Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Sears Holdings (SHLDQ) fit the bill? Let's look at what its recent results tell us about its potential for future gains.

What we're looking for

The graphs you're about to see tell Sears Holdings' story, and we'll be grading the quality of that story in several ways:

- Growth: Are profits, margins, and free cash flow all increasing?

- Valuation: Is share price growing in line with earnings per share?

- Opportunities: Is return on equity increasing while debt to equity declines?

- Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's look at Sears' key statistics:

SHLD Total Return Price data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

(12.5%) |

Fail |

|

Improving profit margin |

(696.1%) |

Fail |

|

Free cash flow growth > Net income growth |

(230.2%) vs. (621.4%) |

Pass |

|

Improving EPS |

(691.3%) |

Fail |

|

Stock growth (+ 15%) < EPS growth |

(6.9%) vs. (691.3%) |

Fail |

Source: YCharts.

"Period begins at end of Q2 2010.

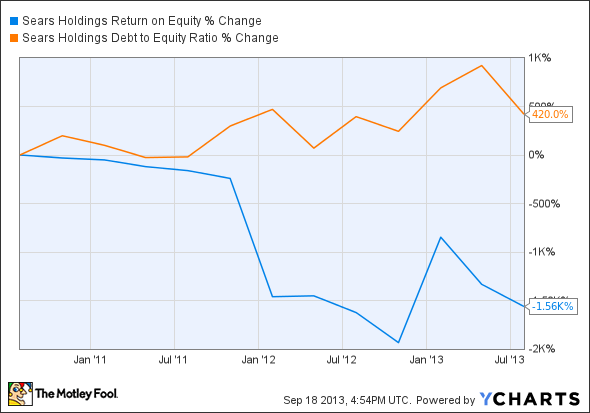

SHLD Return on Equity data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

(1,560%) |

Fail |

|

Declining debt to equity |

420% |

Fail |

Source: YCharts.

*Period begins at end of Q2 2010.

How we got here and where we're going

This is, by all accounts, an ugly, ugly performance. Sears Holdings' only passing grade was granted on a technicality rather than a genuine improvement -- there's nothing to be proud of in a triple-digit free cash flow decline. Sears Holdings' problems are by now well known, but the company's turnaround strategy remains murky. Is there a way out of the doghouse, or is this company on its way to becoming the next Woolworth's?

The demand for new tools and appliances should be rising along with new home constructions and an uptick in home sales. Despite ample evidence of the latter trend, the company has been experiencing declining domestic same-store sales. Sears Holdings' domestic same-store sales fell by 1.5%, which comes from declines of 2.1% and 0.8% for the Kmart and Sears brands, respectively. On the other hand, Home Depot (HD -0.63%) and Lowe's have both reported same-store sales growth of 10.7% and 9.6%, respectively -- weak sales to homebuyers and homebuilders is clearly not an economy-wide phenomenon. What gives?

Fool contributor Adam Weinberg notes that Home Depot poses an ongoing threat to Sears, as both retailers serve similar segments of the home-improvement market. There are ample alternatives to Sears when it comes to furnishings, appliances, and general housewares as well, so it's going to take more than Craftsman tools to lure the average shopper to Sears locations -- and as for Kmart, it's never really been the same since Wal-Mart muscled into the superstore segment with its pricing and supply-chain advantage.

The company has been trying to boost its revenue on the back of its "Shop Your Way" loyalty program, which now contributes 65% of total revenue, compared with 55% a year ago. Fool contributor Sean Williams notes that Sears has been planning to hire more marketing professionals than any other major corporation. This may be necessary to break the company's brands out of their decades-long rut, but it also speaks to a sense of desperation -- what can a few dozen new marketers do that hasn't already been tried? Despite this targeted hiring binge, Sears has been reduced many workers' weekly hours to slide in beneath Obamacare penalties, which indicates somewhat less confidence in their ability to sustain any growth.

Putting the pieces together

Today, Sears Holdings has few of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.

Editors note: A previous version of this article incorrectly stated that a fee existed for Sears' Shop Your Way Loyalty Program. In fact, this program carries no fee. The Fool regrets this error.