Darden Restaurants (DRI 0.46%) might not be the most popular choice for investors at the moment. This makes sense considering the current economic environment and reduced discretionary spending. Darden's two key brands Olive Garden and Red Lobster saw comps decline 3.2% and 1.7%, respectively, year over year in August. Furthermore, Darden expects diluted earnings per share to decline 3%-5% for the year. You might already want to hop to another article to find a better investment opportunity, but that might be a mistake.

Look a little deeper

Olive Garden and Red Lobster didn't perform well in August. However, LongHorn Steakhouse comps improved 4.9%. Darden is a wise and strategic company. This has been proven through the years as it has consistently grown. If one of its locations or even one of its brands is underperforming, then don't be surprised if Darden chooses to divest that location or brand. As long as there's an area with top-line growth potential, the divestments act as a positive because they reduce costs and aid the bottom line. Darden has a lot of potential with LongHorn Steakhouse, as well as some of its other brands, and newly acquired Yard House as well.

The Yard House acquisition

Darden recently acquired Yard House for $585 million in a debt-free deal, where $30 million in net tax benefits are expected to be realized over the next two years. Looking back a second, that expected diluted EPS decline of 3%-5% for the year isn't so hot. If you exclude acquisition costs, diluted EPS would have grown 5%-9%. This is one reason why it's always important to read the whole story. Looking ahead, Darden expects the deal to lead to accretion of $0.10-$0.12 per share in fiscal year 2014 and $0.18-$0.20 per share in FY 2015.

Yard House isn't just another brand Darden purchased to improve diversification. While diversification certainly played a role, the growth potential here is likely beyond what you're imagining. For instance, there are only 39 Yard House locations throughout the United States. That fact alone leaves a lot of growth potential. However, Darden will only grow a brand if it's successful on a smaller scale, and that's the case for Yard House.

For starters, all 39 Yard House locations are profitable. From 2009-2011, at the height of The Great Recession, it delivered a compounded annual growth rate of 19.7% in sales. Currently, the average check size per guest is $20.43. These locations tend to make money at almost all hours of the day. Daypart breakdown: Dinner (46%), Happy Hour (22%), Lunch (21%), Late Night (11%). The revenue breakdown is also diversified: Food (57%), Alcohol (39%), Non-Alcoholic Beverages (4%).

The key to Yard House is that it offers a high-energy, yet upscale, bar and restaurant environment. In the bar, you will likely hear classic rock at a reasonable volume. In the restaurant section, you will find American Cuisine featuring an innovative chef-driven menu with artistic presentations.

Darden has a lot of potential. Does it have as much potential as its peers?

Darden vs. peers

Brinker International (EAT -0.85%) owns Chili's Grill & Bar and Maggiano's Little Italy. It has 1,600 restaurants across the world. Brinker International has become a bottom-line focused company over the past several years. That doesn't mean it's giving up on the top line. One of its most recent moves to fuel top-line growth was to partner with Ziosk, a next-generation, pay-at-the-table technology company.

In simpler terms, Ziosk offers seven-inch touchscreen tablets that allow diners to order and pay at the table. Ziosk tablets also offer entertainment in the way of video games, music, and Facebook. It's yet to be determined how diners will respond over the long haul. Brinker International is pleased with the early results. This new technology has the potential to help drive customer traffic, but it would be difficult to imagine these tablets making a significant impact.

DineEquity (DIN 0.31%) owner of Applebee's and IHOP, is also giving Ziosk a shot at its Applebee's restaurants. DineEquity needs to do something because traffic at Applebee's has slowed. However, second-quarter comps for Applebee's still managed to grow 1.3% thanks to a higher average guest check. IHOP comps grew at a more impressive 1.9% clip, and both traffic and average guest check showed improvements. Aggressive marketing and menu enhancement played key roles for IHOP.

Throughout FY 2013, DineEquity plans on refurbishing 70% of its restaurants and opening 40-50 Applebee's and 50-60 IHOPs. Full-year comps are expected to range anywhere from down 1.5% to up 1.5%. This might make it difficult to decide whether an investment would be worthwhile, but that decision can be made easier.

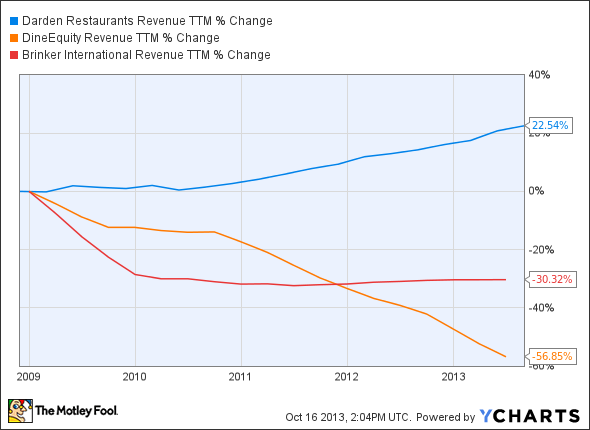

Consider top-line growth for the three aforementioned companies over the past several years:

DRI Revenue TTM data by YCharts

Darden has clearly showed the most consistency. With the addition of Yard House, this trend is likely to continue. It should also be noted that Brinker International and DineEquity are highly leveraged with debt-to-equity ratios of 5.41 and 4.51 respectively, while Darden sports a debt-to-equity ratio of 1.33.

The bottom line

Looking at this from a long-term investment perspective, this is a relatively easy call. Darden is likely to offer more potential than its peers. It's the most fiscally responsible, as well as the most diversified, and it offers the most growth potential.