Macy's (M +1.51%) consistently makes strategic moves to align itself with consumer trends. The company's recent initiative to focus more on active Millennials is a prime example.

Take a look around

Figuring out what consumers want is easier than you might think. For instance, take a look at Under Armour (UA 1.19%); only a decade ago, not many people had even heard of Under Armour. Today, Under Armour apparel wearers include professional athletes, college athletes, fitness enthusiasts, and most importantly, trend-conscious consumers.

The next time you're out and about, look around. If you're at the mall, at the movies, or in the supermarket, try to count how many men, young adults, teens, and kids are wearing Under Armour apparel. You might be surprised by what you find. Consider the company's revenue growth over the past five years:

UA Revenue TTM data by YCharts

And keep in mind that this is during a challenging economic time with a hesitant consumer.

The point here is that there is extremely high demand for Under Armour, and Macy's has added Under Armour as one of the brands for its Millennial strategy.

You might have also noticed Nike (NKE +0.60%) in the chart above. Nike's revenue growth might not have been as impressive as Under Armour's over the past five years, but it's still growth nonetheless. Nike still has plenty of growth potential through innovation and geographical expansion thanks to its deep pockets. And it certainly doesn't hurt that Nike is one of the strongest brands in the world, ranking No. 26 on Forbes' "Most Powerful Brands in the World."

Nike has also been added to Macy's stores, and Nike is highly likely to drive more consumers to those stores. Also note that with Macy's adding Under Armour and Nike to many of its locations, this increases sales potential for the two brands.

Macy's is also adding The North Face, Calvin Klein Performance, Ideology, and Helly Hansen. The North Face targets outdoor enthusiasts and trend-conscious consumers. Calvin Klein Performance is designed for women who want to exercise in style. Ideology is an exclusive Macy's brand geared toward yoga enthusiasts. Helly Hansen appeals to those with sailing and snow skiing interests.

Notice the diversification here. Not only is Macy's attempting to target every type of active Millennial, but these brands offer varying price points as well:

- Under Armour: $23-$75

- Nike: $25-$350

- The North Face: $45-$470

- Calvin Klein Performance: $25-$99

- Ideology: $20-$68

- Helly Hansen: $30-$350

By targeting active Millennials in so many different ways, Macy's doesn't just increase its future sales potential in the active category. If these Millennials are drawn to Macy's stores, then they might shop in other areas of the store as well.

The only negative here is that Millennials don't spend nearly as much as Generation Xers or Baby Boomers. Millennials tend to save more, simply because they're not as confident about our country's economic future as past generations. Therefore, is it possible that one of Macy's rivals presents a better investment opportunity?

Attempting to climb its way out of the abyss

J.C. Penney (JCP +0.00%) is one of Macy's biggest competitors. However, Macy's enjoyed market share gains over the past several years thanks to J.C. Penney mismanagement.

Former J.C. Penney CEO Ron Johnson took the company from struggling to atrocious in a matter of 17 months. If a CEO change wasn't made, then J.C. Penney might have gone out of business by the end of 2014. CEO Mike Ullman was brought in to fix things, and his first move was to eliminate everything associated with Ron Johnson, including casual dress for employees, secret management meetings, and marketing. Ullman also brought back several brands, including St. John's Bay, Made For Life, and JCP Home.

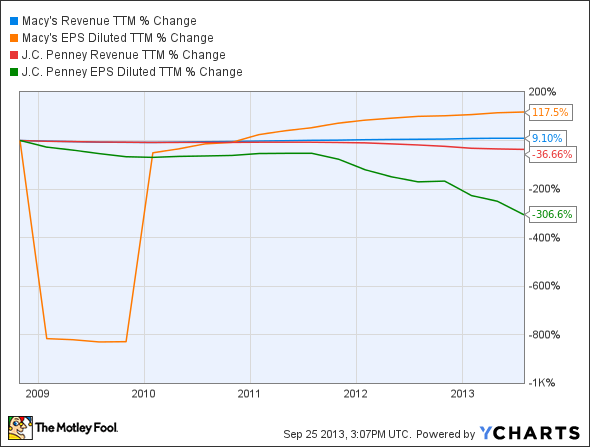

Despite these moves, it might be too late for a turnaround. Nobody truly knows if J.C. Penney is capable of pulling off a turnaround, and in addition to competing with Macy's, it also must contend with Kohl's, Target, Wal-Mart, Dillard's, Amazon, and more. This will be no easy feat. If Ullman can pull it off, then J.C. Penney will end up being a tremendous investment, but it's a gamble, and Foolish investors don't gamble. Consider the solid footing of Macy's in revenue and earnings-per-share growth trends over the past five years:

M Revenue TTM data by YCharts

Now consider some fundamental comparisons:

|

Net Margin |

ROE |

Dividend Yield |

Debt-to-Equity Ratio | |

|---|---|---|---|---|

|

Macy's |

4.93% |

23.35% |

2.20% |

1.18 |

|

J.C. Penney |

(13.29%) |

(53.71%) |

N/A |

2.51 |

In addition to Macy's being stronger on the top and bottom lines, it turns more revenue and investor dollars into profit, it pays a dividend, and it has demonstrated better debt management.

Time to check out

If you're going to invest in retail, then Macy's is likely to offer a better long-term investment than J.C. Penney. The one big concern for Macy's Millennial strategy is that Millennials tend to save more than they spend. If you're looking for unhindered growth, then you should consider Under Armour.