Every investor can appreciate a stock that consistently beats the Street without getting ahead of its fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with improving financial metrics that support strong price growth. Let's look at what Freeport-McMoRan Copper & Gold's (FCX -1.25%) recent results tell us about its potential for future gains.

What the numbers tell you

The graphs you're about to see tell Freeport's story, and we'll be grading the quality of that story in several ways.

Growth is important on both top and bottom lines, and an improving profit margin is a great sign that a company's become more efficient over time. Since profits may not always reported at a steady rate, we'll also look at how much Freeport's free cash flow has grown in comparison to its net income.

A company that generates more earnings per share over time, regardless of the number of shares outstanding, is heading in the right direction. If Freeport's share price has kept pace with its earnings growth, that's another good sign that its stock can move higher.

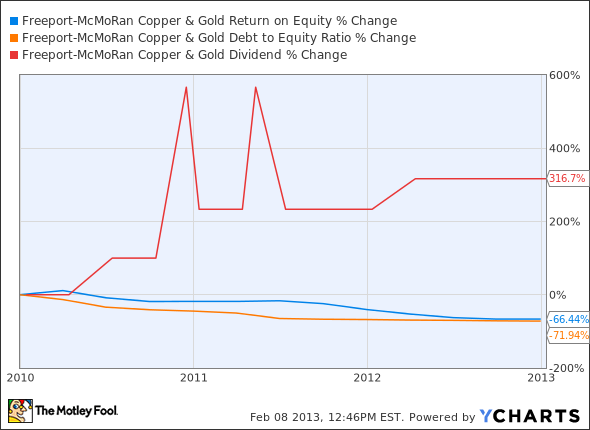

Is Freeport managing its resources well? A company's return on equity should be improving, and its debt-to-equity ratio declining, if it's to earn our approval.

Healthy dividends are always welcome, so we'll also make sure that Freeport's dividend payouts are increasing, but at a level that can be sustained by its free cash flow.

By the numbers

Now, let's look at Freeport's key statistics:

FCX Total Return Price data by YCharts.

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

19.8% |

Fail |

|

Improving profit margin |

(21.8%) |

Fail |

|

Free cash flow growth > Net income growth |

(90%) vs. 20.3% |

Fail |

|

Improving EPS |

8.5% |

Pass |

|

Stock growth (+ 15%) < EPS growth |

(2.6%) vs. 8.5% |

Pass |

Source: YCharts.

*Period begins at end of Q4 2009.

FCX Return on Equity data by YCharts.

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

(66.4%) |

Fail |

|

Declining debt to equity |

(71.9%) |

Pass |

|

Dividend growth > 25% |

316.7% |

Pass |

|

Free cash flow payout ratio < 50% |

324.3% |

Fail |

Source: YCharts and Morningstar.

*Period begins at end of Q4 2009.

How we got here and where we're going

It hasn't been a particularly good stretch for Freeport, which earns four out of nine passing grades despite a solid fourth-quarter earnings report late last month. Return on equity and free cash flow have both fallen precipitously, and the stock's dividend may be in danger soon if Freeport can't push that cash flow total higher. What will it take to earn Freeport a better grade next time?

It would help if gold miners could reflect the continued strength of the metal they're after. Many gold miners have fallen over the past three years after some initial optimism in 2011. Of the larger miners, few have so much as broken even on total returns for the past three years. Only Yamana Gold (AUY) has had similar success to the underlying strength of gold itself:

Gold Price in U.S. Dollars data by YCharts.

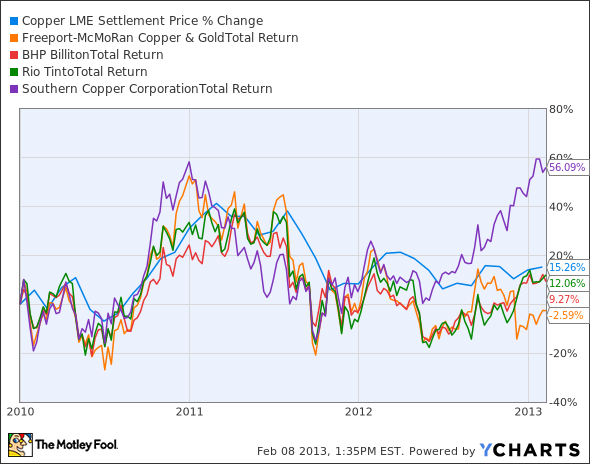

Freeport, however, is more dependent on copper production, which is tied to the strength of industrial and construction sectors. Copper prices have risen less than gold, but Goldman Sachs envisions modest price growth in 2013. So far, we may be seeing that come to pass, as prices have been ticking up through the winter. Over the past three years, the share prices of major copper miners -- with the exception of Southern Copper (SCCO -2.60%), which has been putting forth much stronger earnings growth than Freeport over the past three years -- have marched in virtual lockstep with the changes in copper prices:

Copper LME Settlement Price data by YCharts.

The main driver that will shift Freeport away from this apparent reliance on copper prices is its planned acquisition of both McMoRan Oil & Gas (NYSE: MMR) and Plains Exploration & Production (NYSE: PXP), which would create a much more diversified natural resource company. However, it remains to be seen whether this is a good idea, or just a ploy to enrich the directors of these companies, who, as my fellow Fool David Lee Smith points out, would benefit handsomely from the acquisition. Such moves don't do much to engender investor trust in the executives they depend on to drive returns.

Putting the pieces together

Today, Freeport has some of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.