| Thursday's Markets | |

|---|---|

| S&P 500 6,901 (+0.21%) |

|

| Nasdaq 23,594 (-0.25%) |

|

| Dow 48,704 (+1.34%) |

|

| Bitcoin $92,801 (+0.27%) |

|

| Thursday's Markets | |

|---|---|

| S&P 500 6,901 (+0.21%) |

|

| Nasdaq 23,594 (-0.25%) |

|

| Dow 48,704 (+1.34%) |

|

| Bitcoin $92,801 (+0.27%) |

|

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.

Wake up to the latest market news, company insights, and a bit of Foolish fun -- all wrapped up in one quick, easy-to-read email, called Breakfast News. Delivered at 7:30 a.m. ET every single market day. See an example of our weekday Breakfast News email & sign-up below.

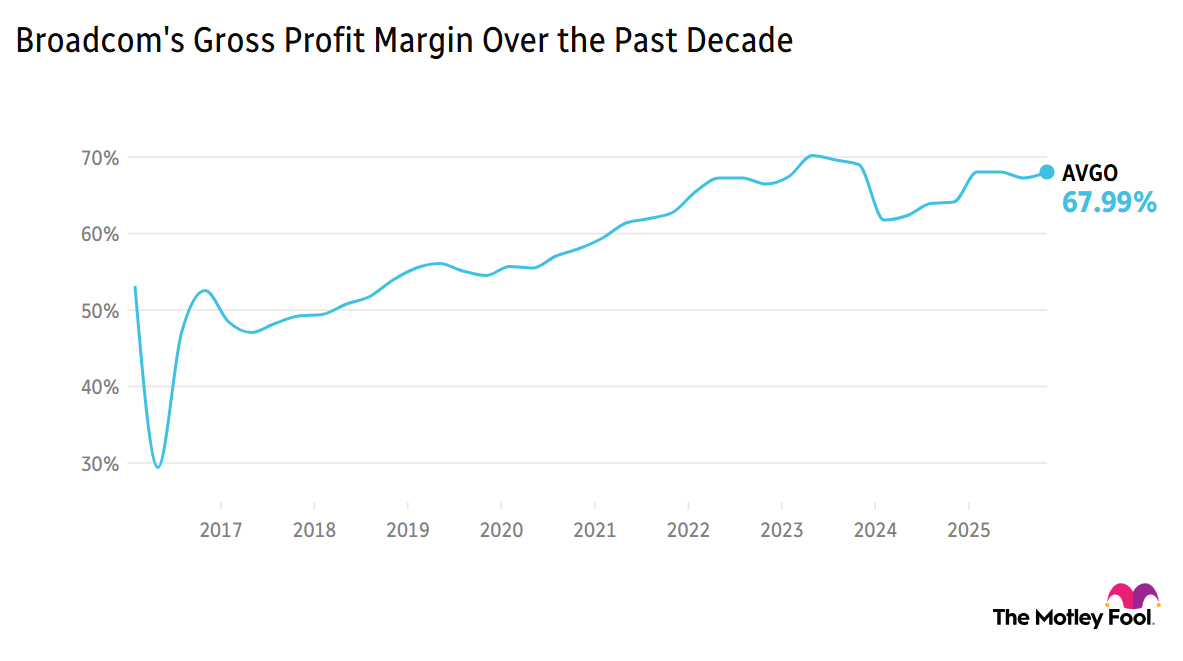

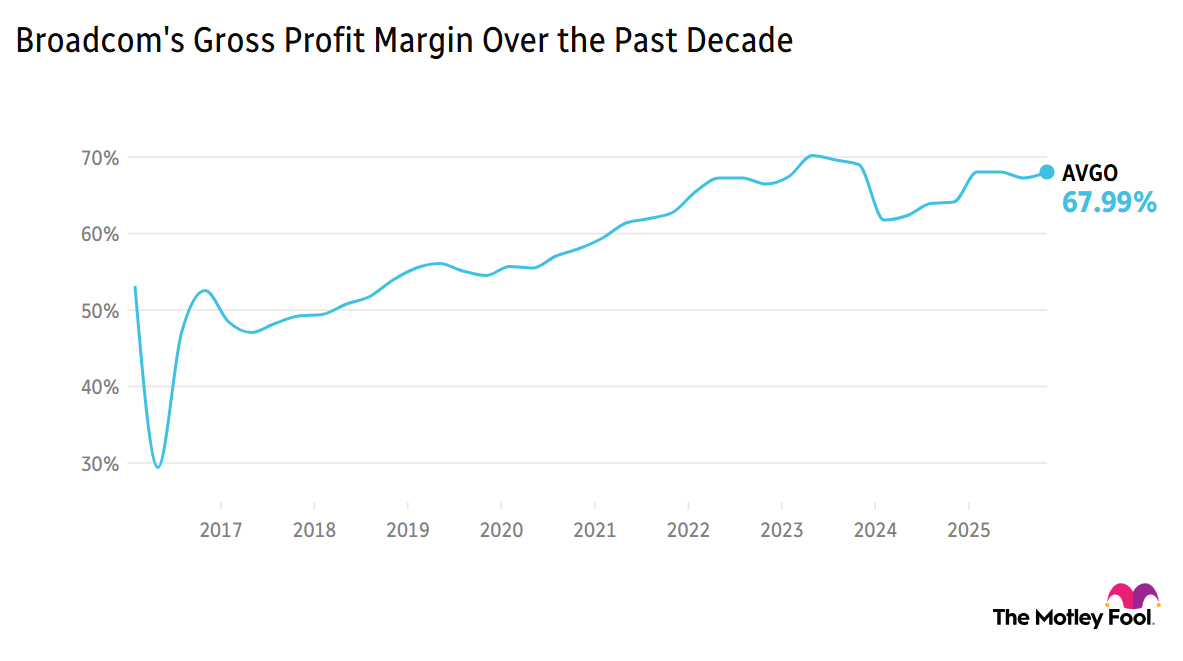

Rule Breakers recommendation Broadcom (NASDAQ:AVGO) was down over 5% in pre-market trading, as quarterly results contained disappointing guidance on shrinking profit margins driven by a shift in revenue mix.

Stock Advisor rec Lululemon (NASDAQ:LULU) rocketed over 10% higher ahead of the market open, thanks to a strong earnings beat, with outgoing CEO Calvin McDonald saying, "As we enter the holiday season, we are encouraged by our early performance."

The S&P 500, Dow Jones, and Russell 2000 indexes all closed at fresh record highs -- in contrast to the tech-heavy Nasdaq, which fell by 0.25% on the day, highlighting the value in owning a diversified portfolio.

Reddit (NYSE:RDDT) has launched a legal case against the Australian social media ban for teens under 16, asserting it infringes on free political discourse and is ineffective. The stock was flat heading into the market open.

Today, we're asking whether you'd rather start a position in JPMorgan Chase (NYSE:JPM) or Walmart (NASDAQ:WMT) today, and why? The companies are currently the closest ones to the $1 trillion market cap that have never reached the milestone (last month, Eli Lilly (NYSE:LLY) became the first pharmaceutical company ever to reach $1 trillion, though it has since slipped back down). Debate with friends and family, or become a member to hear what your fellow Fools are saying!