Breakfast News: Coupang CEO Resigns

December 10, 2025

| Tuesday's Markets |

|---|

| S&P 500 6,841 (-0.09%) |

| Nasdaq 23,576 (+0.13%) |

| Dow 47,560 (-0.38%) |

| Bitcoin $93,101 (+2.22%) |

1. Data Breach Forces CPNG Boss Out

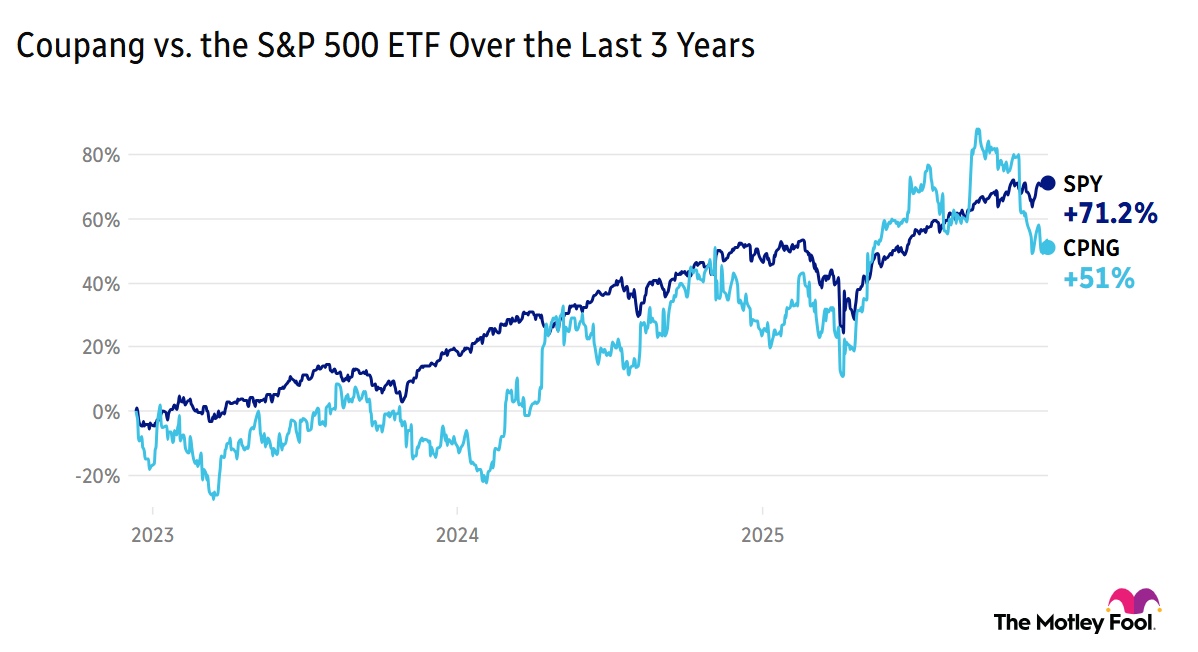

Coupang (NYSE: CPNG) Korea CEO, Park Dae-jun, has resigned after the online retailer was hit by a data breach affecting almost 34 million shoppers. Harold Rogers, chief administrative officer of Coupang’s U.S. parent, will step in as interim CEO. Founder Bom Kim (Coupang’s legal CEO) remains in situ. The company is on the Rule Breakers scorecard twice, with the initial 2021 recommendation lagging the market by 113% and the 2023 rec beating the S&P 500 by 16%.

- "The average level of investment in security systems in Korea is woefully inadequate": Lee Chan-jin, Governor of the country's Financial Supervisory Service, previously said online security compares poorly to other countries including the U.S.

- "Coupang has long been obsessed with its customer experience": Fool analyst Alicia Alfiere pointed out in August "the bulk of Coupang's Product Commerce revenues came from increased spending among its existing customers – including its longest customer relationships." The effect on customer confidence remains to be seen at the company, sometimes known as 'the Amazon (AMZN +0.40%) of South Korea.' Speaking of which...

2. Amazon Reveals India AI Plans

Amazon continues to shrug off AI fears, announcing investments of over $35 billion in AI-related businesses in India by 2030. Revealed at the Amazon Smbhav Summit 2025 in New Delhi, the plans follow almost $40 billion already invested in the country.

- "Amazon businesses will support 3.8 million direct, indirect, induced and seasonal jobs": In addition to boosting jobs, the company said it expects to quadruple exports to $80 billion by 2030.

- "A significant opportunity lies in the shortage of suitable compute infrastructure for running AI": Deepika Giri, of market intelligence firm IDC, told CNBC trade tensions are driving Asian countries to build regional AI capabilities.

3. Indonesia Trade Deal 'Unraveling'?

The trade deal between the U.S. and Indonesia could be breaking down, reports the Financial Times – saying trade representative Jamieson Greer believes Jakarta is backtracking on non-tariff barriers and digital trade issues.

- "$15 billion of U.S. Energy, $4.5 billion in American agricultural products": In July, President Trump spoke of commitments made by Indonesia in a deal to lower tariffs on the country to 19% from his earlier threatened 32%.

- Tariff ruling "before the end of the year": Other Asian countries – including Japan and South Korea – have watered down Trump's earlier commitment announcements, as Greer expects an early Supreme Court decision.

4. Key Earnings to Watch Today

Chewy (CHWY +2.94%) this morning reported an 8.3% rise in Q3 net sales year over year, to $3.12 billion – which CEO Sumit Singh said “exceeded the high end of our net sales guidance.” The company’s gross profit margin rose 50 basis points to 29.8%. Chewy stock perked up 3% in pre-market trading.

- 68% cloud revenue rise on the cards: Oracle (ORCL +0.65%) will report Q2 after the closing bell – as investors watch for signs of AI weakness, with the stock down 36% from its September high. Analysts expect Oracle Cloud Infrastructure revenue to approach $4.1 billion.

- 6.1% forecast dividend yield: We'll have Q1 earnings from Dividend Investor rec Vail Resorts (MTN +1.73%) after market close today following a mixed Q4, as Wall Street expects 3.9% revenue growth year over year – beating a flat quarter this time last year. Adobe (ADBE 2.57%) and Synopsys (SNPS +1.60%) also report this afternoon, as outlined in Monday's Breakfast News.

5. Your Take

Has a CEO transition ever changed your investment thesis – either giving you new confidence or signaling it's time to exit? Discuss with friends and family, or become a member to hear what your fellow Fools are saying.