Krispy Kreme Doughnuts (KKD +0.00%) and Dunkin' Brands (DNKN +0.00%) don't see themselves as competitors. Krispy Kreme thinks of itself as more of a doughnut operation. Considering that 87%-88% of its sales stem from doughnuts, this seems justifiable. However, Krispy Kreme aims to grow its beverage sales from 12%-13% to 20% over the next three years, and it recently jumped on the home brewing bandwagon. This fact alone makes it a competitor of Dunkin' Brands, which sold 7.5 billion servings of coffee in 2012.

While 58% of Dunkin' Brands' sales stem from beverages, most consumers who love doughnuts, or doughnuts and coffee together, are going to choose one brand over the other. So, let's see who's winning this battle for sweet teeth and caffeine fiends.

Krispy Kreme vs. Dunkin' Brands (and Starbucks)

At one time, Krispy Kreme was a Wall Street darling. The stores popped up everywhere, and Krispy Kreme doughnuts were talked about constantly. It almost seemed like the company had amassed a cult following in the early 2000s. Then, accounting irregularities surfaced in 2005. Krispy Kreme also saw reduced demand due to a weakening economy, and it had to close more than 240 locations over a five-year span. Krispy Kreme had quickly gone from sweet to sour.

Against all odds, Krispy Kreme has rebuilt its brand. There are now 775 locations worldwide. However, Dunkin' Brands has much greater brand exposure with 10,500 locations worldwide. Both companies are looking to expand. Krispy Kreme aims to add 159 domestic locations over the next three years. Dunkin' Brands aims to double its store count.

Krispy Kreme has experience swimming in red, and it's now highly focused on maintaining the bottom line. That's why Krispy Kreme stores will be much smaller than they were in the past in order to keep costs low.

Dunkin' Brands, on the other hand, is altering its locations to make them more like Starbucks (SBUX 0.73%). Starbucks' coffee certainly drives many people to its stores, but the atmosphere is what keeps those people in those stores and maximizes sales. Panera Bread has been very successful because it offers a similar concept.

Since the trend of free WiFi and a relaxing, stay-as-long-as-you-want environment has proven to be successful, it makes sense for Dunkin' Brands to go along with industry trends. For instance, many Dunkin' Donuts locations now offer music, televisions, and comfortable seating.

This has the potential to drive more sales. Customers will look at Dunkin' Donuts locations as a place to work, socialize, and relax instead of a place to grab a quick bite or coffee and hit the road. Dunkin' Donuts is also offering more menu items that include gluten-free and healthier food in general, which gives Dunkin' Brands more product diversification than Krispy Kreme.

If you look at top-line performance for Krispy Kreme and Dunkin' Brands, you will see that Krispy Kreme has been growing a little faster over the past five years. However, Starbucks has been the top performer:

KKD Revenue TTM data by YCharts

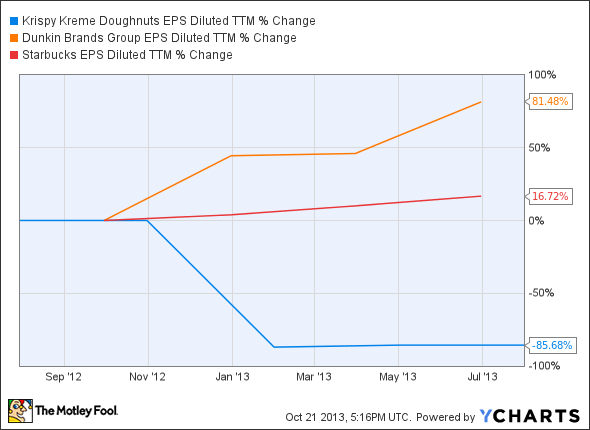

On the other hand, Dunkin' Brands has been the most impressive on the bottom line:

KKD EPS Diluted TTM data by YCharts

If you compare fundamentals, while all three companies are impressive, one stands out:

|

Trailing P/E |

Net Margin |

ROE |

Dividend Yield |

Debt-to-Equity Ratio | |

|---|---|---|---|---|---|

|

Krispy Kreme |

74 |

4.92% |

9.05% |

N/A |

0.01 |

|

Dunkin' Brands |

41 |

18.95% |

22.97% |

1.60% |

5.13 |

|

Starbucks |

38 |

11.06% |

28.74% |

1.10% |

0.10 |

Starbucks offers the most attractive valuation, a somewhat generous yield, and a clean balance sheet. Dunkin' Brands offers a higher yield, but it's also highly leveraged. Krispy Kreme doesn't offer any yield. This makes sense since it's keeping costs low, but it's still not a positive for investors. Also, Krispy Kreme's valuation is extremely high. Altogether, Starbucks looks the most impressive.

Brewing up a plan

Just as Dunkin Brands aims to set itself up with industry trends by offering a more comfortable environment, Krispy Kreme aims to set itself up in the home brewing market. This coffee-line extension featuring 40-oz. packs will be sold exclusively at Sam's Club in the Southeastern United States. Krispy Kreme will use social media and coffee samplings to further inform consumers about the launch. If this launch proves successful, it's likely that Krispy Kreme will be more aggressive in the home brewing market in the future.

The bottom line

Considering fundamentals, brand exposure, company histories, and initiatives, Dunkin' Brands appears to be a safer long-term investment than Krispy Kreme. However, Starbucks plays the red herring role and steals the show. Despite its maturity, it's still outperforming its peers on the top line, it's steady on the bottom line, and it offers a decent yield without any leverage. If these three companies were to be ranked in investment potential, the order would be Starbucks, Dunkin' Brands, Krispy Kreme.