Breakfast News: META, MSFT Fall On Capex

October 30, 2025

| Wednesday's Markets |

|---|

| S&P 500 6,890 (-0%) |

| Nasdaq 23,958 (+0.55%) |

| Dow 47,632 (-0.16%) |

| Bitcoin $110,624 (-2.19%) |

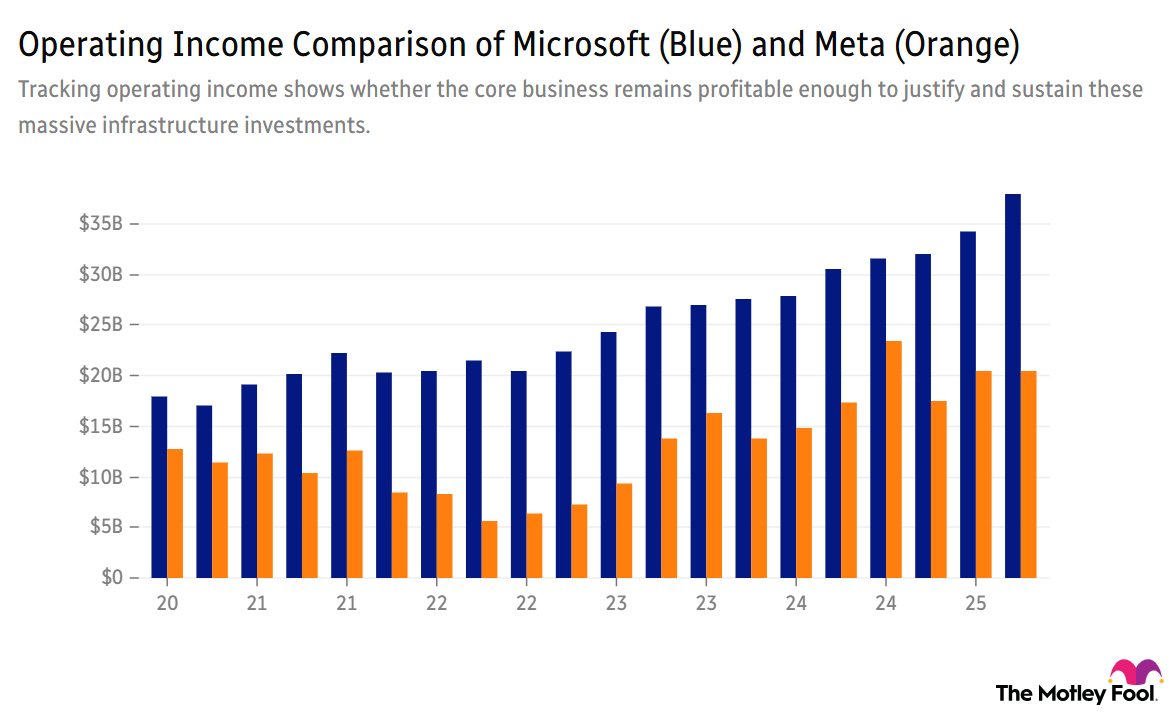

1. High Spending Weighs on Meta and Microsoft

Meta (META +1.47%) and Microsoft (MSFT 2.31%) fell 7% and 4% respectively after the closing bell following quarterly results showing heavy spending on data center construction and AI, pushing overall capex higher.

- "Demand is increasing. It is not increasing in just one place. It is increasing across many places": Microsoft CFO Amy Hood said despite spending tens of billions in the past few quarters, it can't keep up with the pace of AI demand, necessitating the $34.9 billion capex bill as part of results.

- "Meta is not holding back in the AI arms race and is pulling out all the stops": Fool analyst Sanmeet Deo, CFA, recently remarked "it remains to be seen whether the company can generate a significant return on these massive investments, but I wouldn't count out the competitive fire of the young and bold CEO of Meta."

2. Trump-Xi Summit Thaws Trade Tensions

President Trump and Chinese counterpart Xi Jinping agreed for the U.S. to halve fentanyl-related tariffs, with China resuming soybean purchases, in a summit boosting sentiment around trade talks.

- "On a scale of zero to 10, with 10 being the best, I would say the meeting was at a 12": Trump mentioned China would also ease strict controls on rare earth magnets, but indicated no discussions around providing the country with more advanced Nvidia (NVDA +2.98%) chips occurred.

- "Both teams should refine and finalize follow-up work as soon as possible": Xi was cited as saying he wanted tangible results from the meeting, to reassure both his economy and the world. Global stock market futures were little changed following the news.

3. GOOG Wins but Retail Slumps on Earnings

Alphabet (GOOG +1.93%) rose almost 7% in pre-market trading after posting $100 billion in quarterly revenue for the first time, thanks to strong demand for both digital ads and cloud services.

- "While we continue to see persistent macroeconomic pressures...our brand strength remains strong": Stock Advisor recommendation Chipotle (CMG +4.41%) fell over 16% following the closing bell due to management lowering its full-year forecast for comparable sales for a third time this year, but CEO Scott Boatwright struck an upbeat tone.

- The value of all goods sold on eBay rose 10% versus the same period last year: Dividend Investor rec eBay (EBAY +2.34%) dropped almost 10% after the market closed after giving an underwhelming outlook for the coming holiday quarter.

4. Next Up: AAPL and AMZN Continue Mag7 Reporting

Following the market close, Apple (AAPL +0.39%) will release earnings, with a focus on iPhone demand and guidance toward more tangible progress on AI, an area where it's under increasing pressure.

- Superscore of 79 in our Moneyball database: Last quarter, Apple returned to growth in China, with performance in this market key going forward, while a shift in production to India should help ease tariff concerns.

- Beating the S&P 500 by 59% since November '22 rec in SA: Amazon (AMZN +0.17%) reports after regular trading hours with a high bar set for growth in the AWS cloud division and expectations for the key holiday season.

5. Your Take

A little over a year ago, we asked the following question: If every investor had to sell all but one of their holdings and reinvest the money into an S&P 500 tracker fund, what stock would you retain, and why? Debate with friends and family – even if your previous answer might have changed or stayed the same! – or become a member to hear what your fellow Fools are saying.