Breakfast News: Wix Hits, Target Misses

November 19, 2025

| Tuesday's Markets |

|---|

| S&P 500 6,617 (-0.83%) |

| Nasdaq 22,433 (-1.21%) |

| Dow 46,092 (-1.07%) |

| Bitcoin $92,910 (+1.49%) |

1. Wix Earnings Beat, Retail in Focus

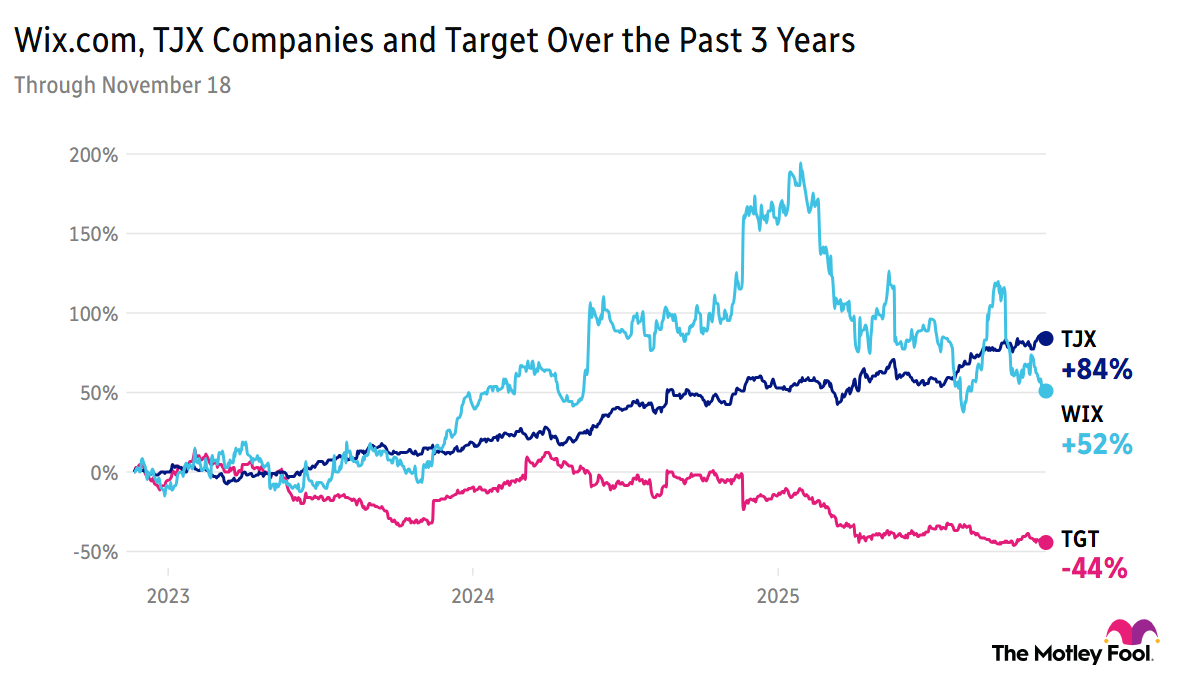

Hidden Gems recommendation Wix.com (WIX 0.58%) posted top- and bottom-line beats this morning, with third-quarter revenue growing 14% to $505 million, as the company said its new Base44 platform is "quickly proving to be a top vibe coding platform with over 2 million users." Full-year revenue guidance edged up to a 13% to 14% rise year over year. Wix fell 8% pre-market, as costs and competition both increased for a net loss in the quarter.

- Down 34.5% year to date, and another 2% in pre-market trading: Target's (TGT 1.46%) Q3 update this morning showed a 1.5% fall in net sales year over year, as CEO Michael Fiddelke spoke of "multiple challenges continuing to face our business." The company expects a further low-single digit sales fall in Q4.

- Beating earnings guidance for 4 straight quarters: Ahead of the S&P 500 by 6% since Stock Advisor recommended the stock last December, TJX (TJX 0.41%) reports Q3 before the opening bell, after seeing revenue rise 7% in Q2. Analysts are expecting a 5.9% rise in revenue year over year this time, close to $15 billion, with earnings per share of $1.22.

2. NVDA Leads After-Hours Earnings

A hotly awaited Q3 update from Nvidia (NVDA 1.19%) arrives after today's market close, with traders increasingly nervous over AI bubble fears. Will the chip maker beat growth estimates? Fool analyst Seth Jayson says "Nvidia's incredible hockey stick growth is going to start bending toward an S-curve. That's inevitable." He notes "How quickly the top of the curve loses its pitch out will determine the next few years' returns."

- Boosted by 16% revenue growth in Q4: Palo Alto Networks (PANW 0.86%) reports Q1 after the closing bell, as analysts predict a continuation of strong Q4 results with revenue this quarter expected to hit company guidance for a 15% rise year over year.

- Currently ranked #1 in Rule Breakers for its ability to beat the market over 5 years: BBB Foods (TBBB 0.44%) is due to post Q3 results this afternoon, after the Mexico-based grocery store operator saw revenue rise 38% in its previous quarter. With 3,000 retail outlets currently, long-term plans are for at least 20,000.

3. Report: Anheuser-Busch to Buy BeatBox

Anheuser-Busch (BUD +0.11%) is in talks to acquire boxed alcoholic drinks maker BeatBox – valuing it at around $700m – reports The Wall Street Journal. The deal could be finalized soon, the report said, in a move to boost revenue at a time when beer sales are slowing.

- Stock down 7% over 5 years: The world's largest brewer is reportedly looking to appeal to younger legal-age drinkers through BeatBox's high-alcohol offerings in brightly colored packs.

- Why Stock Advisor issued a Sell alert three years ago: Fool analysts noted "what we perceived to be a lack of innovation and industry leadership from the company," after the stock lagged the market over the previous one, three, five, and seven years. "We think seven years of underperformance is enough."

4. Economic News Slowly Resuming

Partial data released yesterday shows the number of Americans seeking unemployment benefits climbed by mid-October, reports Reuters. Continued claims reached 1.957 million by October 18, significantly higher than a count of 1.916 million from September 13. The Labor Department says we should have the full data tomorrow.

- The government shutdown put a stop to the collection of the needed household data: The government said we may not get October's unemployment rate at all.

- Import and export price data now set for December 3: The Bureau of Labor Statistics now expects to release the delayed September producer price index print on November 25.

5. Your Take

What retail store have you visited recently that you wish would become a publicly traded company so you could invest in them, and why? Discuss with friends and family, or become a member to hear what your fellow Fools are saying.