Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Weyerhaeuser (WY 0.29%) fit the bill? Let's look at what its recent results tell us about its potential for future gains.

What we're looking for

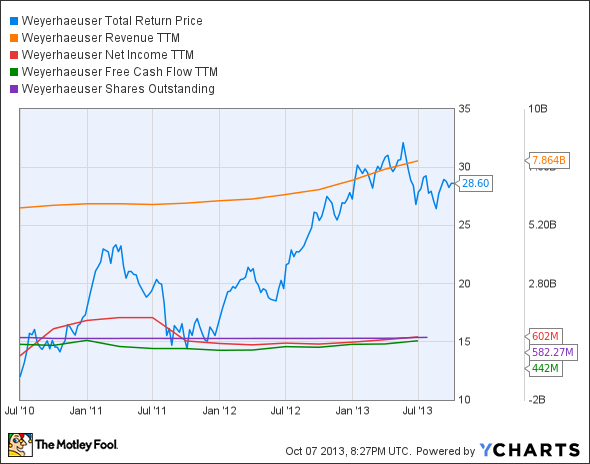

The graphs you're about to see tell Weyerhaeuser's story, and we'll be grading the quality of that story in several ways:

- Growth: Are profits, margins, and free cash flow all increasing?

- Valuation: Is share price growing in line with earnings per share?

- Opportunities: Is return on equity increasing while debt to equity declines?

- Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's look at Weyerhaeuser's key statistics:

WY Total Return Price data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

32.8% |

Pass |

|

Improving profit margin |

350.3% |

Pass |

|

Free cash flow growth > Net income growth |

49.3% vs. 432.6% |

Fail |

|

Improving EPS |

443% |

Pass |

|

Stock growth (+ 15%) < EPS growth |

138.8% vs. 443% |

Pass |

Source: YCharts.

*Period begins at end of Q2 2010.

WY Return on Equity data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

404.8% |

Pass |

|

Declining debt to equity |

(37%) |

Pass |

|

Dividend growth > 25% |

340% |

Pass |

|

Free cash flow payout ratio < 50% |

84.8% |

Fail |

Source: YCharts.

*Period begins at end of Q2 2010.

How we got here and where we're going

Weyerhaeuser put together a strong performance with seven out of nine passing grades, but it was tripped on free cash flow, which has grown more modestly (albeit from a much higher starting point) than net income, and which may not be sufficient to support the company's current dividend payments. A surge in free cash flow could bring Weyerhaeuser to perfection, but that may be far easier said than done. How might this company push its free cash flow higher over the next few quarters? Let's dig a little deeper to find out what's in store.

Weyerhaeuser is poised to profit from the growing demand of construction materials in the U.S. homebuilding markets, particularly as lumber costs continue to rise. Fool contributor Bob Ciura notes that home affordability in the U.S. remains near historically high levels, and home prices rose in 87% of U.S. cities in the second quarter, signaling either a robust recovery, or the possible start of a new bubble, depending on how you want to look at it.

However, Fool contributor Jacob Roche notes that the ferocious pine mountain beetle has destroyed about 12% of the forests west of the Mississippi, which had a major impact on prices at the cost of crimped supplies. However, lumber prices dropped from $400 to less than $300 during the past few months as forests recover -- but demand from homebuilders should offset this impact on Weyerhaeuser's profitability. Weyerhaeuser's rival Plum Creek Timber has been better able to capitalize on the cost increases, since its vast timberland acreage doesn't occupy the areas being affected by the furious beetle.

Weyerhaeuser recently acquired Longview Timber from Brookfield Asset Management and its Brookfield Infrastructure Partners affiliate in a deal worth $2.65 billion. Fool contributor Anjum Khan points out that the deal provides access to roughly 645,000 acres of timberland, which will increase its timber assets in the Pacific Northwest by a third, to about 2.6 million acres. In addition, the region provides easy access to export markets across the Pacific Ocean in Asia, as well as good soil and climatic conditions for the Douglas fir. Weyerhaeuser would also be able to take advantage of tight supply conditions in the north of British Columbia caused by the pine beetle through this new acreage.

My Foolish colleague Maxx Chatsko notes that Weyerhaeuser could also profit by supplying its waste product as feedstock to support KiOR's (NASDAQ: KIOR) cellulosic gasoline and diesel production, as wood pulp is comparably cheaper than other feedstock. KiOR expects to double its production capacity to 26 million gallons at its Columbus location by 2015, which would require quite a lot of feedstock, though much more is required to really make Weyerhaeuser investors sit up and take notice -- the average harvested pine tree weighs as much as roughly 333 gallons of gas, so a quick back-of-the-envelope calculation shows that 26 million gallons of gas would only require about 78,000 trees to produce under a 1:1 conversion ratio.

Putting the pieces together

Today, Weyerhaeuser has many of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.