professionally and personally. But it will also take time for us to learn its best use-cases as the technology evolves."

5. What to Watch on Thursday

Pepsico (PEP +0.16%) released quarterly results before the opening bell, with the stock rising around 1% in response. Earnings per share beat expectations, but CEO Ramon Laguarta outlined the need to continue aggressively optimize the cost structure.

- Superscore of 65 on our Moneyball database: Delta (DAL +4.41%) jumped over 5% ahead of the market open following quarterly results indicating higher fares and strong demand.

- HELE dealing with lingering tariff impacts: Tilray (TLRY +1.02%) and Helen of Troy (HELE +7.40%) should put earnings out before trading starts, too, with Tilray expected to post revenue growth but Helen of Troy due to experience a double-digit percentage decline.

6. Buy, Sell, or Hold?

Advanced Micro Devices (AMD 1.11%), Monster Beverage (MNST 0.25%), and Palo Alto Networks (PANW 1.17%) – all recommended in either Stock Advisor, Rule Breakers, or both! – are trading around all-time highs.

If your portfolio comprised just these three companies, and you bought each of them at the start of the year with the same amount of money, and had to buy more shares in one, completely close your position in another, and hold the final stock, what are you choosing to do and why? Become a member to hear what your fellow Fools are saying!