Dillard's (DDS 2.31%) has been on a rampage since the depths of the Great Recession. Over the past three years, the stock has appreciated 272%, outperforming Kohl's (KSS 1.00%) and TJX Companies (TJX +0.43%), which appreciated 11% and 162%, respectively, over the same time frame.

This might lead you to think that Dillard's will remain the best investment of the three going forward, but that's not likely to be the case. If you take a look at the underlying businesses, instead of the recent stock performances, one of these companies stands out above its peers. But prior to revealing the likely top investment in this group, let's first take a deeper look at Dillard's.

Recent performance

Dillard's recently delivered its best second quarter earnings-per-share in its history at $0.79 -- a 25% jump over the year-ago quarter. Comps improved for the twelfth consecutive quarter. But if you look a little closer, you will see that these numbers aren't outstanding.

For instance, comps only improved 1% year over year. Total cash flow from operations was $131.7 million, lower than the $152.8 million seen in the year-ago quarter. Net sales also came in at $1,479.9 million, versus $1,487.9 million in the year-ago quarter. However, in this case, the retail store count was reduced to 300 from 303.

Divesting three locations and not having as many product markdowns aided the bottom line. While the number of transactions for the quarter decreased 4%, average dollars per sales improved 4%. This indicates that foot traffic has slowed, but those who visit are spending more money. Therefore, it's possible that Dillard's will increase its promotions in order to drive more foot traffic. This would aid the top line but hurt the bottom line.

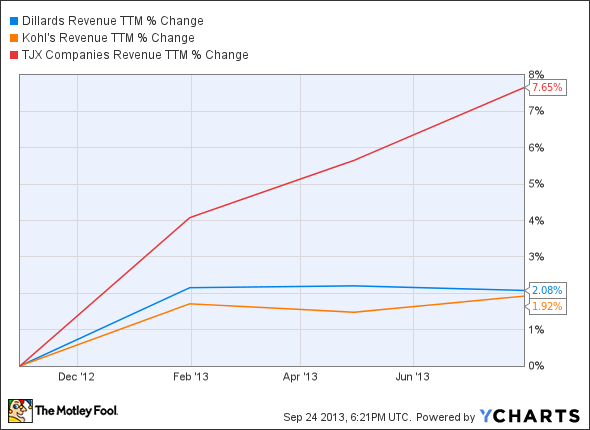

Since we're on the topic of top and bottom-line performance, take a look at recent trends for the three aforementioned companies. Revenue:

DDS Revenue TTM data by YCharts

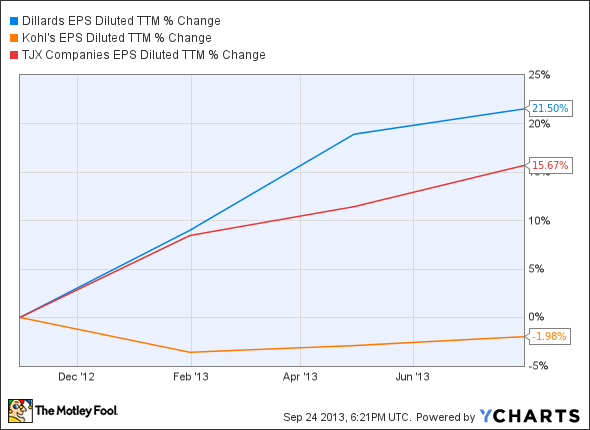

Earnings-per-share:

DDS EPS Diluted TTM data by YCharts

The good news is that Dillard's believes it will see retail sales growth in fiscal year 2013 versus fiscal year 2012. The bad news is that one of its peers is better positioned for changing consumer trends.

Dillard's vs. peers

As noted above, Dillard's comps grew 1% year over year for the second quarter. Comps is the most important number in retail because it doesn't count newly-opened stores, which tend to lead to increased sales and weakened margins. By looking at comps, you're able to determine if a retailer is capable of driving repeat business.

Kohl's saw comps growth of 0.9% in the second quarter year over year -- similar to Dillard's. As you may already know, Kohl's sells a wide variety of brands, which leads to a large target consumer base. Kohl's is a family-oriented retailer with a focus on apparel and home products. While Kohl's offers discounts, these discounts aren't as steep as some other retailers. And consumers crave discounts. Due to a 2% payroll tax increase, high gas prices, and limited wage growth in the United States, Kohl's has found itself in a challenging situation. This is evidenced by Kohl's recently cutting its FY 2013 EPS guidance to $4.15-$4.35 from $4.15-$4.45.

Reading about struggling retailers can make you want to shake your head at the current state of the economy and the weak consumer. However, TJX Companies plays right into this trend. You might know TJX Companies for its popular brands T.J. Maxx, Marshalls, and HomeGoods. As an off-price retailer, TJX Companies is able to offer discounts that are often north of 40%. This, in turn, drives value-conscious consumers to its stores.

In the second quarter, TJX Companies saw comps increase 4%, primarily due to strong foot traffic. TJX Companies is also confident in its future potential, upping its FY 2014 guidance to $2.74-$2.78 from $2.70-$2.78. Additionally, TJX Companies plans on buying back $1.3 billion-$1.4 billion of its own shares in FY 2014. Therefore, even if the company underperforms on the bottom line, this will reduce share count and boost earnings-per-share.

As if that's not enough evidence for an investment in TJX Companies, consider some key metric comparisons:

|

Forward P/E |

Net Margin |

ROE |

Dividend Yield |

Debt-to-Equity Ratio | |

|---|---|---|---|---|---|

|

Dillard's |

10 |

5.39% |

18.04% |

0.30% |

0.41 |

|

Kohl's |

11 |

5.02% |

15.85% |

2.70% |

0.76 |

|

TJX Companies |

17 |

7.47% |

55.22% |

1.00% |

0.33 |

Dillard's might be the most appealing on a valuation basis, but most investors are willing to pay up for TJX Companies. TJX Companies turns the most revenue and investor dollars into profit, and its debt-to-equity ratio of 0.33 is below the industry average of 0.60. The 1.00% yield doesn't hurt, either. All three companies are fundamentally sound, but TJX Companies is the most impressive.

The bottom line

If Dillard's can't deliver impressive growth on the top line, then it will aim for growth on the bottom line while also returning capital to shareholders. This is a positive, but why opt for Dillard's when you can invest in a company that has been stronger on the top and bottom lines and returns capital to shareholders, like TJX Companies?

As far as Kohl's is concerned, it should remain a long-term winner, but it's positioning isn't as optimal as TJX Companies' considering the new economy and value-obsessed consumers.