Dividend stocks outperform non-dividend-paying stocks over the long run. It happens in good markets and bad, and the benefit of dividends can be quite striking: Dividend payments have made up about 40% of the market's average annual return from 1936 to the present day. But few of us can invest in every single dividend-paying stock on the market, and even if we could, we might find better gains by being selective.

That's why we'll be pitting two of the Dow Jones Industrial Average's (^DJI -0.32%) dividend payers against each other today to find out which Dow stock is the true dividend champion. We've already put each stock through one challenge, and both of today's contenders have come through with flying colors. Let's take a closer look at our two contenders now.

Tale of the tape

Intel (INTC 1.97%) beat the Dow's networking representative to earn its place here today. The world's largest chip-maker is also one of the tech industry's most reliable dividend-payers, and it's sure to be a fierce challenge for its opponent. Read more about Intel's first-round victory here.

UnitedHealth (UNH 1.49%) pulled off a surprise victory against the Dow's largest drugmaker to move on to the second round of the dividend tournament. It may be the Dow's newest addition, but UnitedHealth has earned its place on the index by becoming the largest health-insurer in the United States. Read more about UnitedHealth's first-round victory here.

|

Statistic |

Intel |

UnitedHealth |

|---|---|---|

|

Market cap |

$114.2 billion |

$74.4 billion |

|

P/E Ratio |

12.4 |

13.8 |

|

Trailing-12-month profit margin |

19.5% |

4.7% |

|

TTM free-cash-flow margin* |

18.7% |

4.1% |

|

Five-year total return |

25.2% |

182% |

Source: Morningstar and YCharts. *Free-cash-flow margin is free cash flow divided by revenue for the trailing 12 months. UnitedHealth's cash flow margin is calculated from operating cash flow.

Intel has the margins, but UnitedHealth has more of the market's favor behind it. Let's dig into the details to see which of these companies will move on to the next round.

Round one: endurance

Which of these two companies has been paying back shareholders for a longer period of time? Intel's dividend streak begins in 1992. That was good enough for a victory the first time around, but the chip maker falls short of UnitedHealth's streak, which began with annual payouts in 1990 and continued for two decades before switching to quarterly distributions in 2010.

Winner: UnitedHealth, 1-0

Round two: stability

Paying dividends is well and good, but how long have our two companies been increasing their dividends? The same dividend payout year after year can quickly fall behind a rising market, and there's no better sign of a company's financial stability than a rising payout in a weak market (so long as it's sustainable, of course). This round turns out to offer no clear winner. UnitedHealth had a multiyear stretch of flat payouts before its quarterly distributions began in 2010. Intel did not raise its dividend in 2009 at all, but since the company boosted payouts for the second distribution of 2008 to the level it maintained for 2009, its stretch of annual payout growth technically dates back to 2004.

Winner: Intel, 1-1

Round three: power

It's not that hard to commit to paying back shareholders, but are these payments enticing or merely token? Let's take a look at how both companies have maintained their dividend yields over time as their businesses and share prices have grown:

INTC Dividend Yield data by YCharts.

Winner: Intel, 2-1

Round four: strength

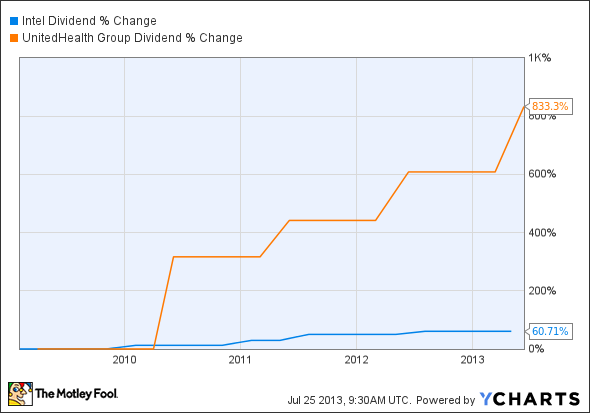

A stock's yield can stay high without much effort if its share price doesn't budge, so let's take a look at the growth in payouts over the past five years. If you bought in several years ago and the company has grown its payout substantially, your real yield will likely look much better than what's shown above.

INTC Dividend data by YCharts.

Winner: UnitedHealth, 2-2

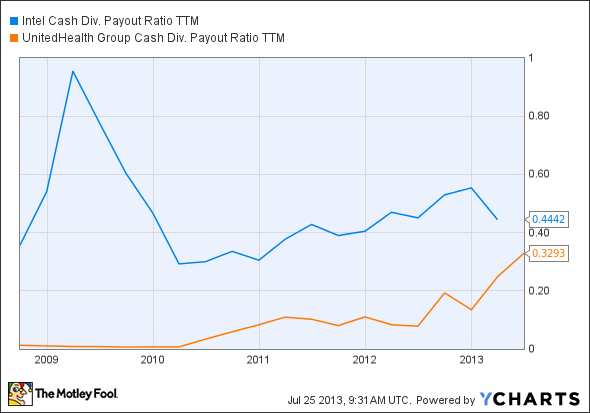

Round five: flexibility

A company needs to manage its cash wisely to ensure that there's enough available for tough times. Paying out too much of free cash flow in dividends could be a warning sign that the dividend is at risk, particularly if business weakens. This next metric analyzes just how much of their free cash flows our two companies have paid out in dividends over the past few years:

INTC Cash Div. Payout Ratio TTM data by YCharts.

Winner: UnitedHealth, 3-2

The Dow's health care rep unseats the strongest tech dividend that was left in the tournament. This result is a little bit surprising, but given the importance of health insurance to the American economy, it might not be that surprising to see UnitedHealth pushing its payouts markedly higher in the past few years. Will you be placing your faith in UnitedHealth, or is Intel's stability still worth hanging on to?