Pet health care provider IDEXX Laboratories (IDXX 2.88%) will be buying back 4 million more shares of its outstanding stock, the board of directors announced Monday.

With more than 2.2 million shares remaining under its current share repurchase authorization program as of March 31, the board has almost tripled the amount to be bought back, though it notes they'll be made at the discretion of management. However, they will be made in the open market -- including through Rule 10b5-1 plans -- and in negotiated transactions.

IDEXX additionally announced that it successfully refinanced its unsecured revolving credit facility that's to be used for general corporate purposes. The aggregate amount available for borrowing was raised from $300 million to $450 million, and the maturity date was extended from July 25, 2016, to May 8, 2018, while the interest rates applicable to borrowings and the one financial covenant attached to it remain unchanged.

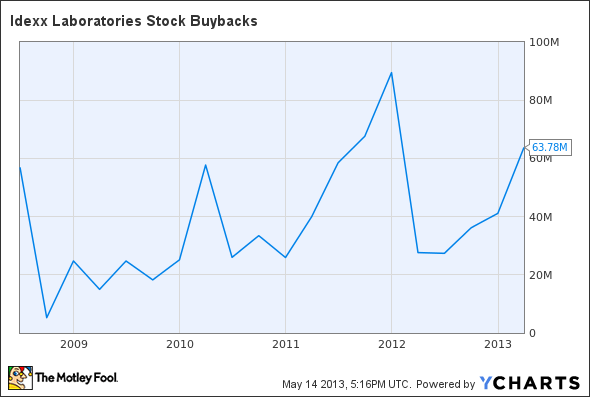

As of March 31, the pet health care specialist had cash and investments of approximately $228.4 million and almost 56 million shares of common stock outstanding. The following chart does not include repurchases after March 31.

IDXX Stock Buybacks data by YCharts