Breakfast News: PZZA Coming Off The Menu?

October 14, 2025

| Monday's Markets |

|---|

| S&P 500 6,655 (+1.56%) |

| Nasdaq 22,695 (+2.21%) |

| Dow 46,068 (+1.29%) |

| Bitcoin $115,672 (+0.69%) |

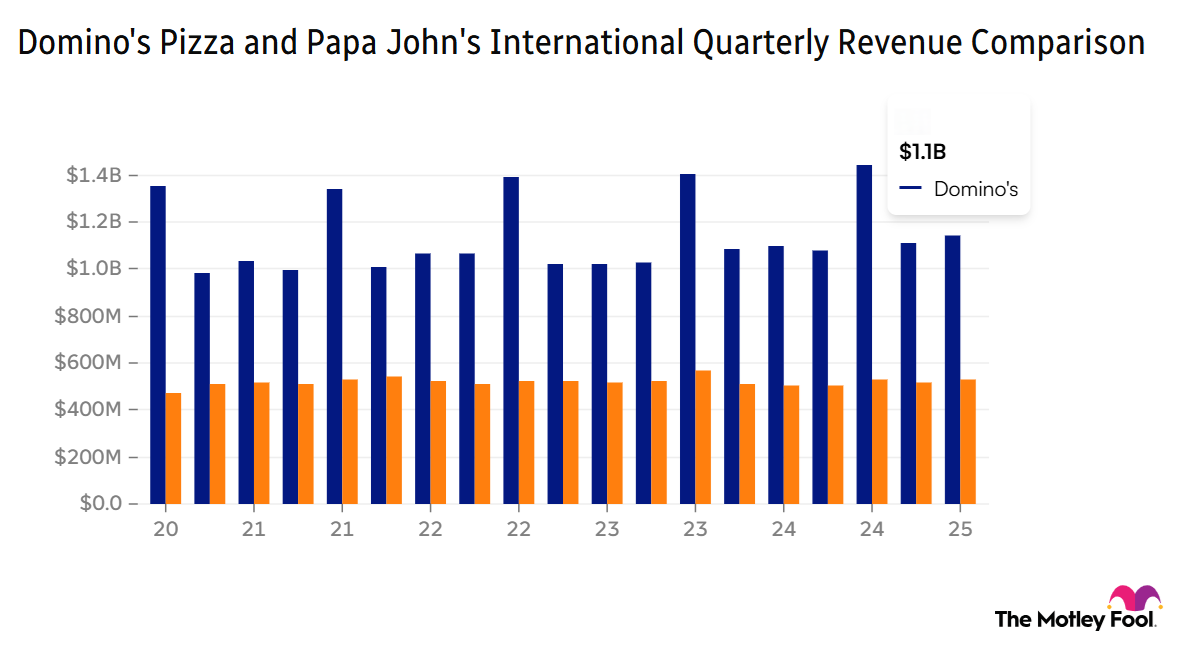

1. Papa John's Up 10% as Domino's Reports

Papa John's (PZZA 4.96%) closed almost 10% higher on headlines Apollo Global (APO 0.25%) is making a takeover bid at $64 a share, with key rival Domino's (DPZ +1.32%) also in focus with Q3 earnings due out before the opening bell.

- "The involvement of Apollo added financial scale and operational credibility to the bid narrative": Jim Salera, analyst at Stephens, outlined the benefit Papa John's could experience from the backing of an asset management powerhouse like Apollo.

- "DPZ keeps rewarding its shareholders with dividends and stock repurchases": Domino's Q2 earnings impressed Fool analyst Sanmeet Deo, CFA, saying "the real dough is in the cash flow. Free cash flow for the first half of the year grew a whopping 43.9%!" Today, investors will be watching to see if price-conscious consumers are pulling back from restaurant spending.

2. Alphabet's $15 Billion India AI Hub Plan

Alphabet (GOOG +0.82%) is planning to invest around $15 billion on a new AI infrastructure hub in India in the coming five years, a move to capitalize on a country seen as one of the biggest future beneficiaries of the AI boom.

- Google's largest investment in India to date: The plan revolves around a data center being built in Visakhapatnam, with the local state aiming to host six gigawatts of capacity by 2029.

- AI flows into India are expected to top $100 billion by 2027: According to data from CBRE Group, it's not just Alphabet pushing in the region, with Amazon (AMZN +4.00%) and OpenAI also having similar multi-billion dollar projects.

3. U.S.-China Port Fees Spark Trade Escalation

The U.S. and China started charging new port fees on each other's vessels, with China threatening further retaliatory measures, in a tit-for-tat escalation causing S&P 500 futures to dip 0.75%.

- Ministry of Commerce placing trading limits on five U.S. entities: The new curbs prevent any entity from doing business with the five U.S. shipping companies, at the same time as it starts collecting additional port fees on U.S.-owned or operated vessels.

- Maritime dominance is a key trading battleground: Higher levies from both sides add significant costs to the sector, with Thurlestone Shipping freight analyst Claire Chong saying ships carrying dry cargo could pay up to $3 million in port fees alone.

4. KARO and JNJ Report Amid Growth Hopes

Karooooo (KARO 0.83%) reports after the market closes, with investors hoping for another beat of revenue and earnings based on further subscription revenue growth with lower churn rates.

- "Karooooo's major innovations have to do with its fleet telematics offerings for commercial vehicles, which have some impressive use cases": TMF co-founder Tom Gardner recently said he believes the company has good potential, with earnings today expected to show an 18% rise in revenue versus the same period last year.

- Full-year outlook upgraded last time around: Johnson & Johnson (JNJ 1.38%) should release earnings before the opening bell after coming off a strong report last quarter, with expectant news around further acquisitions and product launches.

5. GS Acquires VC Firm to Expand Wealth

Goldman Sachs (GS 0.49%) has agreed to buy venture capital investor Industry Ventures for up to $965 million, in a deal showing the desire to push further into asset and wealth management.

- Boosting assets under management by $7 billion: Industry Ventures has exposure to about a fifth of the U.S. venture capital space, providing the bank with closer ties to potential clients in both a personal and corporate relationship.

- It "further diversifies the firm's $540 billion alternatives investment platform": Management spoke of the benefits of the deal, as it tries to increase returns from the combined divisions that generated one-quarter of total earnings last year.

6. Your Take

In Rule Breakers, the Cola Test asks – for any stock you are looking at – is the company you're evaluating the only one doing what it's doing? Can you find no Pepsi to its Coke?

CAVA Group (CAVA 2.44%) is one of hundreds of companies that can be said to have 'passed the Cola test,' given it's the only pure-play, publicly traded Mediterranean restaurant chain on U.S. exchanges.

Today we're asking you to think of an example of a company you believe passes the Cola test. Share with friends and family why you rate the stock's prospects so highly, or become a member to hear what your fellow Fools are saying.