Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does 3M (MMM 0.45%) fit the bill? Let's look at what its recent results tell us about its potential for future gains.

What we're looking for

The graphs you're about to see tell 3M's story, and we'll be grading the quality of that story in several ways:

- Growth: Are profits, margins, and free cash flow all increasing?

- Valuation: Is share price growing in line with earnings per share?

- Opportunities: Is return on equity increasing while debt to equity declines?

- Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's look at 3M's key statistics.

MMM Total Return Price data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

19.2% |

Fail |

|

Improving profit margin |

(4.7%) |

Fail |

|

Free cash flow growth > Net income growth |

(1%) vs. 13.6% |

Fail |

|

Improving EPS |

16.3% |

Pass |

|

Stock growth (+ 15%) < EPS growth |

59.7% vs. 16.3% |

Fail |

Source: YCharts.

*Period begins at end of Q2 2010.

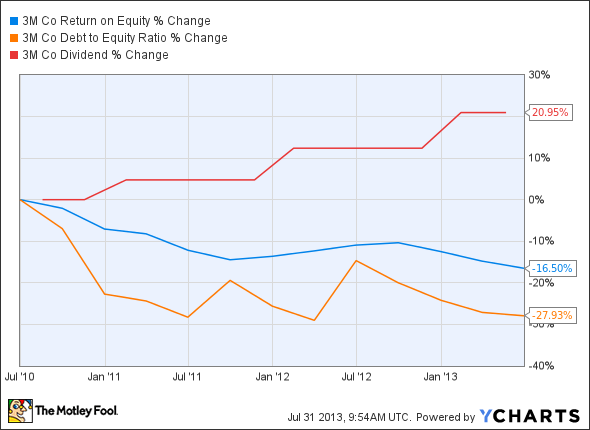

MMM Return on Equity data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

(16.5%) |

Fail |

|

Declining debt to equity |

(27.9%) |

Pass |

|

Dividend growth > 25% |

21% |

Fail |

|

Free cash flow payout ratio < 50% |

40.5% |

Pass |

Source: YCharts.

*Period begins at end of Q2 2010.

How we got here and where we're going

3M doesn't quite come through with flawless performance, as it's only earned three out of nine possible passing grades. The combination of flat free cash flow and underwhelming earnings growth have damaged 3M in our tests, but these don't have to be fatal wounds. Will 3M be able to turn this weakness around and rebound, or is the company going to have to settle for a below-average score for the foreseeable future? Let's dig a little deeper to find out.

3M's latest quarterly report gave investors revenue that was a shade below analyst predictions. Management blames poor economic conditions for the sluggish revenue growth, but they expect increased demand during the second half of 2013. The company will try to leverage lower-cost operations in China to expand its net margins. 3M's presence in the developing markets also makes it attractive for long-term investors. Revenues from mature markets have been shrinking, but 3M has identified opportunities in its health-care and consumer segments. At present, 3M's health care segment only pulls in 21% of its revenue from developing markets. That's about $1.1 billion -- a number that should be quite possible for 3M to double over the next few years.

3M has quietly developed some world-beating RFID technology, which could give the company a leg up in the nascent Internet of Things -- or at least provide it with a new avenue of growth in connected warehouses and shopping centers. Another of 3M's innovative new products is an LED light bulb with a 25-year lifespan. These two products aren't enough on their own to push 3M into the future, so the company has also committed between $1 billion and $2 billion per year for mergers and acquisitions to boost-up organic revenue.

Putting the pieces together

Today, 3M has some of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.