Breakfast News: AI Demand Restarts Reactor

October 28, 2025

| Monday's Markets |

|---|

| S&P 500 6,875 (+1.23%) |

| Nasdaq 23,637 (+1.86%) |

| Dow 47,545 (+0.71%) |

| Bitcoin $114,775 (+1.08%) |

1. Alphabet and NextEra Bet on Nuclear Power

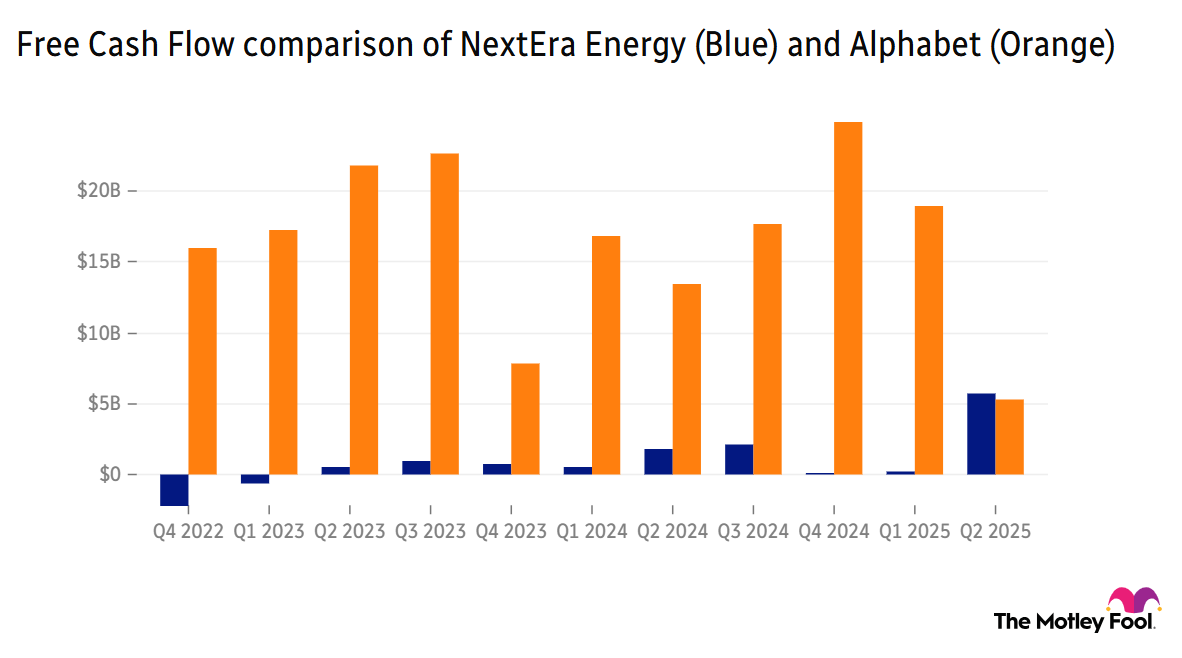

Alphabet (GOOG +4.51%) and NextEra Energy (NEE +1.61%) announced a new partnership to reopen a nuclear power plant, as low-carbon energy demand from AI picks up.

- "A 24/7 carbon-free energy source to help power Google's growing cloud and AI infrastructure": The joint press release for the Duane Arnold Energy Center in Iowa means it could begin operating in 2029, with the state's largest energy provider committing to buying the leftover electricity.

- "This is a very strong business, and its balance sheet is perfectly fine": Earlier in the year, Fool contributing analyst Jason Hall said NextEra Energy "does have plenty of ability to continue to grow its cash flows just based on being an adequately managed business." An update on quarterly financials will come ahead of the opening bell, with revenue expected to jump by 21.8% versus last year.

2. WHR and WM Drop on Mixed Q3 Results

Dividend Investor recommendation Whirlpool (WHR 0.30%) fell almost 3% after the market closed due to reporting a 39.1% drop in earnings per share, as excess inventory and competitor actions weighed on the company.

- "Our third quarter results continued to be impacted by the inventory loading from Asian competitors": CFO Jim Peters said Whirlpool is focusing on what is within its control, as free cash flow expectations were cut to $200 million for this year.

- Collection and Disposal segment set a new record for adjusted operating margin at 38.4%: Stock Advisor rec Waste Management (WM 0.31%) also dropped close to 3% in pre-market trading as third-quarter results missed estimates due to weaker commodity prices weighing on performance.

3. U.S. and Japan Sign New Critical Minerals Pact

President Trump signed a fresh trade agreement with Japan for critical minerals and formalized a 15% export tariff, as the two countries try to finalize the $550 billion investment package discussed with Japan's former Prime Minister.

- "Anyting I can do to help Japan, we will be there": Trump referred to the country as being "an ally at the strongest level" as he seeks to boost ties with new Prime Minister Takaichi.

- Signed agreements light on details: The critical minerals pact pledged to coordinate on permitting and financing, with the tariff and investment deal referring to a commitment to implementing future plans.

4. Next Up: Payments and Travel Earnings

PayPal (PYPL +0.22%) jumped over 14% ahead of the market opening after releasing earnings that introduced a quarterly dividend program and a new payments partnership with OpenAI.

- Beating earnings expectations for the past four quarters: After the closing bell, Booking Holdings (BKNG +0.52%) will post Q3 results, as the business continues to diversify revenue away from just 'nights booked.'

- Consumer spending trends act as macro barometer: Visa (V 0.16%) releases earnings after hours as well, with payments volume and processed transaction growth being closely followed for signs of consumer health, with no slowdown signs last quarter.

5. Would You Rather?

Today we're asking whether you'd rather start a position in Airbnb (ABNB 1.15%) or Booking Holdings today, and why? Debate with friends and family, or become a member to hear what your fellow Fools are saying!