Investing in the wrong discount retailer can lead to frightful days, and even more terrifying nights. These nightmare-filled nights may feature you standing at the edge of a cliff, your hands cupped, filled with hundred-dollar bills. While you desperately want to stuff those hundred-dollar bills back in your pockets as fast as possible, your hands uncontrollably open wider, allowing those precious greenbacks to float on a light wind, slowly swaying their way toward violent ocean waves. The slow speed of the descent makes it excruciatingly painful, as you hope by some miracle that a strong gust will suddenly blow those bills back your way. But in the world of investing, hope often turns to despair.

To avoid such a nightmare, consider investing in a company like Fred's Inc. (FRED +0.00%). With this company you won't have to worry about nightmares. That's the good news. The bad news is that Fred's isn't quite as impressive as any of the following companies: Dollar General (DG 1.97%), Walgreen (WAG +0.00%), and Wal-Mart (WMT 0.79%).

A growth investor's dream

Fred's September total sales increased 4%, with comps improving 2.8%. The latter compares to a 3.8% drop in the year-ago quarter. This is especially impressive because most retailers are seeing weaker comps than they saw in their year-ago quarters. For Fred's, the improved performance is mostly due to a restructuring plan that has expanded the Health Aids and Hometown Auto & Hardware departments.

Fred's expects fierce competition and a hesitant consumer to remain challenging factors throughout the next year. The company feels that its pharmacy expansion and planned aggression in general merchandising initiatives will offset these weaknesses. For fiscal year 2013, Fred's expects earnings-per-share growth of 17%-25%.

Fred's is probably right. If you visit fredsinc.com, go to "New Products," scroll down, and read customer reviews, you will see that Fred's is loved by its customers. Fred's Smartcard is an added bonus, as it allows customers to earn up to 5% in Smartbucks toward future purchases. But that's not the only way Fred's forms a connection with its customers.

For example, Fred's is currently running a "Great Ghost Grab" contest on its website. If you find Guzzie, then you have a chance at a share of $3,000 in prizes. The company also takes a light and fun approach to customer service, which is evidenced by this line on its customer service page: "Tell us about the level of customer service your local Fred's Super Dollar provides. Are we "wonderful like a Swan" or "pitiful like an Ugly Duckling"?"

As Fred's expands its Health Aids and Hometown Auto & Hardware departments, it should continue to see growth. But it's still not as impressive as another discounted retailer.

A flugelhorn sounds

The instant the gates swing open, lightweight aluminum shoes gallop on a cement track, each horse attempting to knock the other off the track while being steered by strategic and relentless jockeys. The crowd roars, each individual holding their ticket with printed words that equate to the hopes of a thousand dreams. While all these horse-racing fans have reasons to be optimistic, one horse is way out in front.

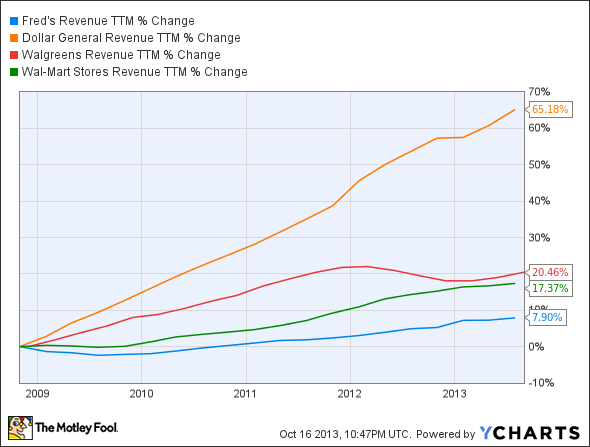

Top-line growth comparisons over the past five years:

FRED Revenue TTM data by YCharts

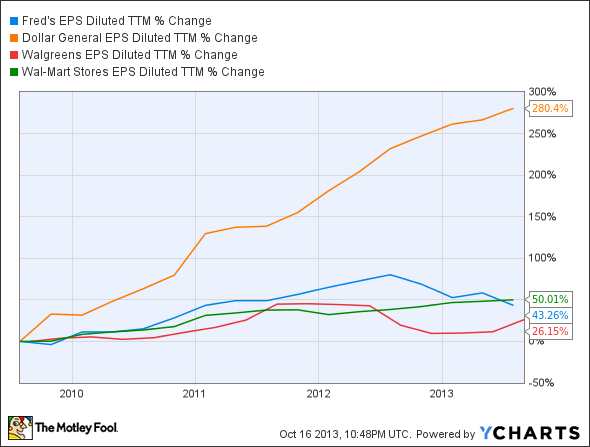

Dollar General has widened the gap on its peers like a steroid-induced thoroughbred. The song remains the same on the bottom line:

FRED EPS Diluted TTM data by YCharts

Dollar General has performed well partially because of the Great Recession. At that time, the once excess-conscious consumer found across the United States began to search for value. Dollar General fit the bill. Since that time, Dollar General customers have remained loyal to the brand. This should come as no surprise considering the company's constant promotions in order to keep its customers which include bulk offerings and $5 off a purchase of $30 or more.

Walgreen is seeing much greater demand for generic drugs. This is a good news/bad news situation. This heightened demand is helping drive top-line growth, but generic drugs are low-margin items which means it will be more challenging for Walgreen to grow the bottom line. That said, the company's resolution with Express Scripts should help a great deal in both areas.

As far as Wal-Mart is concerned, it's the largest retailer in the world. While you might not agree with the company's cost-cutting practices -- especially in regards to employees -- they make the company attractive to investors and allow consistent capital return to shareholders. Wal-Mart offers the highest yield of the companies mentioned here at 2.50%. Walgreen yields 2.30%, and Fred's yields 1.50%.

Wal-Mart is also opening more Express Stores in order to steal market share from the dollar stores. This might also negatively impact Fred's. After successful tests in rural North Carolina, Wal-Mart plans on launching the first of three ecosystems by March of next year. These stores will be stocked directly from nearby supercenters. Currently, Wal-Mart has 20 Express Stores and 306 Neighborhood Markets, but it will build on this going forward.

The finish line

All of the aforementioned companies have potential. If you want to play it safe, consider Wal-Mart (yield included) or Walgreen (not affected by Wal-Mart small-box expansion.) If Wal-Mart can't steal significant share from Dollar General, then Dollar General should remain a big winner. As far as Fred's goes, it's a growing company that has fought off fierce headwinds, which is often the sign of a winner. But it's not likely to be as strong of an investment as Dollar General.