Breakfast News: Citi Reveals Shake-Up

November 21, 2025

| Thursday's Markets |

|---|

| S&P 500 6,539 (-1.56%) |

| Nasdaq 22,078 (-2.15%) |

| Dow 45,752 (-0.84%) |

| Bitcoin $87,991 (-2.79%) |

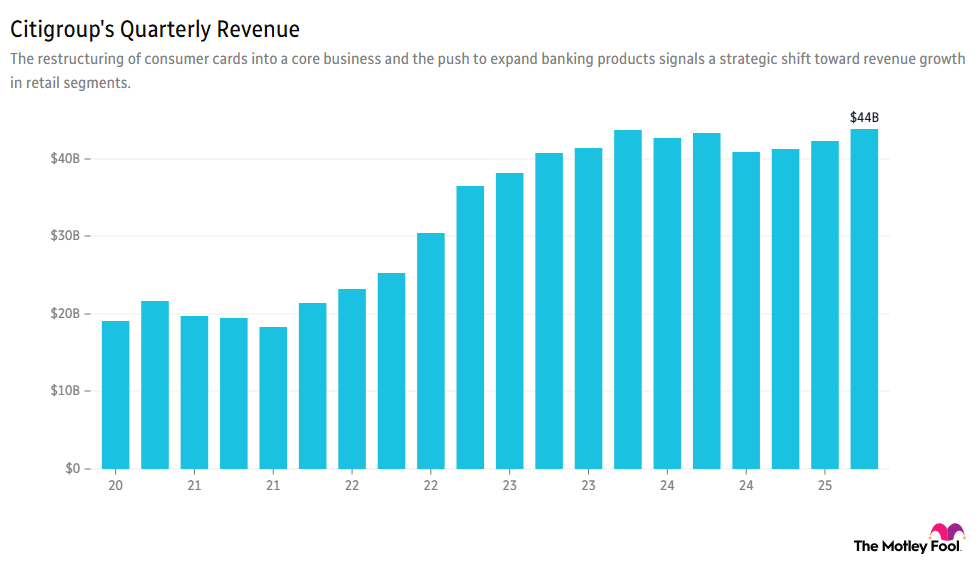

1. Citi Unveils Major Restructuring Plan

Citigroup (C +0.42%) announced a large-scale business transformation package, with a new CFO, integration of retail banking and wealth management, a push on U.S. consumer cards and more, as the bank aims to challenge banking peers. The stock was up around 1% in pre-market trading.

- U.S. consumer cards to become one of Citi's five core businesses: Current CFO Mark Mason will transition his role to Gonzalo Luchetti, the current head of personal banking. Pam Habner, who previously oversaw branded cards and lending, will take on an expanded role to help push consumer banking products to an existing portfolio of more than 70 million Americans.

- "The evolution of our leadership team and structure is well timed": CEO Jane Fraser said further details on the restructuring will be shared at the investor day next May.

2. PayPal Losing Streak Hits Day 7

Stock Advisor recommendation PayPal (PYPL 0.74%) posted a seventh consecutive day of losses, as concerns around checkout growth increase and notable insider sales add to post-earnings pressure.

- Chief risk officer sold 20% of shareholding last week for $615k: The market continues to digest the cautious outlook provided last month, with some investors clearly concerned about the impact of competitors and the need to see improvement in online branded checkout conversions.

- "The market might not be giving PayPal its due credit in the near term": In late October, Fool analyst Jason Moser said PayPal "strikes us as a compelling valuation for a company that continues to grow and play a key role in the payments space." The stock is underperforming the S&P 500 by 42% since the February 2024 SA recommendation.

3. Market Fear Trumps Nvidia Earnings Beat

The Nasdaq had a high-to-low range of 4.89% on Thursday, with the S&P 500 advancing 1.93% before closing 1.56% lower, as the exuberance of strong Nvidia (NVDA 0.72%) earnings evaporated with concerns the U.S. Federal Reserve won't cut interest rates next month.

- "If we delivered a bad quarter, it is evidence there's an AI bubble. If we delivered a great quarter, we are fueling the AI bubble": Business Insider reports CEO Jensen Huang said "the market did not appreciate" the quarterly results as part of an all-hands company meeting.

- "Don't just sell because of the bubble": Legendary investor Ray Dalio said the conditions for a market bubble to pop aren't currently present, as it typically comes with interest rates being increased rather than the current easing path.

4. Thursday Results: INTU Jumps, VEEV & CPRT Struggle

Intuit (INTU 0.94%) rose over 3% following the closing bell thanks to posting revenue growth above estimates, with CEO Sasan Goodarzi saying "early bets" in AI have left the company "well positioned."

- "I'm pretty optimistic about the industry overall": Veeva Systems (VEEV 2.75%) fell almost 7% after the market closed with results showing the number of key clients expected to adopt the Vault CRM system was lower than expected, despite CEO Peter Gassner striking an upbeat tone.

- Rule Breakers Primary database score of 87 for Dominance: Copart (CPRT +0.74%) was down 3% in pre-market trading due to quarterly results showing weaker demand with falling used car values, with CEO Jeff Liaw focusing in part on expanding international demand.

5. Your Take

With Thanksgiving fast approaching, today we're asking you for the stock you're most grateful to have in your portfolio this year, and what it has taught you as an investor. Discuss with friends and family, or become a member to hear what your fellow Fools are saying.