Wal-Mart (WMT 0.69%) isn't the most well-liked company in the world, especially by business owners who have had their store or industry crumble due to this steamrolling big-box retailer. If you talked to a Wal-Mart investor, however, you would likely be greeted with a smile.

Recent results

Forget Wal-Mart's last quarter. If you take a look at the first half of the year, then you will see that despite some negative trends, the outlook is still bright.

In the first half of the year, net sales improved 1.7% year over year. This was primarily due to a 3.4% increase in square footage, acquisitions, and positive comps at Sam's Club of 0.4%.The latter can be attributed to improved member traffic.

The biggest negative for Wal-Mart is its domestic comps performance. Total comps declined 0.8% in the first half, with Wal-Mart's U.S. comps dropping 1.1%. This compares to a 3.1% comps increase in the first half of last year. Wal-Mart attributes the poor performance to lower consumer spending, which the company believes to be tied heavily to a 2% payroll tax increase.

Recent failures

Wal-Mart has many goals. Two of them are growing operating expenses at a slower rate than net sales and growing operating income faster than net sales.

In the first half, operating expenses grew at a 2.3% clip, faster than net sales at 1.7%. Wal-Mart attributes this failure to weaker-than-expected sales as well as higher investments in international markets and e-commerce. Operating income improved 1.3%, still slower than net sales at 1.7%. Furthermore, free cash flow dropped to $5.2 billion versus $6.1 billion in the previous year. However, this was primarily due to income tax timing and capex.

Plenty of reasons to be hopeful

By this point, you might be wondering what could possibly drive you toward an investment in Wal-Mart. The first reason is Wal-Mart's international growth and exposure. For instance, international sales improved 2.9% in the first half. Better yet, if you look at this number on a constant-currency basis, then net sales jumped 4.4%. If Wal-Mart is still in the early stages of international expansion, then its international growth has the potential to be as impressive as its domestic growth was in earlier years.

You might have read about Wal-Mart lowering its full-year net sales guidance to 2%-3% from 5%-6%. That's still solid growth for a mature company. Wal-Mart also reduced its full-year earnings per share guidance to $5.10-$5.30 from $5.20-$5.40. While reduced guidance is rarely considered a positive, it can knock down the share price of a company with a strong brand that rewards its shareholders, allowing potential investors to get on board at cheaper prices.

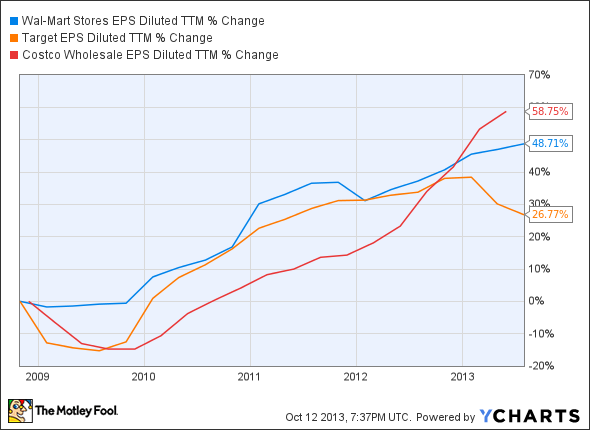

While it's possible that Wal-Mart will struggle in the near future due to a weak consumer, consider the company's strong performance on the bottom line over the past five years:

WMT EPS Diluted TTM data by YCharts.

While Costco (COST 1.27%) has outperformed Wal-Mart on the bottom line, Wal-Mart has outperformed Target (TGT 3.06%). A company's ability to cut costs in the current economic environment is imperative. The top performers often indicate the best management teams.

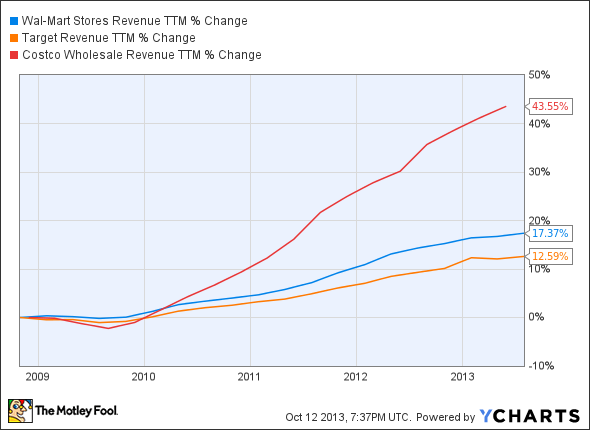

Of course, top-line growth is also necessary for a company to succeed over the long haul. Without demand, sales will drop and investors will flee the name. Fortunately, Wal-Mart, Costco, and Target have all performed well on the top line over the past five years. Costco has been the most impressive.

WMT Revenue TTM data by YCharts.

All three companies are capable of delivering top- and bottom-line growth over the long haul. Industry trends favor all three companies because consumers are constantly looking for value.

Given these results, Costco has likely piqued your interest the most. Costco's fourth-quarter revenue increased 0.8% year over year, with membership fees jumping 3.2%, domestic comps rising 5%, and international comps growing 4%. Costco's simple game plan of offering high-quality products at low prices seems to be highly effective. It currently has 638 locations, and it plans on opening 11 more by the end of the year -- a sign of health. The big potential negative for Costco is pricing pressure from competition with Wal-Mart's Sam's Club, as they both fight to win traffic.

Target might lag Wal-Mart and Costco on top- and bottom-line performance, but it yields 2.70% versus 2.60% for Wal-Mart and 1.10% for Costco. Target is also looking to drive growth in many ways, including Canadian expansion, City Targets, and a new focus on capitalizing on the health and wellness trend by upgrading 560 Target cafes. Target introduced Simply Balanced, its line of healthier groceries, in June. This month, it's adding Jamba Juice fruit smoothies and all-natural white meat chicken bites with whole-grain breading to its in-store cafe offerings. So while Costco may offer the most growth potential, Target has been active in finding ways to drive growth recently.

The bottom line

For Wal-Mart, increased international exposure should drive the top line. If it doesn't, Wal-Mart is capable of acquiring smaller companies for inorganic growth. Simply put, Wal-Mart will find a way to drive the top line -- and it has always been consistent on the bottom line. A 2.60% yield is an added bonus.