Shares of Michael Kors

How it got here

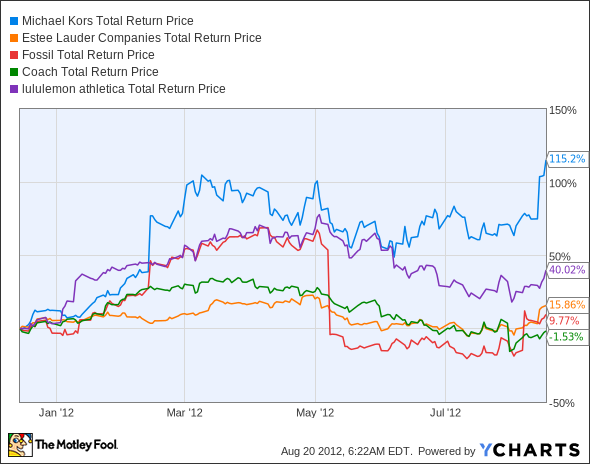

There are significant variations in performance across the fashion sector, even in the luxury subsector that Michael Kors might be said to inhabit. But there's clearly no competition for Kors to date. The stock has been on an absolute tear since going public late last year, and has left even high-flying, cultish yoga-pant purveyor lululemon athletica

KORS Total Return Price data by YCharts.

Kors' recent surge came after a strong quarterly performance blew out expectations, but the company's been a fast grower for some time, and its stock price reflects that fact. Just take a look at some of Kors' numbers compared to its peers.

What you need to know

Kors sports a premium price even in a sector well-known for its premium pricing. There's one reason for that, as you can see:

|

Company |

P/E Ratio |

Price to Free Cash Flow |

Net Margin (TTM) |

3-Year Annualized Income Growth |

|---|---|---|---|---|

| Michael Kors | 57.5 | 331.3 | 11.9% | 78.7% |

| Lululemon | 46.5 | 61.7 | 17.9% | 50.3% |

|

Coach |

17.2 | 16.9 | 21.3% | 12.3% |

|

Fossil |

18.6 | 32.0 | 11.2% | 29.7% |

|

Estee Lauder |

29.0 | 34.1 | 8.8% | 21.5% |

Source: Morningstar. TTM = trailing 12 months.

The market seems to expect continued strength out of Kors, but it'll have to fly like a rocket to justify its currently exorbitant P/E and even more outlandish P/FCF. The company's net margin is nothing to write home about when compared to Lululemon or Coach, and Fossil and Estee Lauder both offer cautionary examples of what its ratios may dwindle to if income growth slows.

It's especially important to look at Fossil when considering Kors' market future. My fellow Fool Sean Williams highlighted Fossil's recent 52-week low, which came after a tremendous two-year run ended with a splat this summer. That seemed like a major overreaction, and the company isn't expecting to start losing ground anytime soon, but that doesn't help anyone who got in before the plunge. One sniff of blood in the water, even if it's just a scratch, and the sharks will probably be all over Kors just as they've been on Fossil.

What's next?

Where does Michael Kors go from here? How strong will its sales growth be this quarter, and the quarter after that? As long as there's fuel in the rocket, this stock will keep soaring. Unfortunately, few people really know when that rocket's going to run out.

The Motley Fool's CAPS community has given Michael Kors a two-star rating, with 80% of the CAPS players who weighed in expecting the company to keep beating the market.

Interested in tracking this stock as it continues on its path? Add Michael Kors to your watchlist for all the news we Fools can find, delivered to your inbox as it happens. If you're on the hunt for more consumer favorites flying under the radar (and you should be), take a look at the Fool's latest free report: "Three Middle Class Millionaire-Makers Wall Street's Too Rich to Notice." You'll get everything you need to jump into these three stocks before they make a splash -- just click here for your free information now.