Investors like nothing more than to hear that one of their holdings has increased its dividend.

Such a raise, of course, puts extra money directly into the lucky shareholder's pocket. Not only that, but it often improves the stock price, as the market is willing to pay that much more for the extra payout. Companies that improve their long-term fundamentals typically have extra resources to add to their distribution over time.

Last week, several dividend raises came down the pipeline. Investors in these three companies will get a boost in their next quarterly payouts.

Estee Lauder

Of this week's chosen trio, the company taking the prize for highest dividend raise, in terms of percentage, is sweet-smelling Estee Lauder (EL -1.52%). The beauty products company declared an upcoming quarterly distribution of $0.24 per share, 20% higher than its predecessor.

Lauder is a frequent dividend-raiser, and it's no wonder: Both its top and bottom lines have seen a sharp, consistent rise over the past five years. Revenue has spiked from $7.8 billion in fiscal 2010 to just under $11 billion for 2014. Net profit, meanwhile, climbed much more steeply from $478 million to $1.2 billion.

This performance, combined with a fairly conservative managerial approach that shuns debt and keeps free cash flow high, bodes well for the future of the dividend. If the company continues to do well, we should expect that payout to keep growing -- especially since the stock's yield is a relatively low 1.3%.

Estee Lauder's new distribution will be paid on Dec. 15 to shareholders of record as of Nov. 28.

Cedar Fair

It's hard not to feel generous when notching a new financial record. That's the happy position amusement park operator Cedar Fair (FUN -1.40%) finds itself in after posting a new all-time high revenue figure in its third quarter. Concurrent with that news was the company's announcement that it would pay a fresh dividend of $0.75 per unit of its limited partnership, a 7% raise over the previous $0.70.

Despite that top-line record, the company's business lately hasn't grown that strongly. Third-quarter revenue was only 1% higher on a year-over-year basis, while both net profit and attendance were down by roughly the same percentage.

On the plus side, thanks in no small part to a recent wave of price increases in the amusement park industry, Cedar Fair's operating cash flow has seen a pronounced upward tick over the past three years. That's the climbing rollercoaster that's helping to lift the dividend.

FUN Dividends Paid (TTM) data by YCharts.

Americans have always liked amusement parks, and there's no reason to suspect that trend will cool at any point. A 1% slump isn't big enough for investors to start worrying.

Cedar Fair's new distribution is to be handed out on Dec. 15 to unitholders of record as of Dec. 3.

Rockwell Automation

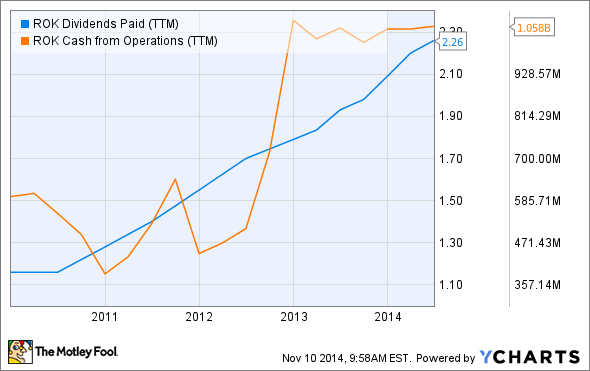

Industrial technology specialist Rockwell Automation (ROK -0.04%) tends to produce its dividend at steady, reliable intervals. That payout has risen notably over the past four years. Few shareholders, then, were likely shocked when the company hiked its dividend by 12% to $0.65 per share last week.

The company's stock could use the juice that good news provides. Following the release of disappointing third-quarter results in July, Rockwell's shares were hammered badly, at one point dipping below $100. They've regained some momentum since then, but at $112 and change, they're still about $15 shy of the year-to-date high.

But as far as the dividend is concerned, investors shouldn't fret much over earnings. Rockwell tends to hold a nice cash cushion, with free cash flow at least doubling what the company pays out in dividends. This is not a reckless company; it habitually lives well within its means.

ROK Dividends Paid (TTM) data by YCharts.

Nevertheless, investors should scrutinize the fundamentals when Rockwell releases its fourth-quarter results before the market opens on Wednesday.

Rockwell's just-declared dividend will be distributed on Dec. 10 to shareholders of record as of Nov. 17.

The payouts flow with the cash

This week's crop of selected dividend-raisers are all rather cautious in their payout policies (especially Cedar Fair, which, as a partnership, is obligated to make hefty distributions). Of the three, the only dividend that seems to have a remotely questionable future is Rockwell's, but the company's strong cash flow means the risk is likely not high.

We were lucky to have a fairly sturdy trio of companies with conservative payout ratios for this update. Let's see whether next week's candidates are similarly robust.