Following large, recent, insider buying is a fun way to screen for stocks. It's not scientific, and shouldn't be an investment thesis on its own, but it still can be a very bullish sign. In fact, many studies have shown that stocks of companies with heavy insider buying go on to outperform the market by as much as 7%.

Auto parts and do-it-yourself dynamo, AutoZone (AZO 0.84%), recently had two large insider purchases. Let's dig into the back-story to see if this stock really deserves a spot in the fast lane.

The buy

Auto parts giant AutoZone recently saw two large insider purchases by two directors, Douglas Brooks and Bryan Jordan, of $150,000 and $101,728 respectively.

The bull

It's natural for investors to look for catalysts when large insider purchase are made. In the case of AutoZone, and the auto parts industry in general, the bullish case is centered more around long-term trends than any short-term "buy" signal.

That's where I see the bull case for AutoZone. Really, since the recession in 2009 there's been a huge shift in consumer sentiment, with American's owning their cars for longer than ever. According to research firm Polk, the average age of all U.S. auto's is 11.4 years, and it's expected to grow 20% by 2018. If you agree with me, that game changing trends are the key to great investments, then you might look at these purchases as a sign that AutoZone's growth will continue. Since the recession hit in 2008, when consumers seemingly changed their views on autos, AutoZone has grown earnings over 22% annually.

It's not just AutoZone that benefit from this sentiment though. The entire industry, especially successful competitors such as O'Reilly Automotive (ORLY 0.75%) and Advance Auto Parts (AAP 7.04%). Both stocks have racked up more than a triple since 2008, and Advance recently completed a major acquisition of Carquest, which should help it rival AutoZone's revenues as number one in the sector.

Further, there may be more to the long-term growth of the auto parts industry, than older cars. A recent survey by MainStreet.com revealed that 70% of Americans prefer "do-it-yourself" when it comes to projects, over professionals. To me the survey reinforces a larger sentiment that seems to be brewing--Americans have become more thrifty, and less superficial. That has to be bullish for auto parts retailers, even as the economy continues to recover.

The bad

It's not all sunshine and rainbows for AutoZone, there are definitely some concerns. The biggest concern, for all auto parts retailers, is the troubling idea of "peak driving." If you haven't heard, younger people have apparently decided they don't like the idea of driving very much. Over the past decade the miles driven by people aged 16-34 has dropped by 23%.

Common sense would likely say that younger people are driving less because of the economy or the environment, but that's actually not the case. Believe it or not, millennial's are driving less for unprecedented reasons like the desire to "stay home more" or because they "know someone with a car."

Blame it on the Internet, or just laugh loudly at the idea that teenagers are actually choosing to spend weekends with their parents, but whatever you do, don't ignore this trend if you own auto stocks. While auto part retailers can thrive from a thrifty consumer, they can't thrive from consumers who avoid driving altogether.

The verdict:

So at the end of the day, there's two questions at stake here. The first is if AutoZone is a good stock among its peers.

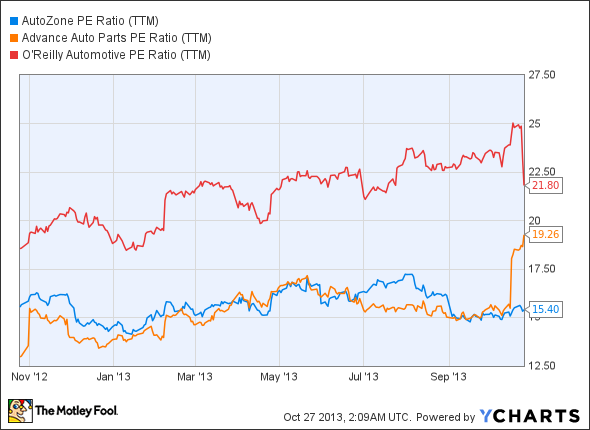

Considering the auto part retailing sector has been on fire, there's no shortage of good companies. But where Advance and O'Reilly share AutoZone's track record of success, they trade at much higher multiples and O'Reilly has done so for some time now.

AZO P/E Ratio (TTM) data by YCharts

Based on valuation alone, it's easy to see why insiders are loading up on AutoZone. Which brings us to our second question; are the trends that have been propelling this sector due to continue?

Insider Buying: Never bullish on its own--but it helps

You'd like to think that insiders have a better understanding of their company than we could ever hope to. But that alone isn't reason enough for us to buy a stock. When I look at AutoZone, and try to determine whether the insiders are correct, I see a clash of two trends.

On one hand, you have a nation that is holding onto cars for years and making repairs themselves; on the other, you have a new generation on the horizon that doesn't share the nations historical love of autos.

Which trend will win out? Insiders seem to think that, eventually, improving economic factors will continue to benefit AutoZone. That's what the people in the know think. Do you agree?