Wake up to the latest market news, company insights, and a bit of Foolish fun -- all wrapped up in one quick, easy-to-read email, called Breakfast News. Delivered at 7:30 a.m. ET every single market day. See an example of our weekday Breakfast News email & sign-up below.

| Thursday's Markets | |

|---|---|

| S&P 500 6,775 (+0.79%) |

|

| Nasdaq 23,006 (+1.38%) |

|

| Dow 47,952 (+0.14%) |

|

| Bitcoin $85,185 (-0.73%) |

|

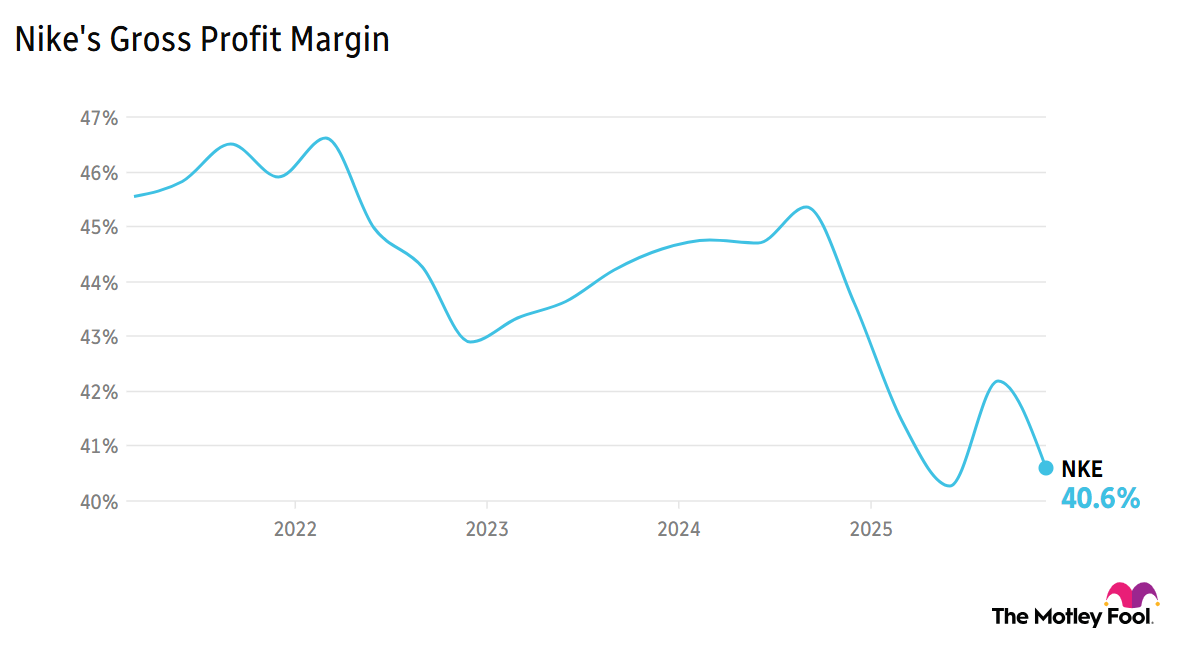

Nike (NYSE:NKE) posted a 32% fall in second-quarter earnings per share (EPS) year over year (YOY) after market close yesterday, as management expects further direct-to-consumer sales weakness in the coming quarters. We saw some signs of recovery in North American markets, with revenue up 9%, though with a gross margin down 330 basis points. Nike stock fell over 10% in pre-market trading.

- "Increased product costs due to higher tariffs": In the earnings call, CFO Matthew Friend also spoke of "inventory obsolescence in Greater China that was not contemplated 90 days ago," as revenue from the region fell 17%. The company expects these pressures to last for the whole of fiscal 2026.

- "The thesis for buying Nike stock today is as a turnaround": Contributing analyst Vicki Hutchison for Hidden Gems recently suggested investors considering the stock ought to ask whether they "believe that a corporate reorg and new management can fix whatever is broken?"

TikTok's U.S. operations are to be taken over by a new joint venture, CEO Shou Zi Chew told employees in a memo yesterday, per Bloomberg. TikTok USDS Joint Venture LLC will be led by three managing investors -- Oracle (NYSE:ORCL), Silver Lake, and MGX, who will share 50% of the ownership. Chinese owner ByteDance will retain 20%, with 30% held by other affiliates.

- "Majority owned by American investors, governed by a new seven-member majority-American board of directors": Chew added the venture will be "subject to terms that protect Americans' data and U.S. national security," with Oracle a "trusted security partner."

- Oracle gained 5% in early trading: The news gave Oracle stock a boost, after reports earlier emerged of a financing issue over the company's $10 billion, 1-gigawatt, artificial intelligence (AI) data center in Michigan.

Stock Advisor recommendation FedEx (NYSE:FDX) reported a 19% YOY EPS jump with yesterday's Q2 update -- as profitability improves despite a number of obstacles, including the grounding of the company's MD-11 aircraft following November's UPS (NYSE:UPS) crash. The stock remained stable overnight.

- "On track to spin off FedEx Freight on June 1, 2026, as a separately listed public company": CEO Rajesh Subramaniam described the new spin-off as "the best customer value proposition in the LTL market," with Marshall Witt named as CFO.

- Superscore of 62 on our Hidden Gems Primary database: Affordability pressures on homebuyers hit sales at KB Home (NYSE:KBH), leading to a 16% decline in Q4 revenue -- with adjusted EPS down 24% YOY. Management remains cautious for fiscal 2026, with revenue guidance of $1.05 billion to $1.15 billion. The stock gave up 3% in pre-market trading.

How important is order backlog visibility when you're choosing stocks, and in which industries does it matter most? Debate with friends and family, or become a member to hear what your fellow Fools are saying.