Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Ecolab (ECL 0.11%) fit the bill? Let's take a look at what its recent results tell us about its potential for future gains.

What we're looking for

The graphs you're about to see tell Ecolab's story, and we'll be grading the quality of that story in several ways:

- Growth: Are profits, margins, and free cash flow all increasing?

- Valuation: Is share price growing in line with earnings per share?

- Opportunities: Is return on equity increasing while debt to equity declines?

- Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at Ecolab's key statistics:

ECL Total Return Price data by YCharts.

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

102.5% |

Pass |

|

Improving profit margin |

(14.4%) |

Fail |

|

Free cash flow growth > Net income growth |

71.7% vs. 73.4% |

Fail |

|

Improving EPS |

38.1% |

Pass |

|

Stock growth (+ 15%) < EPS growth |

129.2% vs. 38.1% |

Fail |

Source: YCharts. * Period begins at end of Q2 2010.

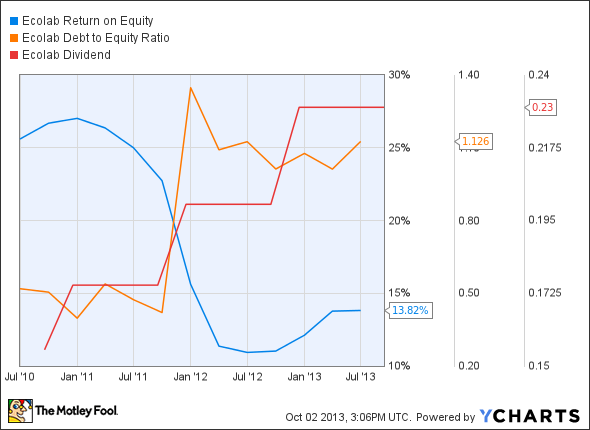

ECL Return on Equity data by YCharts.

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

(46%) |

Fail |

|

Declining debt to equity |

117.1% |

Fail |

|

Dividend growth > 25% |

48.4% |

Pass |

|

Free cash flow payout ratio < 50% |

34.1% |

Pass |

Source: YCharts. * Period begins at end of Q2 2010.

How we got here and where we're going

Ecolab comes close to a strong showing, but its final score of four passing grades was hindered by a narrow miss on the free cash flow comparison, and more notably by a weakening of profit margins over the past three years. Despite this weakness, Ecolab's shares have performed quite strongly, moving far in advance of the company's earnings per share -- another source of potential concern. Is this progress sustainable, or will Ecolab's inconsistent financials catch up it to the end? Let's dig a little deeper to find some answers.

Over the past few quarters, Ecolab has increasingly been targeting niche industry segments with higher growth potential, especially in developing economies, to leverage its proven expertise in sanitation and water management. The company is going through a restructuring process to refocus on its water-management business -- quite recently, Ecolab divested its Mobotec subsidiary and has also sold off the assets of its Vehicle-Care Division. At the same time, Fool contributor Doug Ehrman notes that Ecolab plans to expand its NALCO Division through various business acquisitions across India, the second most populous country on the planet but which makes use of only 4% of the world's water supply. The company could reap significant benefits from expanding the Indian water treatment market, which is expected to increase by roughly $20 billion in the next five years.

However, Ecolab also has a bright future in the mining and resource exploration wastewater treatment niche, which produces massive quantities of unusable water that must be processed. The company recently bolstered its position in this segment through the $2.5 billion acquisition of privately held Champion Technologies. This is nearly five times the present market cap of oilfield-services water specialist Nuverra Environmental Solutions (NESC), and the difference in strategies is stark -- Nuverra, which has been primarily a fracking wastewater treatment company from the start, has seen its share price cut in half over the past three years, while shares of the more diversified Ecolab have more than doubled in the same period. However, it's possible that Nuverra might be a future acquisition target for Ecolab, since Fool contributor Matthew DiLallo notes that Nuverra founder Richard Heckmann has a track record of building companies he later sells to the highest bidder. It would certainly deepen Ecolab's penetration in the oil patch, as Nuverra is already a key player in wastewater services across America's most promising oil shale regions.

Fool contributor William Bias notes that Ecolab has also been rolling out innovative products to strengthen its position in the sanitation segment. Quite recently, the company launched Kay Super Contact Cleaner for kitchen use and a Kay Heated Soak Tank program for easier sanitation of restaurant equipment. Ecolab has also rolled out the Advantis FC Cleaning Program, a low-temperature, foam-based cleaning product for food and meat processors. The company also recently introduced its OxyCide Daily Disinfectant Cleaner, which is designed to kill harmful bacteria and viruses.

Putting the pieces together

Today, Ecolab has some of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.